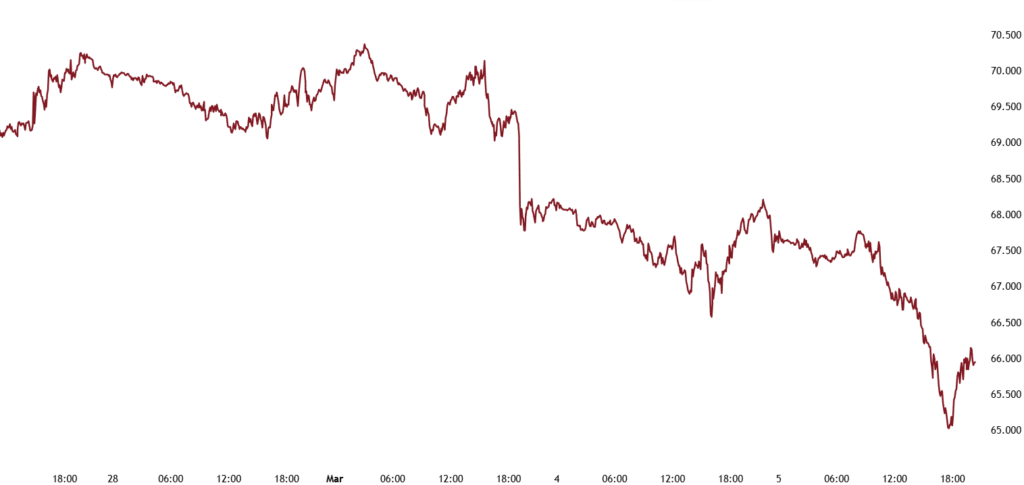

On Monday OPEC+ decided to proceed as planned in relation to the April oil output increase. This might be a result of President Trump to put pressure on oil price and bring prices to a lower level. The OPEC-8, Saudi Arabia, Russia, Iraq, Kazakhstan, United Arab Emirates, Kuwait, Algeria and Oman agreed to proceed with release of the 2.2 million bpd of voluntary cuts starting April with an additional 138 000 bpd production.

The group keeps its flexibility, and the gradual increase may be paused or reversed depending on market conditions. This will allow the group to continue to support the oil market.

Benchmark oil prices saw a steep decline on the news, with trade war looming and fundamentals uncertainty. On Tuesday Brent dipped to its lowest level since September 2024. The continuous hawkish tone from the Trump administration and increase in US inventories, benchmark oil prices hit multi-year lows on Wednesday.

Figure 1. Trade War Outlook A Threat to Global Demand.

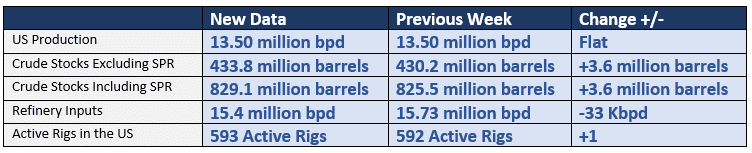

US Crude inventories and production.

