General:

After a few good weeks, the dirty tanker segment saw a decrease both in volume and number of inquiries this week, pushing for a natural decline in rates. Nevertheless, sentiment among market participants remains high, and same does our outlook as we believe the dirty tanker segment still has a lot to offer, especially the Suezmax’s. Second-hand activity continues to be strong and in newbuilding, we again saw a few orders for product tankers, it’s clear to see how orders have picked up in the tanker segment in the last months as the spot market proved to have legs and stability to last for more than just the short term.

Chartering and Spot market:

VLCC: The steam took off on the VLCC market this week, as we saw a couple of points knocked off on the MEG/Far East voyages, but it seems mainly driven by relets and more ships becoming available in the area. In the WAF things also looked a bit slow and inquiries were less than the week before. All in all, there is still a healthy amount of optimism in the segment, and the loss of a couple of points after several good weeks should not scare Owners yet.

SUEZMAX: The Suezmax segment experienced much of the same as the VLCCs. A few points were knocked off in the MED this week as rates leveled down after last week’s spike on the news of Libyan ports reopening. The West is in general a stronger market at the moment, while much is driven by the MED, as WAF also was a bit down this week.

AFRAMAX: Finally, the Aframax segment followed troops as the momentum took a hit this week. In the North Sea, cargoes were short this week, which lead to a drop in the area, and some ships even ballasted away, which should provide some relief for the ones that stayed. In the MED the story was very similar to Suezmax’s as rates leveled out on the back of the previous week’s short spike.

LRs: The LR2s have taken the throne as LR1s are now the ones falling behind. It is a funny market when you see LR1s earning less than the MRs on some routes, and in general, the MRs have been firm throughout, while the LRs seem to struggle to find their place.

MRs: Charterers cannot seem to catch a break as another firm week of MRs showed the strength of this market. Especially in the west USG and UKC were firming up this week and we remain bullish for the mid/shortterm spot market.

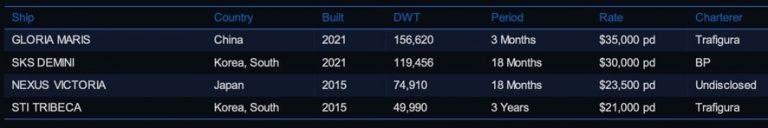

Period market:

As we see the LR2s starting to go after the returns, that the economy of scale should provide them in this market, we also see that TC rates for the segment are increasing and we have adjusted our benchmarks accordingly. Suezmax’s and VLCCs are two segments that have probably been the most stable in terms of period rates lately, but we expect to see increases in these two segments.

List of highlighted fixtures this week:

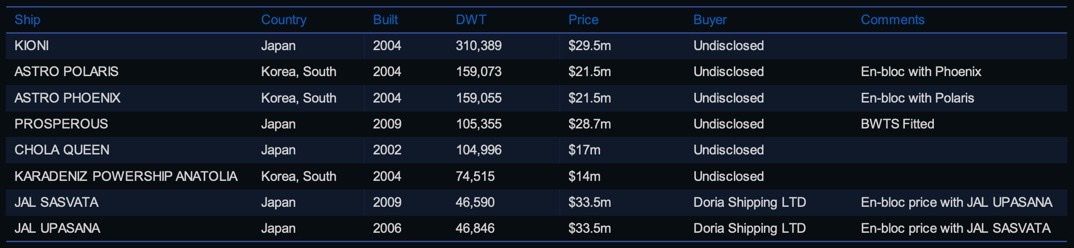

Second-hand market:

The second-hand market is lively and seems unaffected by the summer vacation time. We are still seeing week-on-week increases both in secondhand prices for product and dirty tankers, but we are getting the feeling that pricing for product tankers has close to reached its limit, with LR2s being the ones that have the most potential for further increases.

List of highlighted transactions this week:

Newbuilding market:

More newbuildings to report this week being the third consecutive week with tankers being contracted. K Shipbuilding reported that it has received an order for two firm 50,000 DWT MR2 tankers from Pacific Carriers. Both vessels are scheduled for delivery throughout H1 2024.

CMJL Yangzhou announced that it has received an order from Furetank for one firm LNG dual-fuel ice-class 18,000 DWT chemical tanker bringing their total series to 11 at the yard.

The number of tankers being contracted could suggest that owners are being more optimistic about the mid-term tanker market and pulling the trigger for new tonnage compared to modern second-hand tonnage pushing newbuilding benchmark prices even higher as Chinese yards continue to increase costs.

Recycling market:

The low activity in the recycling market seems to continue for the foreseeable future as exchange rates continue to drop against the US dollar and new Letter of Credit restrictions are taking place in Bangladesh which will further squeeze the supply leaving owners of vintage tonnage to continue trading.

The most affected hub this week was the Turkish yards with rates dropping 4% settling at $240 per ldt. Bangladesh offer prices gained 1.9% settling at $550 per ldt while India gained 0.9% and settled at $545 per ldt. Pakistan offer prices remained the same as last week at $535 per ldt.

There was one vessel reported sold for recycling this week. ‘BONKOT STAR’ (1997 built, 41,098 LDT) Sold basis ‘as is’ in Malaysia at $530 per ldt.

Crude oil market:

The September contract for WTI Crude settled once again below $100 this week and is the fourth consecutive week with a settlement below the $100- mark. The contract settled at $98.62 and increased 3.35% w-o-w. WTI Crude shortly touched +$100 on Friday but fell below 100 again shortly after. September contract for Brent Crude settled at $103.97 and hardly changed being down 0.06% w-o-w.

While oil and gas companies continue to report booming profits due to the elevated oil and gas prices, their peers in sanctioned trade do the same. Iran and Venezuela are posting elevated profits due to the high volatility in the market and increasing oil prices which mainly go to shadow buyers or China. The market may continue to be tightened for years to come due to lower investments in exploration and production amidst the pandemic and could be an indicator that we will see even higher oil prices as demand is high while supply continues to be limited. The only option to allow more oil to the market to stabilize the elevated oil prices would be to lift sanctions on Venezuelan and Iranian oil but that option seems to be farfetched and not very likely to happen any time soon as talks between Iran and the U.S are on standby.

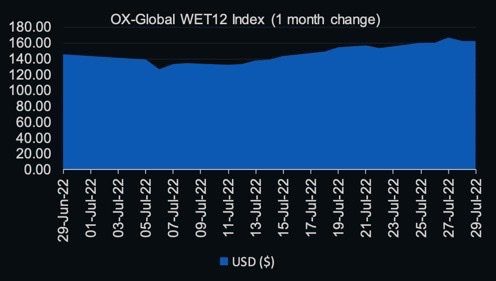

OX-Global Shipping Indices:

The OX-Global WET12 index saw an increase of 1.86 points or 1.16% w-ow settling at $162.08. The WET12 index continues to increase and outperform its peers which suggests that investors are more confident and optimistic when it comes to tankers compared to dry bulk and containers which has seen historical rates and profits but might just be the start of the downturn. This week we understand that the container operators are forcing owners back to the table to negotiate rates whilst the dry bulk market seems to soften.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.