General:

The tanker market did not bother much with the Easter break, as we saw a healthy amount of activity across the board. It seems that we are now starting to find more stable ground, not only on period rates but also in the second-hand market. This comes after weeks of increasing prices which were kickstarted by the rapidly improving spot market.

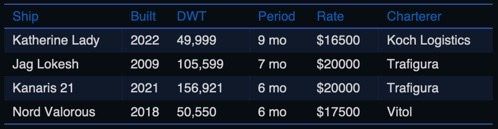

Chartering and Spot market

There was a fair amount of activity in the period market this week. As we previously pointed out, we are seeing vessels fixed out for shorter and shorter periods, which is a clear indicator of how firm the market is. While we have been seeing steep increases in rates throughout the previous weeks, this week marked the first, where we began to see a more stable market as rates started to align with last done levels.

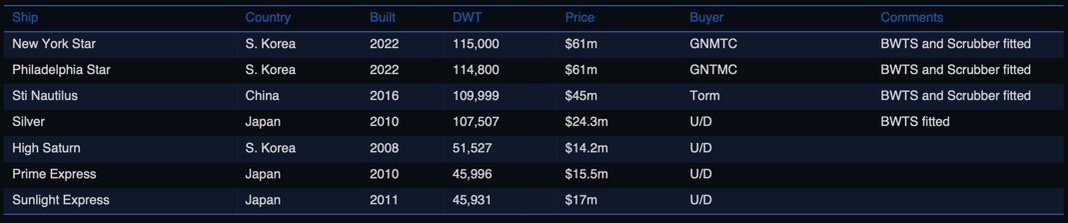

Second-hand market

The second-hand market is lively as always. The market is increasing fast and we see buyers trying to secure tonnage before the market potentially takes off, resulting in a healthy amount of transactions throughout the last couple of weeks.

We saw that second-hand prices followed the development of the spot market very fast, and it seems that sellers and buyers are just now starting to find common ground on what tonnage should cost. In total, we recorded over 20 transactions this week across second-hand and recycling.

Newbuilding market

No newbuilding orders were recorded this week.

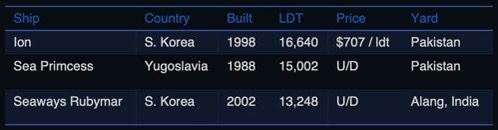

Recycling market

Even though tankers have become an increasingly profitable segment to operate, we still see a few units going for recycling every week, which will have a healthy impact on the long-term market. The tanker fleet historically has been oversupplied with tonnage, which in the past has made it harder for Owners to run a profitable fleet when the market is not under extreme volatility.

Oil and futures market

WTI Crude (May contract): Settled at $106.95 and saw an increase of 9.24% w-o-w. Brent Crude (June contract): Settled at $111.70 and increased 9.08% w-o-w.

While Russian crude and gas continue to flow, some Buyers of Russia’s natural gas have agreed to pay in rubles for the discounted gas, such as Armenia. Hungary has also announced that they are prepared to pay in rubles for Russian natural gas.

Tanker rates continue to be affected by the ongoing war between Russia and Ukraine and the tensions between the West and Russia. Russian production has not seen any change since the invasion of Russia, suggesting that Russia is ready to sell its oil at any price. Production data from EIA shows that Russia had 11.3 mbpd of crude oil and liquid supply in February 2022 while that number was only slightly less at 11.28 mbpd in March 2022.

Russia’s Energy Minister Shulginov stated earlier this week that the federation is prepared to sell oil at almost any price to friendly nations. According to the International Energy Agency, the Western sanctions could reduce Russian exports by around 3 million barrels daily during this quarter.

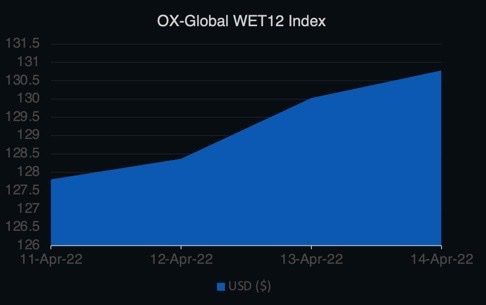

OX-Global Shipping Indices

The OX-Global WET12 index saw an increase of 2.97 points or 2.27% w-o-w.

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.