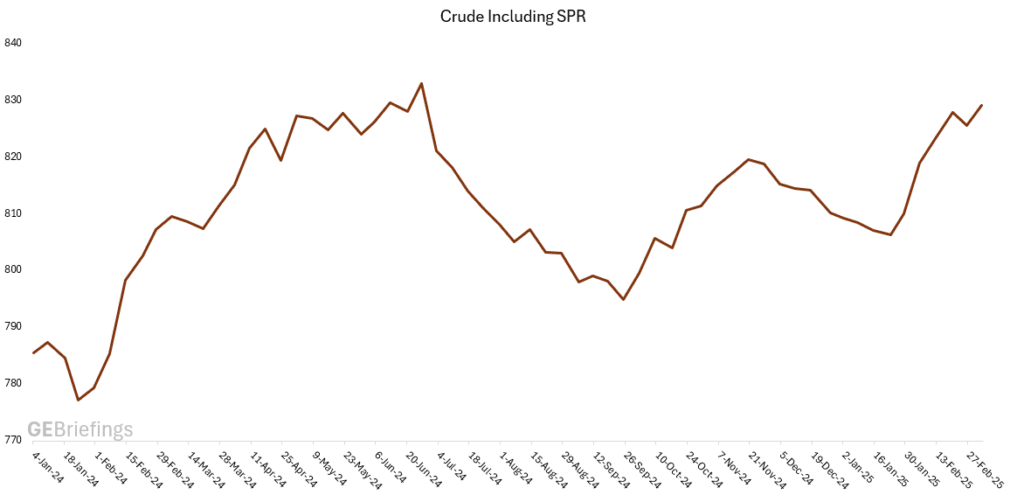

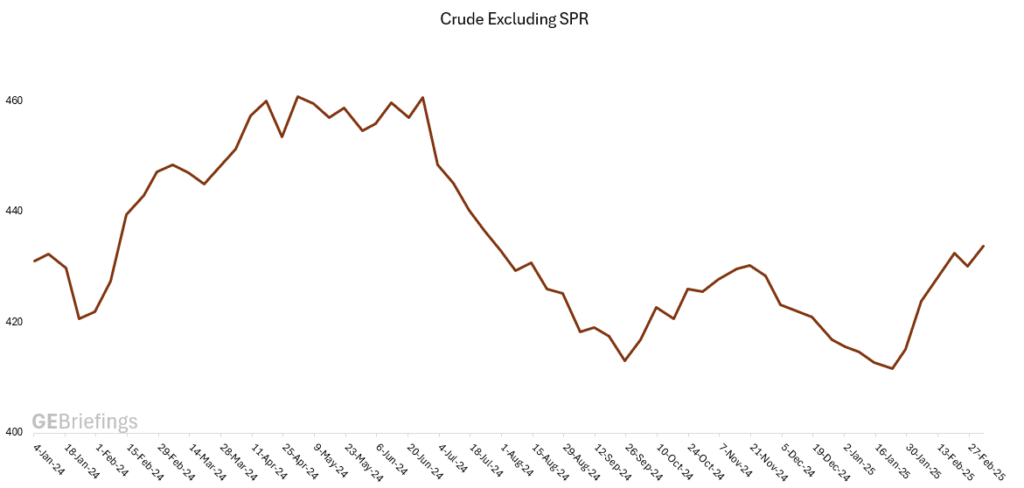

US commercial crude oil inventories increased by 3.6 million barrels in the week ending February 28, with market forecasters predicting between 0.5 and 0.9 million barrel-increase in crude stocks. U.S. commercial crude oil inventories are about 4 percent below the five-year average for this time of year and 14.8 million barrels lower than a year ago. U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending February 28, 2025, which was flat compared to the previous week`s average. Refineries operated at 85.9 percent of their operable capacity last week.

Figure 2. US Crude Stocks including SPR at 829.1 million Barrels.

Figure 3. US Crude Stocks Excluding SPR at 433.8 million Barrels.

