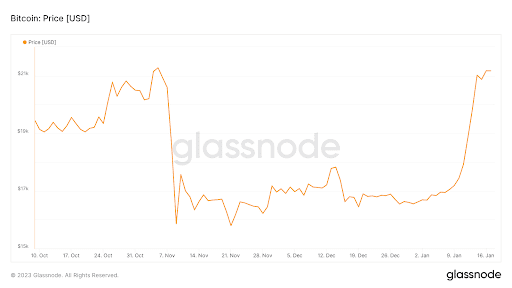

Bitcoin made a spectacular comeback during last week and made a jump back above the magical $20.000-level which was the highest valuation point of its last cycle high.

The move happened following two important events in the market. First off, the CPI print which is the go to datapoint for measurement of inflation levels came out positive yet again. In fact, not only have inflation numbers been falling consistently over the last months measurement but a consensus seems to be forming among macro analysts that it will continue to do so.

Feedback from a large investment bank conference here in London

— Alf (@MacroAlf) January 16, 2023

A) Most consensus view

The Fed is done, inflation is coming down hard, recession avoided

B) Most consensus trade

Long EM

Secondly, and more importantly for the industry, liquidators of FTX announced that more than 60% of the funds on FTX is expected to be recovered. This brings back a strong wind of hope to what has otherwise been a complete shit-story for the industry (More in this in the section below).

The macro markets continue to be muddy, and it is our expectation that volatility will persist even though the outlook is surely getting brighter. Meanwhile, the crypto markets are still plagued by an overhanging risk of contagion in the markets following the FTX collapse, where especially Digital Currency Group has taken headlines lately because of the insolvency of Genesis.

FTX Saga Updates

The FTX saga has dragged on for more than two months, and it seems far from over. We have been covering the developments extensively, and with a fresh new year in front of us, it seems likely that this year will still be heavily weighed by the events unfolding here. Below are a few things to look out for.

- Liquidators of FTX secures $5B in liquid assets

On January 11th, a bankruptcy attorney made a surprising announcement at a hearing that crypto exchange FTX has recovered more than $5 billion in assets, not counting the $425 million in crypto held by the Securities Commission of the Bahamas. This is a significant increase from the $1 billion in assets that the company’s new leadership had reported on December 20th, 2022. However, it is still unknown how much FTX owes its creditors, as the initial bankruptcy filings indicated a figure between $1 billion and $10 billion.

- SBF publishes a Pre-Mortem for FTX

Sam Bankmann-fried has just published his personal take on the FTX collapse dubbed “FTX Pre-Mortem Overview”. This isn’t the first time the discredited founder has expressed his opinions publicly. In November, he said in a series of tweets that FTX International was attempting to raise liquidity and was discussing with «various parties.» It appears to be the same tune being played again. Leverage, bad hedging and CZ as the antagonist.

Notably Shakers

- Ethereum’s Shanghai Upgrade Inching Closer

The Ethereum Shanghai upgrade, set to take place in March, will allow ETH that has been staked to be withdrawn. As of writing, more than 16 million ETH is staked on Ethereum’s Proof-of-Stake (PoS) network, equating to over 13% of the entire Ether supply. It is worth noting that this narrative has caused a surge in the price of Liquid staking ETH derivative tokens, such as LDO, which has seen a 40% increase over the past two weeks.

- Ethereum’s Shanghai Upgrade Inching Closer

- Microsoft Eyes 49% Stake in ChatGPT

Microsoft Corp is reportedly in negotiations to invest $10 billion in OpenAI, the owner of ChatGPT, which would give the firm a valuation of $29 billion, according to Semafor. A peculiar agreement is said to be part of the deal, where Microsoft would get 75% of OpenAI’s profits until the initial investment has been recovered. Microsoft would then own a 49 percent stake in OpenAI, while other investors would take over the other 49 percent. The remaining 2 percent will reportedly be owned by OpenAI’s non-profit parent company.

Binance US has obtained initial court approval to purchase assets from the bankrupt crypto lender Voyager Digital for $1 billion, comprising a $20 million cash payment and the transfer of Voyager’s customers to the Binance US cryptocurrency exchange. This buyout comes after a prior agreement to sell Voyager’s assets to FTX for $1.4 billion failed to materialise in November due to FTX’s insolvency.

Another “battle of the giants” is playing out as Gemini’s Cameron Winklevoss is lashing out at DCG’s Barry Silbert. Winklevoss publicly accused crypto broker Genesis and its parent company Digital Currency Group (DCG) of fraud, and called on DCG CEO Barry Silbert to resign. In an extensive letter, Winklevoss also accused Genesis of carelessly lending money to 3AC, which was used for a «kamikaze» trade, exchanging Bitcoin for shares in Grayscale’s Bitcoin trust product (GBTC).

- GBTC’s discount to NAV narrows for the first time in a year

The start of 2023 has seen Grayscale Bitcoin Trust’s (GBTC) rally exceed that of its underlying bitcoin (BTC) holdings, resulting in a significant decrease in its discount to net asset value (NAV). GBTC’s discount to NAV is currently at 38%, the lowest it has been in eight weeks, after ending 2022 at a 45% discount. However, the looming brawl with Gemini is not good news for the Trust, with DCG having recently wound up its $3.5 billion wealth management division.

- GBTC’s discount to NAV narrows for the first time in a year

The fourth quarter of 2022 saw a $1 billion net loss attributable to the common shareholders of Silvergate Bank, which is currently the target of a class-action lawsuit regarding its transactions with FTX and Alameda Research. The report also noted that client deposits decreased from the third quarter’s $12 billion total to $7.3 billion in the fourth quarter.