General:

A bit of a sleepy week has passed by. Sleepy, as it was not very eventful, and overall activity levels seem to be dragging. For the first time in weeks, we saw some actual resistance in the product tanker market, which LR2s paid the price for. The crude/dirty tanker market is rather boring as rates keep sliding and not much has changed over the last couple of weeks.

We saw an increase in recycling activity just as prices made a significant drop after months of increase, which pushed a few Owners out of the bush, in fears of further decline.

Chartering and Spot market:

VLCC: A very quiet and steady week on the VLCC side as nothing major changed. We started to see some of the June loading dates being negotiated in the AG where the market remains steady.

SUEZMAX: It was not too exciting for the Suezmax Owners either, as we saw rates dragging globally this week.

AFRAMAX: Slightly disappointing week for the Aframax Owners that had to make the best of a very slow week.

LRs: The LR2s started to come under pressure this week and rates are already sliding as we saw in the AG where a mix of ballasters and a slow market forced rates downwards.

While its big brother was struggling, the LR1s managed to keep rates steady throughout the week, but we need to see some renewed demand enter the market otherwise, the LR1 market will soon get impacted by the LR2 segment.

MR: In the West/UKC and AG the MR market looked healthy and rates kept steady at their current levels, however, the Asian MRs were under more pressure and we saw rates starting to slide.

The period market remained rather unaffected as the few fixtures reported were much in line with the previous week.

List of highlighted fixtures this week:

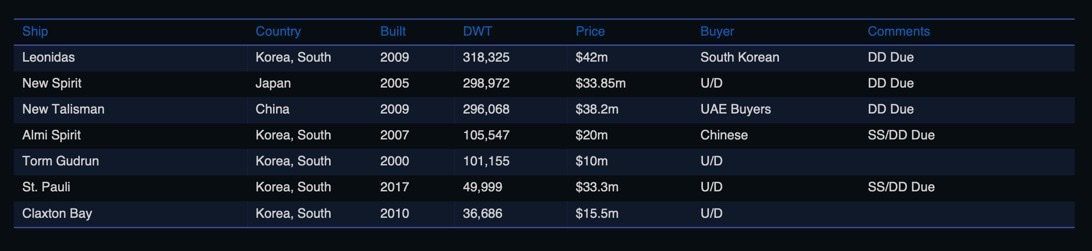

Second-hand market:

A healthy amount of transactions were recorded in the second-hand market this week. We expect some decline in our benchmark prices of 15 years old crude tankers in the coming weeks as declining recycling prices are forcing second-hand values down, the product tanker market is less affected due to the prevailing spot market.

List of highlighted transactions this week:

Newbuilding market:

Newbuilding prices continue to increase amidst the current supply chain disruption which has resulted in havoc in both good and bad in the last two years. Almost all segments saw an increase in the benchmark prices with most notably suezmaxes increasing 2.56% w-o-w. A Koran VLCC now stands at 118 being up 1.29% w-o-w. The reason for the increasing newbuilding prices must be found in the fact that equipment costs continue to rise as well as labor costs due to the heated newbuilding market within LNG and Container, taking away much of the regular slots and projects from the tanker market.

No newbuilding orders were reported this week.

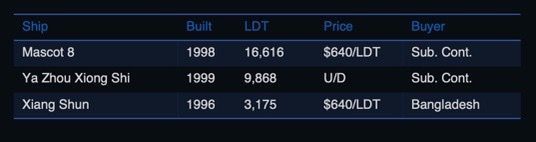

Recycling market:

Scrap rates continued their free-fall during this week with rates in Pakistan sliding 6.2% and settling at $610/ldt, while India only saw a decrease of 3.8% and settled at $625/ldt, while Bangladesh fell 1.6% and settled at $635/ldt. Turkey remained stable this week.

We saw a jump in activity in the recycling market this week and while the tanker market conditions did not change much, it’s more likely that the increased activity was induced by the anticipation that recycling prices will drop further in the coming weeks

Crude oil market:

WTI Crude (June contract): Settled at $110.28 and saw a decrease of 0.86% w-o-w. Brent Crude (July contract): Settled at $112.22 and decreased 0.29% w-o-w. Futures markets continued to be stable around $105-115 per barrel this week some notable changes throughout the week, reacting to market news and factors, but seem to always find firm ground at the end of the week.

While Russia is fighting a war in Russia, the Russian Federation seems to be preparing for another “war” on a different front. Russia continues to sell oil at heavily discounted prices to Asian buyers and India but may struggle to find stable long-term buyers who can commit to large volumes such as Europe has done, risking phasing out 4 million barrels of oil per day from Russia, potentially driving prices even higher. The question remains as to whether Russia can continue finding buyers and supply needy importers or whether they would be hit by a wrecking ball after Europe stops import of all Russian oil and has difficulties finding buyers for their oil.

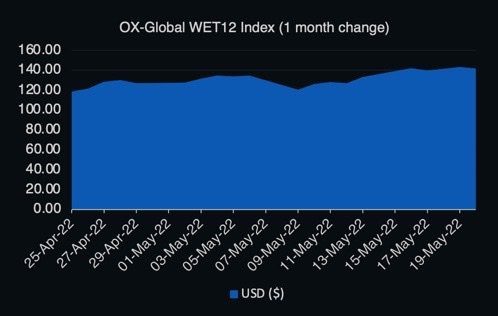

OX-Global Shipping Indices:

The OX-Global WET12 index saw a decrease of 0.21 points or 0.15% w-o-w.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.