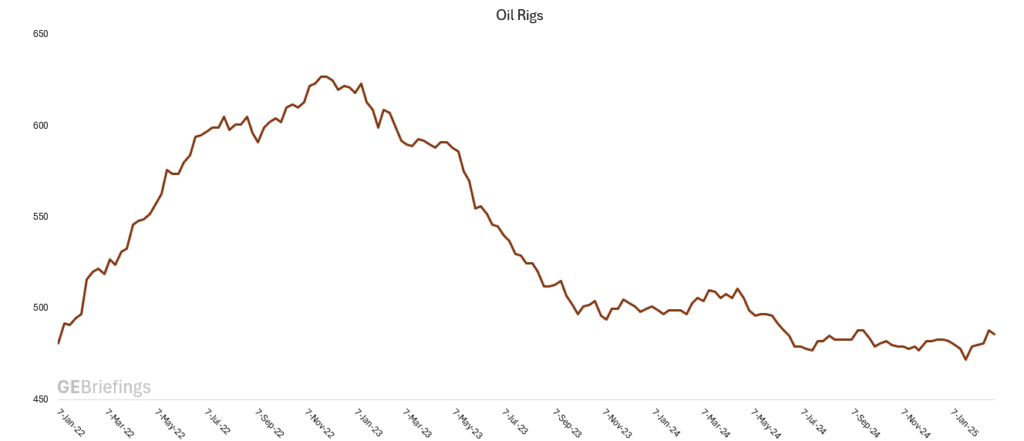

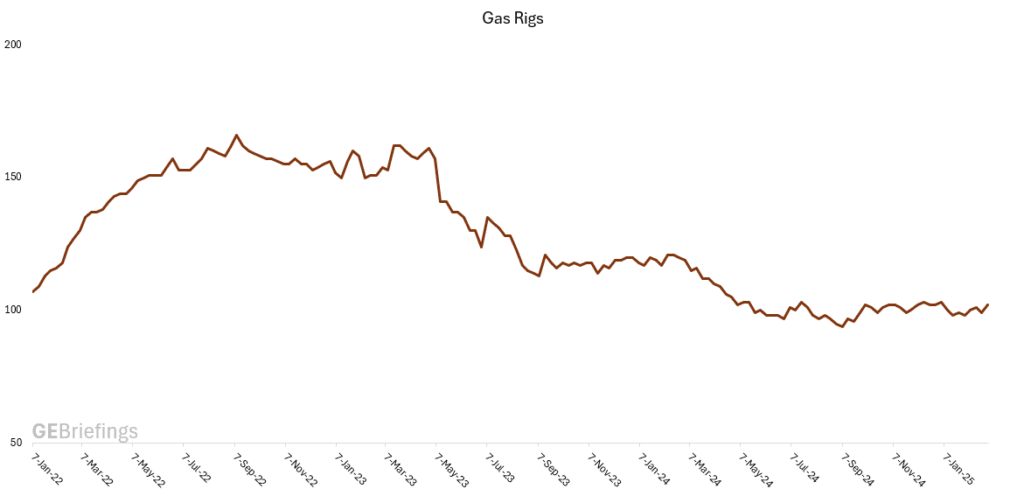

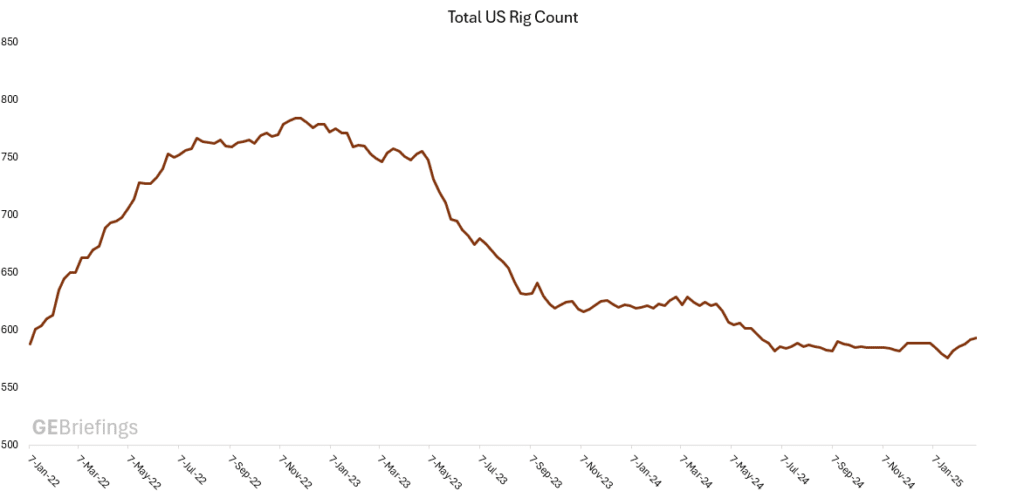

US Rig Activity.

The total number of active rigs operating in the US according to Baker Hughes rig count increased by one rig last week, currently at 593. Oil focused rigs decreased last week, from 488 to 486 active rigs. Gas focused rigs increased by three, now at 102 active rigs. Miscellaneous was flat last week still at five active rigs.

Figure 4. Active Oil Focused Rigs Decreased From 488 to 486

Figure 5. Gas Focused Rigs Increased from 99 to 102 Active Rigs.

Figure 6. Total Active Rigs in the U.S. Increased by One Last Week, now at 593.

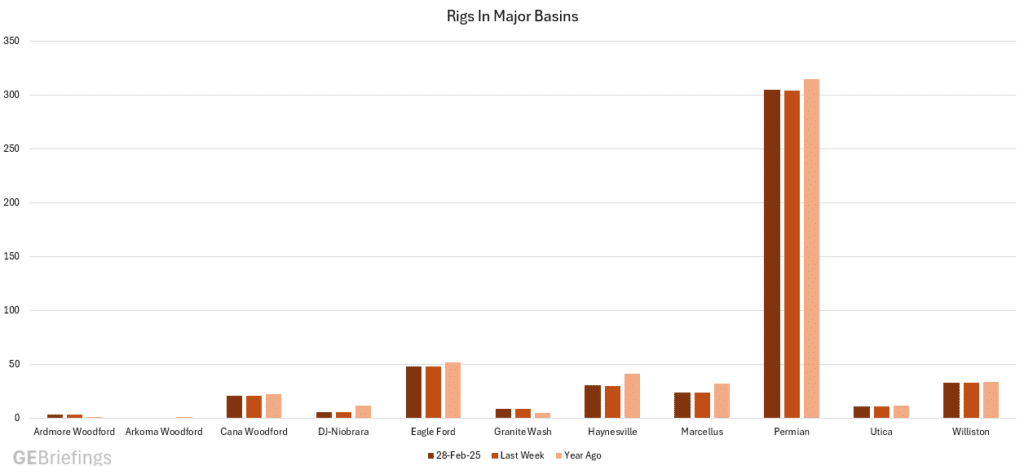

Figure 7. Rig Count in Major Basins.

Baker Hughes has issued the rotary rig counts as a service to the petroleum industry since 1944, when Baker Hughes Tool Company began weekly counts of U.S. and Canadian drilling activity. Baker Hughes initiated the monthly international rig count in 1975. The North American rig count is released weekly at noon Central Time on the last day of the work week.

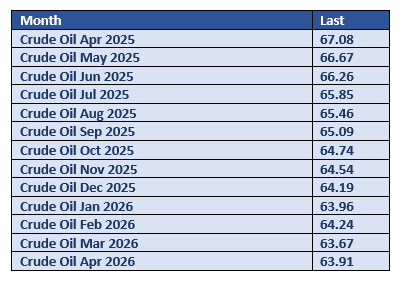

By the Numbers March 5, 2025.

Disclaimer

This report is under no circumstances intended to be used for or considered as investment advice. This report is to be used as information and general market guidance. The author, GE Briefings and Investornytt cannot guarantee that the information from sources is without incentives, but the author has taken considerable care to ensure that, and to the best of his knowledge, material information contained in the report is in accordance with the facts and contains no omission likely to affect its understanding. Please note that this report is the author’s own research, opinions and conclusions, and the readers are recommended to draw their own conclusions based on other sources than this report, the facts and market picture can change in an instant and therefore the reader must do their own due diligence. The author, GE Briefings and Investornytt cannot be held responsible for the readers investments based on this report.