General:

Patience is key, especially in the Tanker market. It seems that the longawaited firm market has finally arrived as the dirty segment is now chasing the clean segment to become the most profitable. Especially on the VLCC, which were the last to follow, Owners seem pleased to finally see some earnings come in.

Will it be a long-lasting return of the market? Much seem to be pointing in that direction, as long as oil prices do not become too expensive again. Looking at the world’s inventory lists and the current geopolitical situation, forcing many countries to source their oil from other trades increasing tonne mile ratio. It seems to be a quite hopeful future for tankers. A resupply and extensive effort to keep petrol prices down is a top priority in most major economies, therefore, as long as oil prices stay somewhat modest, we are convinced that the market will remain firm.

Chartering and Spot market

VLCC: The firm market that their colleagues in the smaller segments had enjoyed for a few weeks has now reached the VLCC owners/operators. After a long wait, it now seems VLCC participants are starting to make actual profits again

SUEZMAX: An active week in the Suezmax segment where rates only seem to be going one way recently (up). On the WAF/Cont trade, rates kept firming throughout the week, and in the AG the market remained active and firm. There is a good sentiment in the market and Owners remain confident.

AFRAMAX: The dirty/crude tanker segment is firming across all sectors as the Aframax segment follows troops. Especially across Med and black sea we saw some nice increase, and enough demand to keep Owners excited for the next week.

LRs: The dirty tankers might be on a rise across the board, but in the LR segment, things are looking a bit more sideways. While rates are still firm, we are seeing some slow decline. The optimism is strong, however, as Owners hope to see some renewed demand next week, hopefully, some will get passed along from their colleagues in the MR segment.

MRs: Forgetting about the LR segment, MR tankers are enjoying their firm market. Looking at the AG/East Africa, rates are on the rise and owners are making serious returns. The Far East market is firming as well and we are starting to see Singapore owners, ballasting their tankers to the AG or further up North East/Far East which should bring some more joy to the ones remaining in Singapore, where rates were more flat throughout the week. The market is just as good in the west. Around Europe, rates are firm but without serious increases, however, in the USG it seems charterers could not hold the pressure down, as rates saw a drastic increase on the USG/Brazil lane and overall firm.

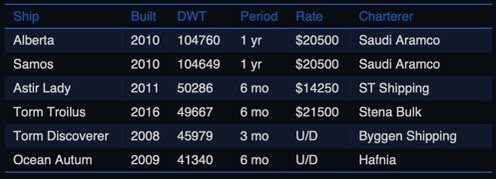

Dirty is up and product/clean is down. More or less the short story of the period fixtures framing the market this week. Dirty/crude tanker fixtures are aligning quickly with the firm spot market, which has led to some serious increases in rates this week. Compared to a few months ago it is safe to say that product/clean tankers are still able to lock in favourable levels as well, but with the quick and recent jump, it seems that operators are trying to find common ground with Owners at slightly lower levels than seen the past few weeks.

Second-hand market

The second-hand market is usually the last to get affected by the underlying spot market, but given the strong sentiment and optimism, we are already seeing dirty/crude tankers sold well above recent benchmark levels. Owners within the product tanker segment have also been readjusting their ideas, as it has become increasingly expensive to purchase a product tanker over the last couple of weeks.

Newbuilding market

With a cramped newbuilding market and fewer available slots at the regular tanker newbuilding yards together with the improved activity in the product tanker markets and strong optimism in the dirty segment. The newbuilding prices saw a steep increase this week with most sizes being up close to 1% w-o-w.

The activity will most likely remain balanced and unchanged throughout the next couple of months without any interesting action going on, while the majority of owners and players sit tight and await the situation i.e JCPOA, Russia/Ukraine war, OECD inventory levels, Chinese lockdown and Saudi production capacity.

No newbuilding orders were recorded this week.

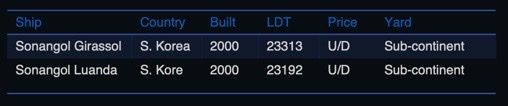

Recycling market

Recycling prices increased slightly throughout this week, but only a few tankers went for recycling. With a shipping industry that is almost profitable across all segments, the overall lack of tonnage is still present, which can be expected to push prices even higher in the coming weeks.

Oil and futures market

WTI Crude (May contract): Settled at $98.26 and saw a decrease of 0.31% w-o-w. Brent Crude (June contract): Settled at $102.78 and decreased 0.80% w-o-w.

Oil prices continue to be stable around the $100 per barrel mark with some adaption to the ongoing geopolitical factors affecting the paper markets. With the recent couple of weeks’ supply shortage fear and discussions of a global disruption in the energy markets which we believe is happening just now, but might not be as severe as first anticipated, due to the various factors affecting demand levels such as the covid lockdown in China and the high oil prices which have halted the increasing demand after the world came out of a global pandemic lockdown.

Although a ban was placed on Russian oil imports shortly after the invasion of Ukraine, it seems that Russia’s oil and energy sector has adapted to the situation for now and continues to sell the majority of its oil to India and China at discounts of more than $30 per barrel.

Iran’s foreign ministry spokesman Khatibzadeh announced said this week that Tehran considered the draft to be complete and would not negotiate any further, but only return to Vienna to sign the final agreement, which was now in Washingtons’ court to settle outstanding issues.

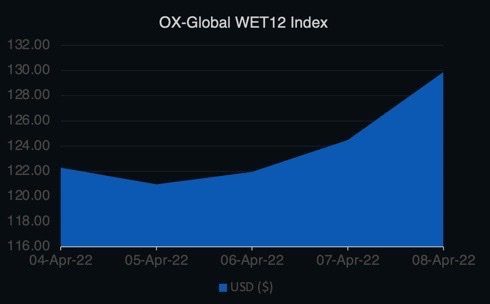

OX-Global Shipping Indices

The OX-Global WET12 index saw an increase of 7.6 points or 5.85% w-ow.

Disclaimer: The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.