The Organization of the Petroleum Exporting Countries and their allies were looking for strong demand with tight balances before starting to unwind the voluntary cuts according to plan.

«We are waiting for interest rates to come down and a better trajectory when it comes to economic growth … not pockets of growth here and there,»

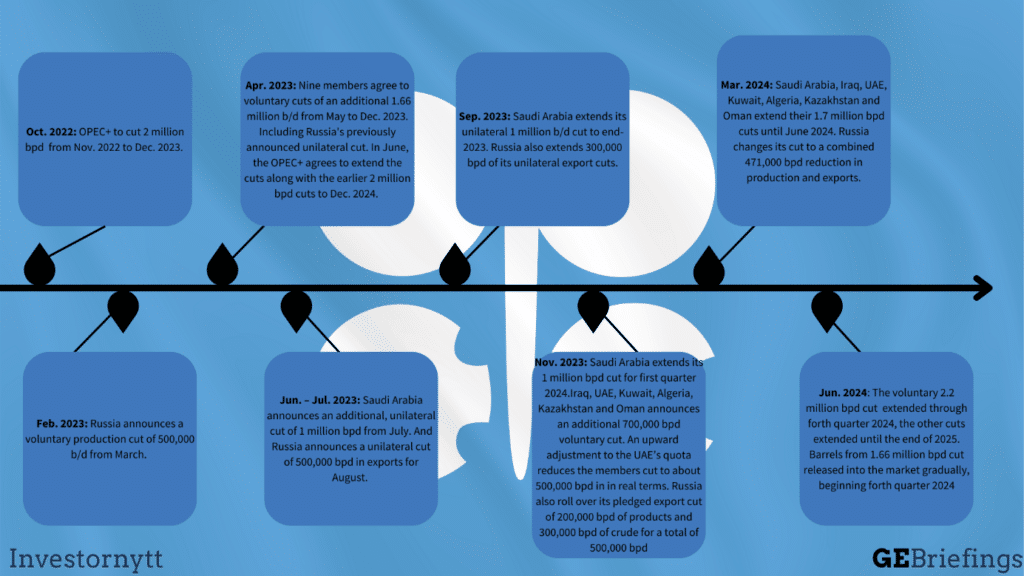

Saudi Energy Minister Prince Abdulaziz bin Salman told reporters at the organizations June meeting. The 2.2 million bpd cuts made by the OPEC-eight, Saudi Arabia, Russia, UAE, Iraq, Kuwait, Algeria, Oman and Kazakhstan is due to hit the market in October 2024. Over a twelve-month period, the plan is to release the barrels gradually with 183 000 bpd a month. But OPEC+ would not let themselves to hold the short end of the stick without options, the cartel has announced that they can pause the unwinding of cuts and even reverse them if demand and market signal isn’t strong enough.

OPEC+ holds back approximately 5.86 million bpd or about 5.5 percent of global demand, and with that losing market shares to other oil producing countries. The group aims to take some of that shares back, but with a wobbly market and prices plummeting out of the cartels comfort zone its back to the drawing board for OPEC+. Earlier this summer (August) OPEC even revised down their demand growth outlook for 2024 for the first time. Citing weaker Chinese demand signals and the emergence of hard H1 data. Still, OPECs outlook was only lowered by 135,000 bpd, keeping its forecast at about 2.1 million bpd and well above historical averages, but the cat was out of the bag. OPECs 2025 forecast was also reduced by 65,000 bpd, in response to a weaker growth outlook for China and Middle East. OPECs projection for 2025 demand growth now sits at 1.78 million bpd.

Another question is the groups internal cohesion. Some of the group’s 18 producers with quotas have been stepping out line especially thanks to the three notorious overproducers- Russia, Iraq and Kazakhstan that has continued to exceed targets. Kazakh compliance is expected to improve markedly after planned maintenance at its Tengiz field August, with maintenance also planned at Kashagan in October. Concerns regarding Iraq shows Baghdad’s refusal to acknowledge production in the semi-autonomous region of the Kurdistan Regional Government (KRG). Iraq’s compensation cuts have increased notably in the new program, and now include a 120,000-bpd cut through first quarter of 2025. With totalcompliance, Iraq would cut an average of 100,000 b/d from August 2024 through September 2025. With Kazakhstan’s maintenance program we see it likely they can comply with the pledge 50 000 bpd cut in the same period.

When OPEC+ reached an internal agreement to pause theOctober unwinding of production cuts its not without challenges. The groups resolve to support oil price comes with a cost of market shares to non-OPEC producers, and loss of revenue on both lower market shares and struggling oil prices. The pause is to last through November, and barrels from the voluntary cuts set to hit market during December, but depending on market condition we could se further delays.