Volodymyr Zelenskyy is a hero. Contrary to what I thought would happen last week, Ukraine is putting up a valiant battle, holding off the Russian invaders and, in doing so, uniting a large portion of the world. It’s amazing to see their courage under fire.

Sadly, it appears that the Ukraine is going to have to continue the fight all on their own. Without trying to get political and rant about what should happen, I’m trying to keep this blog focused on what is likely to happen. There are many pundits out there with far greater knowledge of the Ukraine, NATO and international affairs. I’ll leave it to them to figure out how best to salvage this situation.

Instead, I’ll just offer this one piece of advice to investors…don’t you try to be a hero.

While it might not technically qualify as a bear market yet, make no mistake, we are caught in one. I’ve been preaching caution for a very long time and that tone is not going to change this week. I see great value in micro-cap stocks. As a group, they will likely be a better value over the coming days and weeks. This is a great time for nibbling at beaten up stocks but don’t go hog wild calling a bottom. It’s likely still a ways off for the overall market.

There is one area that does look quite attractive, however. That would be gold, which is finally doing what it’s supposed to in a time of money printing and runaway inflation. It’s breaking out.

I wrote last week that Bitcoin was trading like a risk asset now. It had a nice bounce on people buying bitcoin to give to Ukrainian relief but ask yourself what the Ukrainians will do with their bitcoin? Sell if, of course. The only real store of wealth over time has proven itself to be gold and it is finally acting the way it was meant to. I expect anyone who bought crypto as an inflation hedge to be disappointed and wouldn’t be surprised if they migrated back to gold and it really took off.

This is because, like the Russians in the Ukraine, inflation isn’t going away any time soon. Putin appears highly unlikely to change his tactics (admit defeat? not him…) and the longer the struggle goes on, the more likely we see higher energy and food costs; and this is a big problem for the markets.

So, don’t be a hero…at least not when it comes to investing. This remains a time for caution and the market, while it will see violent rallies at times, remains firmly in a downtrend.

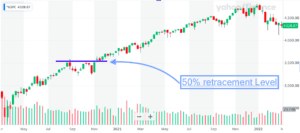

How low can it go? A 50% retracement from the initial lows of the pandemic to the recent highs suggests a target of 3,500 on the S&P. This would also be an area where there is some support on the chart. Here’s the 2-year view on the S&P.

I don’t know if we get to that level or not. However, in light of what’s going on in the world, it makes a lot of sense to me that the next 10% move will be lower not higher. Trade accordingly.

INmune Bio (INMB) reported their year-end results and had an investor update on Thursday afternoon. On the call they detailed the cause of trial delays (manufacturing supply chain issues) and announced that they are now screening patients in their Alzheimer’s Disease trial.

«The mild Alzheimer’s Phase II trial is actively screening patients. We will announce when we have treated our first patient. The MCI trial will start in a few months and we remain confident that the top-line data will be reported in the first half of ’23 for the MCI trial, the second half of ’23 for the mild AD trial.» – CEO RJ Tesi

Despite the delays in starting the trial, that timeline for results is unchanged and the Company believes that they will have rapid enrollment due to the patient friendly trial design and excitement from the centers involved in the trial. We published a longer note on on INmune for premium subscribers on Friday.

As an investor, one always has to evaluate the performance of management, particularly in terms of executing in a timely manner. INmune has certainly failed to get their trials started on time yet I’m willing to cut them some slack here. Quite simply, the pandemic and subsequent supply chain issues is impacting every single company in ways that are unforeseen. Large companies can overcome these issues by throwing money at them, but that’s not always possible for the smaller entities of the world.

Every healthcare company I cover has suffered delays. This is without exception and, while it’s painful, is a trend that is obviously beyond the control of management. So, I tolerate delays and maintain confidence that, despite missing timelines, teams like INmune’s leadership are high quality and not failing in their jobs.

Premium subscribers had Zoom calls with TFF Pharma (TFFP) and Diamcor Mining (DMIFF) this last week.

TFF was very timely as they have just announced an expanded relationship with Catalent (CTLT), a contract drug manufacturer. This is a very exciting development for TFF and provides not only a high-quality endorsement of their technology but an avenue for rapid expansion of business development efforts.

The news on Catalent follows right after positive results from work done on TFF’s inhaled niclosamide. We covered the significance of those results in this note for premium subscribers, TFFP: More Thoughts Regarding NICLOSAMIDE.

Getting a complete response letter from the FDA is never fun, as Amryt (AMYT) found out this past week. From my read, their EB product is not likely to get through the FDA anytime soon if ever.

I had been expecting a CRL on this product ever since their first effort failed. Now the bad news is out there and Amryt looks very safe for investors. It is growing rapidly as MYCAPPSA sales ramp and they are generating cash; enough so that they announced a share repurchase plan. At this price, Amryt is a very attractive play.

I had a call with Modular Medical (MODD)‘s CEO this past week. Interesting company that recently uplisted to Nasdaq yet is down 50% from a simultaneous to uplisting financing. It’s a tough market out there and MODD is suffering along with many other companies. However, with enough money to get through product approval, it’s one that could be well positioned when things turn around.

I’m still doing work here and would appreciate feedback if anyone out there knows the company.

Spectra7 (SPVNF) had a lockup of shares from their most recent financing come off this past week. Situations like this often create nice buying opportunities.

* Disclaimer: DFC Advisory Services LLC, dba: Tailwinds Research, owns shares in companies mentioned in this report. For a full list of disclaimers and disclosures, please visit http://tailwindsresearch.com/disclaimer/.