We saw a more flat market this week, especially on the clean side where charterers managed to steal back a few points, primarily west of Suez, the same goes for the crude/dirty market where activity was a bit duller, though earnings are still not something to complain about and the overall sentiment remain strong

The full EU sanctions on Russian oil and products are closing in very fast, and we are eager to see the full outcome of this. We have previously expressed our bullish views on this, due to the imminent increase of tonnemile, but realistically all cards are in play and time will soon reveal the outcome.

Crude/DPP

The VLCC market was a bit slower this week and consequently dropped a few points more or less worldwide. The sentiment is strong, and activity is flowing with plenty of cargoes leaving the middle eastern gulf and USG, many headed for China, so a few points were knocked off, but earnings remain over $100k p/d so it’s all relative. The Atlantic market continues to perform well for the Suezmax Owners which are now fully on the bullish wave as well. WAF is looking healthier, and the same goes for the black sea, only area looking slower this week was the far east. The Med market is looking very good for the Aframax Owners, where they won the battle against charterers of another few points this week, the only market in retreat seems to be the north sea, where Owners had to let go of a few points due to less activity.

CPP Market

The LR1 outperformed its big brother LR2 in the east this week. LR2’s activity was slower this week which ended up kicking $200k of on westbound voyages but still closed excess of $4mill. The LR1 market was more active and much came from its ability to tap into some of the MR cargoes, westbound voyages for LR1 is about $3.5mill at end of last week. The eastern market performed very well for the MRs this week, TC17 (ME/Africa) is fixing around WS 400 and with room for more in the week to come, the westbound voyage for UKC was fixed excess of $3mill. In the UKC however, the market is looking duller and for another week the market dropped a few points due to a long tonnage supply list, also in the Med the MR market dropped significantly.

Period Market

The period market is looking good, and the charterer’s confidence is easily reflected in the numbers that they are willing to commit over a long period. Though only a few fixtures were recorded this week, there is plenty of ongoing negotiations, and we expect a few majors to be locking in more tonnage over the next couple of weeks, due to the upcoming market changes with EU/Russia sanctions.

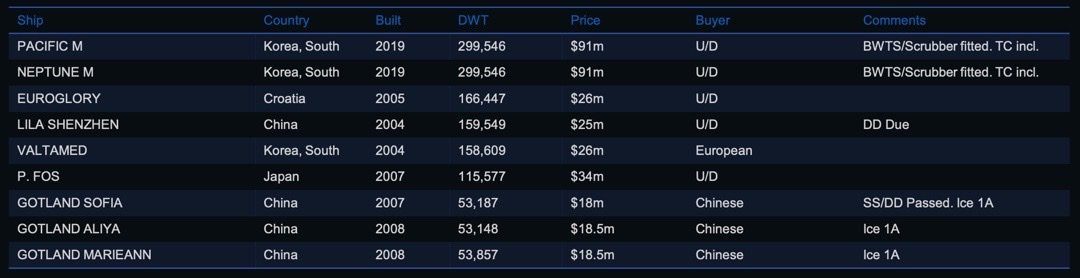

Second-hand market

Another week with transactions surpassing last week’s benchmarks and pushing asset prices upwards. The interest in second-hand tonnage seems to continue and Buyers are not yet satisfied, gearing up for winter with possibly higher freight rates and less availability

List of highlighted transactions this week:

Newbuilding market

The newbuilding market continues to be silent with not much going on due to the increasing prices and owners needing tonnage prompt to get a slice of the current booming profits. Deliveries are being pushed further out due to filled slots with mainly LNG carriers and the pile of container ship orders we saw in particular during 2020 and 2021 which means that even MRs are being scheduled for delivery 2-3 years from now.

Whether we are going to see a spike in newbuilding orders is too soon to tell but if we do, it will be for another reason than the current elevated freight rates as owners have to take into consideration the long waiting time and would most likely be through fleet renewal strategies that we are going to see more orders coming in.

Recycling market

Recycling yards are still empty with very little activity going on. It seems that nobody is willing to send their vessels to the yards just now while the freight rates continue to increase and recycle prices are not that interesting due to the complications experienced by the yards such as flooding in Pakistan, currency troubles, and Letter of Credits being limited. With the new carbon emission restrictions being just around the corner we might just see a bit more activity unless there will be extensions granted.

There were no reported tankers sold for recycling this week.

Crude oil market

With just five weeks left before the EU embargo on Russian oil comes into effect the tanker market seems to be confused as to what will happen and how to play their cards to get the most out of the situation. While Russia continues to export its crude to Asian countries have seen minimal changes in exports after invading Ukraine the situation could be changed after December 5th, 2022. With tonne-miles being increased due to the longer routes and availability being less we might only have seen the beginning of the tanker boom with questions about whether more vessels will be deployed in Russian trade reducing availability even more and pushing oil prices upwards.

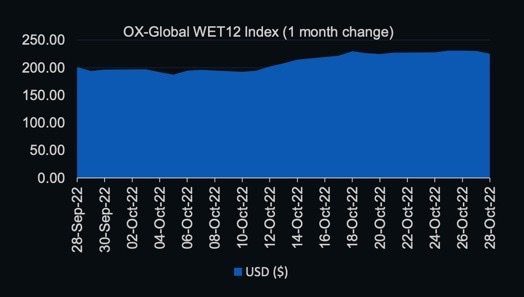

OX-Global Shipping Indices

The OX-Global WET12 index decreased this week and settled at $225.57 on Friday. This is only after the index reached a new all-time high on Wednesday settling at $230.93. The index fell an overall 0.91% this week or 2.09 points. The optimism is still there and compared to other segments such as container and dry bulk, the tanker-listed companies seem to be in favor of elevated freight rates that continue to increase, NAVs being positively adjusted as asset prices spike every week with some segments having reached close to 100% increase Y-o-Y.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.