General

If the market follows its recent trajectory the CPP market will be left behind by its colleagues in the DPP segment where the market is looking a lot more bullish right now, but the crude tankers have also been waiting patiently for their turn at the table. Though the CPP market is looking a bit flatter, especially for the larger segment, it’s not something that we are yet calculating as a risk for the future, as Owners have handled the situation great by being selective even though demand was not in their favor, thus rates have been as steady as possible and we expect them to start ticking in the other direction again in early November.

DPP Market

Lots of confidence in the DPP segment with yet another week of steady increase. VLCCs are now seeing over $11.5mill for a USG/China trip and on other routes, we also saw steady improvements this week, which leaves us with a feeling of optimism. Suezmax’s had a bit more of a mixed week as AG was up a few points while WAF/UKC was down a few points, due to a slow WAF market, but generally, the positive sentiment is not giving the Suezmax Owners anything to doubt. The Aframax Owners were likewise seeing green this week, as from area to area you were met with a tight tonnage list and busy charterers. In North Europe available Aframax’s are becoming a rare sight for charterers and the same goes for the MED as we saw healthy rate increases in both areas.

CPP Market

While the media keeps reporting about a shortage of diesel and gasoline, it seems that this demand is not reflecting very much on the LR2’s, as demand for LR2’s has been rather dull this week, however, Owners managed to keep their rates somewhat steady and afloat. The LR1 segment remains a bit unpredictable, but overall rates have managed to stay steady and even saw an increase of close to 10% for MEG/Japan. Some MR Owners had more fun than others this week. In the far east the MR market was a bit dull, and sentiment remained rather flat throughout the week, we hope to see some renewed demand in the region, or Owners will move their ships west at any chance they get, as the western market.

Period Market

The TC market has been very quiet, over the past week with few things to report. More and more Owners and operators seem convinced that the current tanker market increase is not just a short-term run, but instead a «supercycle» that could last up to years. As a charterer, it’s getting increasingly difficult to ensure tonnage in a market with this much optimism from the Owner’s side, and with the recent spike in the DPP market, there is no easy street for charterers.

Second-hand market

If you are in doubt whether the VLCC market is doing well, simply look at the asset prices. The past month, we have recorded an increase of about 25% for the value of a 15-year-old VLCC, that’s up from $40mill to $50mill at the time of writing. Not only VLCC but all crude oil tankers are seeing steady increases in prices, while the coated tankers are experiencing a more steady market after months of volatility.

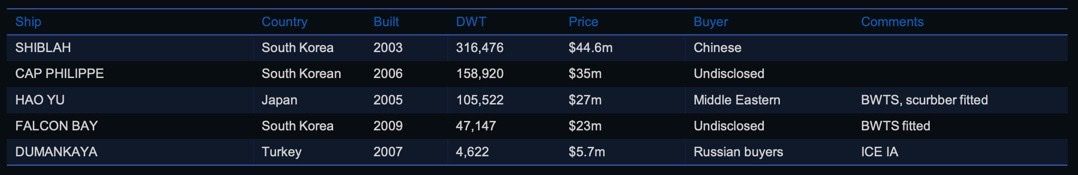

List of highlighted transactions this week:

Newbuilding market

If you are ordering now, you should be lucky to get your ship before 2026 with the latest prospects from the yards, which is predominantly what’s keeping many tanker Owners away from the new building market these days, plus it has become increasingly expensive.

Anyhow, some Owners with good relations to the yards and optimistic mindsets still manage to find a deal that makes sense for them. EPS reportedly made a sizeable order of four plus two optional 50.000 DWT MR tankers at News Times Shipbuilding this week, deliveries expected to be between Q2 to Q4 2025.

Recycling market

The recycling yards have not looked this empty in a long while and even though the yards would like to keep prices higher to attract vessels, it seems that with dropping steel prices, we would soon start to see levels move closer to $500/LDT in the sub-continent again. Even though the market is dry, the Tradewind recycling forum in Dubai saw great participation this past week where the main topic was the planned and implemented improvements of scrap yards conditions and regulations in the sub-continent, which is great news.

There were no reported tankers sold for recycling this week.

Crude oil market

Another week passed and talks about a global recession again surfaced in debates and discussions. However, we continue to see oil prices being somehow stable around $80-90 per barrel. Most noteworthy this week, we understand that Chinese refiners have ramped up imports which could indicate a recovery in the Chinese crude demand resulting in increasing VLCC rates as the day rates surpassed $100,000 per day. While the crude tanker market continues to be very profitable, we may see further increase in the foreseeable future as the market has to make up for the missing Russian crude which found its way from the Russian Baltic ports to Europe but now has to find it’s way to Asian buyers increasing tonne-miles and reducing availability due to longer routes.

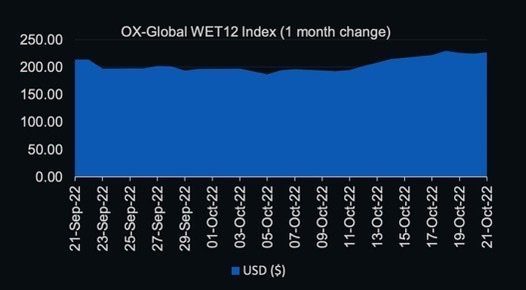

OX-Global Shipping Indices

The OX-Global WET12 index is again seeing some firm movement and bounced back this week to +$200 levels. The index saw an increase of 2.49% or 5.54 points settling at $227.26. It seems everyone is holding their breath awaiting the winter season to see how tankers will perform with already elevated asset prices and freight rates. The joker in this equation is OPEC+ and geo-political factors being a threat to shareholders and booming profits. We expect further increases in both asset prices and freight rates during Q4 and the index to continue increasing as a result of the optimism.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.