General

While Q1 and Q2 were primarily reserved for the product tanker Owners, it looks like crude tanker Owners might be joining the fun in Q4. VLCC’s soared the week before last and to our comfort, the market stood its ground this past week as well, and looking at the demand side, we are confident about the future.

With the last summer days coming to an end, we are on high alert for the winter days coming up. The rise in energy and heating demand during winter is a fearful season for most Europeans this year and as most countries are already now starting to prepare, we expect to see its impact on the tanker over the coming months of «final preparations».

Chartering and Spot market

VLCC: The VLCC market gets more interesting every week that the rates hold firm. We saw that Atlantic got a bit of an adjustment after rates soared the week before last, however, MEG was holding firm this past week.

SUEZMAX: The Suezmax’s were keeping steady with no major outswings, however, it does seem that a lot is getting fixed off-market which makes it harder to track the actual performance. The Mediterranean market continues to perform well for the Suezmax’s but the WAF is looking a bit duller this past week.

AFRAMAX: The week prior we saw a few Aframax’s exiting the NSEA area which has caused rates to stabilize this past week. In the MED and the Black Sea, things were a bit slower the past week.

Period market

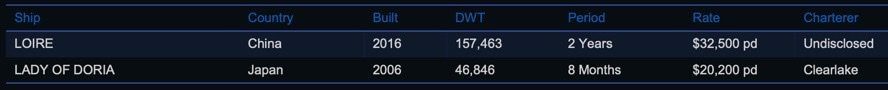

On the period side, we saw some meaningful rates getting committed on crude tankers, both for long and short-term periods giving us an indication of Charterers’ expectations. Product tanker fixtures are a bit more modest than what they have been as a reflection of the spot market.

List of highlighted fixtures this week:

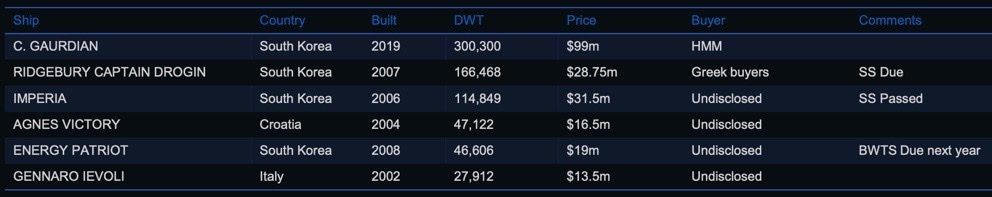

Second-hand market

Buyers’ appetite remains high, especially for Aframax’s where it seems that some buyers are still willing to increase their offers week after week. We also recorded some useful benchmarks on the product tanker side, most were well aligned with last done.

List of highlighted transactions this week:

Newbuilding market

A pair of VLCC’s were ordered this week being the first VLCC newbuildings being contracted during 2022. The pair (309,000 DWT) was ordered by Mitsui OSK Lines (MOL) at Dalian COSCO KHI and are scheduled for delivery in 2025 and 2026. Both vessels will be fitted with LNG dual-fuel propulsion.

The order suggests that owners are now more optimistic than ever with increasing rates, asset prices, and a positive outlook forcing owners to bet on the crude market. We suspect that even more orders for Aframax, Suezmax, and VLCC’s will be placed during the second half of 2022 pushing asset prices and newbuilding prices even higher.

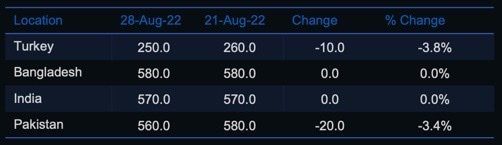

Recycling market

The recycling market took a turn this week with optimism being present throughout the entire chain of the market with cash buyers finally starting to place bids on larger vessels and concluding with longer laycans to adjust for the current Letter of Credit difficulties in Bangladesh and Pakistan which is expected to normalize in Q4.

There was 1 reported VLCC sold for recycling:

‘URANUS’ (Japanese 2002 built, 39,825 LDT) was sold for $610 per ldt with long laycan as delivery is set during October in sub-continent.

Crude oil market

The oil market is as “hot” as it can be amidst a global supply restrain with the winter season being just around the corner. While Washington’s efforts to keep oil prices stable it seems geopolitical factors continue to havoc plans. Oil is currently being traded at around $90-100 per barrel but that could very well change soon as Iran and the U.S. are once again negotiating a successor to the 2015 nuclear deal otherwise known as the JCPOA. If Iran manages to get a deal with the U.S. it could mean that another 1.4 mbpd would enter the market on top of the current production levels of Iran which accounts for approximately 2.55 mbpd and would be sold in the free market. While the message is clear and optimistic from both sides, there seem to be unresolved issues that could very well be the cause of the deal to fall through and spike oil prices even further.

OX-Global Shipping Indices

The OX-Global WET12 index fell 0.41% this week or 0.78 points being the first weekly decline in over 2 months. The index started off the week at $190.16 Monday and reached an all-time high of $193.21 on Wednesday only to bounce back to sub 190 and settled on Friday at $189.37.

A couple of companies reported their earnings this week with increasing dividends payouts and overall optimistic prospects being the headline and focus. We see more capital being deployed in the tanker segment and with a more promising short to mid-term outlook and winter just around the corner, we might see the index increase even further during September and Q4 2022.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.