General:

The tanker market had a very steady week and was very similar to the previous week. We did not see the boost in activity on the crude/dirty tanker side that many owners have been waiting and hoping for, but at least the product tankers managed to keep their rates at healthy levels.

Overall, it seems that Owners have a lot of optimism for the dirty market in the near term, but only time will tell whether we see an upswing in the market.

Chartering and Spot market

VLCC: Not the best week as a VLCC Owner. There was not much movement from the charterers/demand side, which has caused a slow market that seems to be going in circles.

SUEZMAX: The Suezmax market remains optimistic, and the demand/supply is leveling out well, giving a sense of a steady market. With some potential upswing in the coming week, it could look promising.

AFRAMAX: Activity slowed down a bit on the Aframax side this week, which gave charterers some optimism to try and push rates lower, and a few were successful. We do expect to see some more activity in the coming week.

LRs: The LR2s had a slightly slower week than the LR1s, but that being said, both segments still enjoy a very firm market, and with the current market conditions, our outlook remains bullish.

MR: The east market went down a notch this week, as we saw fewer cargoes hit the market, which eventually forced rates to drop, even though Owners are still in a strong position and managed to demand higher rates.

The western market still looks more promising with steady levels. Whenever rates drop a little or activity falls, there will be a flock of new cargoes and charterers trying to take advantage, quickly pushing the levels back up again.

List of highlighted fixtures this week:

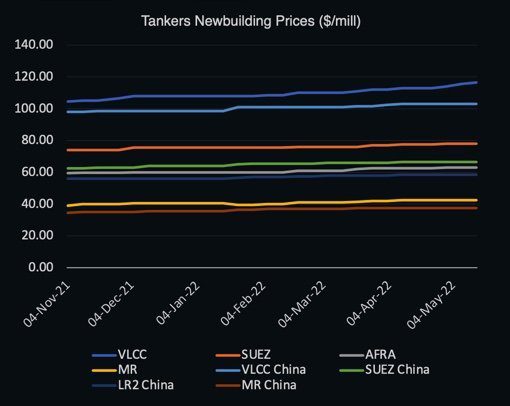

Newbuilding market

A notable scarcity of slots together with increasing equipment cost continue to drive newbuilding prices upwards, putting owners in somehow of a dilemma in terms of fleet renewal and asset investments, which could lead to a temporary slowdown of the fleet development.

No newbuilding orders were reported this week.

Recycling market

The scrap prices are in free fall dropping to $330/ldt in Turkey which is a drop of 17.5% w-o-w. India and Pakistan settled at $650/ldt which is a negative change of 2.3% each. Bangladesh remained stable this week and settled at $645/ldt as the previous week.

The continued decrease in scrap prices must be found in the limited tonnage being sold for recycling due to the war and ever-lasting supplychain issues. Many owners continue to hold on to their vessels due to the state of the energy markets and great volatility which has not been seen in more than a decade, pushing owners to remain their hopes high and continue being optimistic for a similar upswing as seen in the dry bulk and container market.

No tankers were recorded sold for recycling this week.

Oil and futures market

WTI Crude (June contract): Settled at $110.49 and saw an increase of 1.28% w-o-w. Brent Crude (July contract): Settled at $111.55 and decreased 0.17% w-o-w. Futures markets continue to be stable around $95-105 per barrel with some notable changes throughout the weeks, reacting to market news and factors, but seem to always find firm ground at the end of the week.

While the EU has officially proposed a full ban on Russian oil imports, the draft proposal also included going after Russia’s ability to transport oil to other buyers such as the Asian market via vessels owned by European entities. However, this proposal in the draft has been met with resistance and objections by some EU countries such as Greece, having owners taking advantage of elevated rates of sanctioned/embargoed trade such as Iran and Venezuela, and now also Russia. According to Bloomberg, sources are stating that the EU is considering removing the proposal of banning European-owned vessels from transporting Russian oil but continuing to ban insurance of the cargo itself, which means that Russia would have to ensure its cargo itself.

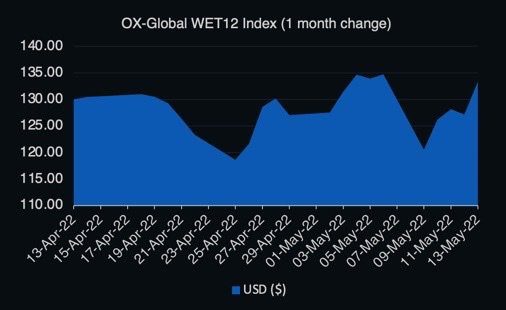

OX-Global Shipping Indices

The OX-Global WET12 index saw an increase of 12.8 points or 10.62% w-o-w.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.