General

As OPEC+ made a move to squeeze profits in what already looks like a tight market, we are anxious to see the real impact of this proposed cut. A cut in production means less volume which inevitably is bad for the tanker market, however, on the plus side demand is still very strong and with winter plus full EU sanctions coming up, we feel that there is still a lot more to gain than loose in the coming months as tonne-mile is set to increase, also, we will see if OPEC+ really meets their target once prices reach a satisfactory level.

DPP Market

We will soon come to see what impact the production cut will have on the crude market in particular, but for now though, the market remains steady and healthy. US production keeps increasing and therefore the USG remains an attractive area for VLCCs to look for good fortunes. As it is already announced that SPR releases will continue as needed in order to equalize the market, we expect the USG to remain firm for a while. In WAF it is still slow compared to what it once was, and rates consequently dropped for VLCC’s and Suezmax’s in the region. In northern Europe Aframax’s no longer enjoys the same glory as earlier in the year, but as available tonnage slowly shrinks, we could soon start to see some better days again. Cross MED dropped a few points, but the sentiment was good in the region as Libya continues to fuel the market with fresh cargoes and generally healthy demand.

CPP Market

As a result of slower demand and pilled-up ships, the LR1/2 rates recently fell off a cliff, and with no clear bottom the week prior, charterers were met with some more restraint this past week as Owners managed to pull rates up from the bottom that was reached earlier in the week. Whether it’s just a dead cat bounce or Owners have enough demand to properly fight back, remains unclear, but we are not of that impression as CPP products are still in great demand and likely to bring life back into the LR segment. From the Pacific to the Indian ocean the MR market saw red numbers as negative sentiment shadowed the MR tankers and charterers took full advantage. In the AG we did see some fighting back as Owners got a bit of help with increased demand, but also holding back tonnage for long hauls as Owners expect to see steady rate increases in the week to come.

Period Market

We did not record much activity on the period side this week as recent news from the OPEC+ cartel might have scared long-period charterers as to how sustainable the market will be a year from now. However, news comes and goes, and we feel this one will be easily forgotten as long as rates remain steady and healthy.

Second-hand market

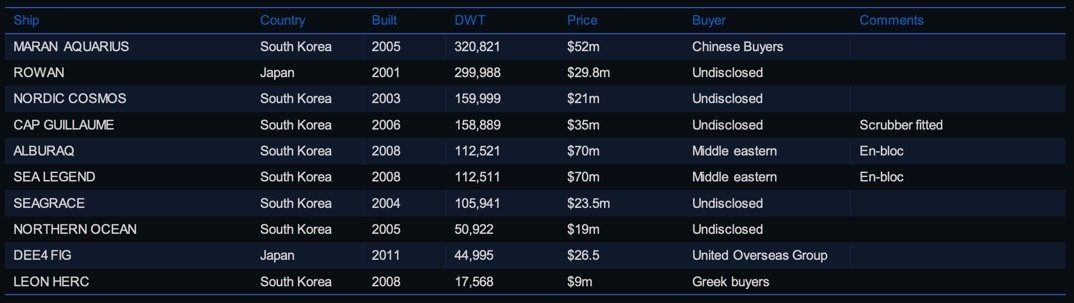

There is still plenty of activity on the sale and purchase side, and while it feels like it should be impossible, prices are still slowly increasing, especially VLCC’s are starting to attract better numbers as the spot market for these units has finally started to prove its worth. Even though the spot market is a bit volatile on the product tanker side, second-hand prices have not been affected yet.

List of highlighted transactions this week:

Newbuilding market

Finally some activity within the larger segments! This week Euronav confirmed contracting two scrubber-fitted 157,000 DWT Suezmax Tankers at South Korea’s newly rebranded DH Shipbuilding which was previously known as Daehan. The vessels are scheduled for delivery in 2024 Q3 and Q4. DH Shipbuilding also announced receiving orders from Atlas Maritime for two 115,000 Aframax Tankers which are both scheduled for delivery during 2025 Q1.

As the larger segments continue to attract Buyers in the second-hand market and pushing asset prices upwards, we expect to see more owners pulling the trigger to order newbuildings instead of paying big bucks to secure vessels for further trading via the second-hand market. We will still see some owners continue paying elevated prices to secure tonnage for the winter period and potentially fitting themselves with vessels for when Russian seaborne oil becomes sanctioned in December, but as these are mostly older units this will not be the reason for increasing asset and newbuilding prices but rather the fact that a large number of vessels might be taken out of the open market to trade highly rewarding sanctioned cargo will result in increasing prices.

Recycling market

Another week with no activity within the recycling market as owners continue to enjoy the elevated freight rates and even older units are now being traded and extended with class/flag to get a piece of the cake while owners can. We might however soon see some change as container freight rates have dropped significantly and older vessels that have been employed and sought after during and the aftermath of the pandemic might be soon headed for the recycling yards as fewer operators are interested in paying for those vessels and new carbon emission regulations (EEXI and CII) will soon be implemented. For now, we can only sit and wait to see how the recycling yards will fill in the empty slots.

Crude oil market

The main story of this week is by far the OPEC+ production cuts on Wednesday. The cartel announced on Wednesday that there will be a production cut of about 2 million barrels per day which is a big step back for the U.S. which has since the pandemic done what it could to increase output and keep oil prices at a steady level. What seems to be a joint and united attempt to push prices up came as a great surprise to the western countries which has always had a saying in decisions and in-direct impact, but this time western governments seem to have no saying or impact on the decision made suggesting that OPEC+ countries are willing to do whatever they must to protect their own interests and care little of the consequences western allies might impose to change that. The official reactions and consequences have so far been awkward with only President Biden commenting that he was “disappointed by the shortsighted decision by OPEC+ to cut production quotas” and threatening to reduce the power and impact of OPEC+ on energy prices. So far the only real consequence has been the suspension of weapon deliveries to Saudi Arabia which is not a severe consequence in the short term and hardly seeing any reactions by the Kingdom.

OX-Global Shipping Indices

The OX-Global WET12 index once again dropped this week and settled at $196.1 which is a small negative change of 0.54% since last week. This is the third consecutive week the index declined but there is still hope as we saw during the week when the index bounced back from $187.15 on Wednesday and quickly regained some points which on Thursday settled at $194.44 suggesting that investors are still optimistic as we enter the winter period knowing that earnings will be unprecedented. Buyback programs also contributes to the general optimism.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.