General

No major events occurred in the market this week, but if anything we have started to see some indications of where the market might lead. It seems that the crude segment trying to slowly climb while charterers are starting to test product tanker Owners as LR2s came under further pressure. The continuous release of 1 mbd of the strategic reserves from April till October seems to be creating some light in the crude tanker market, which gives some hope for Owners.

A good level of activity remains on the transactional side of the market, with a small rise in recycling activity in the last couple of weeks as prices started to go down, but also second-hand tonnage is shifting hands, suggesting Buyers east of Suez are more optimistic compared to fellow colleagues west of Suez, who are currently selling more than Buying.

Chartering and Spot market

VLCC: We started to see some movement in the AG this week, where rates were pushed upwards due to higher activity. The US Gulf looked more promising as the effect of the minimum 180 Mb release (average over 1 Mb pd) between April and October from the strategic reserves, started to show.

SUEZMAX: The Suezmax Owners experienced some optimism in their market as well, demand seems to be increasing, pushing the rates in the right direction. Activity is mainly situated in the west with a strong US market, but conditions are slightly improving in the East as well.

AFRAMAX: The Aframax Owners are trying to combat a slow market as Med/northwest Europe vessels have come to terms with the past and started to ballast away from the area, many heading to the US Gulf where the best market conditions currently are.

LR: As seen before, when demand starts to slow, the bigger segments are the first to feel it. LR2s saw a decrease in available cargoes putting them under pressure this week, allowing charterers to fix at lower levels. LR1s remain a firm segment, and Owners can still be happy with the returns they are seeing. Even though charterers are testing (and some successful) lower levels, the LR1 list looks tight, and the outlook is favorable for Owners.

MR: The MR segment is healthy, but as charterers are trying to correct the LR segment, it affects some MR tankers as well, putting pressure on rates in the AG. Nevertheless, MR Owners are still in a strong position, and the global market looks healthy.

Not much excitement in the period market this week, as only a handful of fixtures were reported at pretty much the same levels as the previous week, with no changes.

We continue to see stable activity in the period market and owners are in general optimistic that the market is going to continue seeing fixtures with healthy and profitable rates.

List of highlighted fixtures this week:

Second-hand market

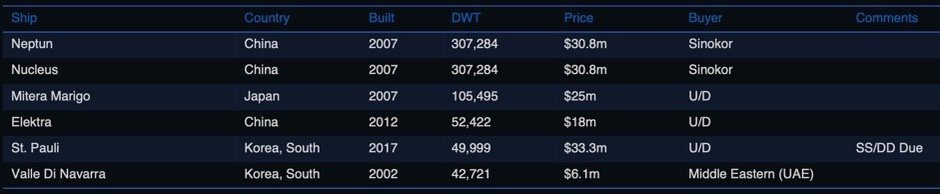

We continue to see a healthy amount of transactions with volatile asset prices that swing from week to week resulting in new benchmarks being set every week. More risk willing Buyers carry on acquiring older vessels suggesting that there is a general optimism among middle eastern and Asian owners/operators.

During the past couple of weeks, we have seen more middle eastern buyers acquiring assets compared to the last couple of years, which is indicating that the region is strongly believing that both product and crude markets have seen the bottom and there is only one course from here, and that is upwards.

List of highlighted transactions this week:

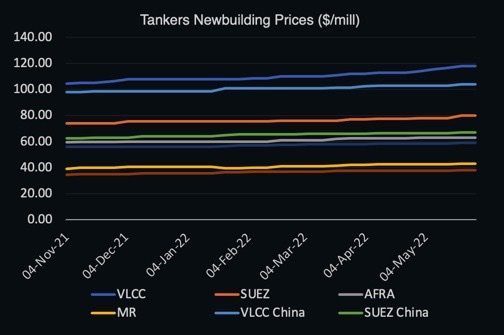

Newbuilding market

Even though very few orders being reported due to the current situation in increasing equipment and labour costs, we continue to see benchmarks being set at new and elevated levels, resulting in fewer orders, but rather owners / operators looking towards the second-hand market to invest and renew their fleets, resulting in a tight second-hand market with modern eco candidates.

No newbuilding orders were reported this week.

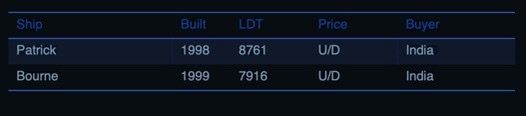

Recycling market

Another week with steep decline in recycling rates throughout sub-continent with Turkey to continue remaining stable. During this week rates in Pakistan settled at $590/ldt falling 3.3%, while India settled at $605/ldt and sliding 3.2% w-o-w. Bangladesh had the steepest fall this week dropping $25/ldt and settling at $610/ldt (-3.9% w-o-w)

There seems to still be some activity in the recycling market with some owners selling before rates decline even further, but we also see owners who previously considered to sell for recycling keep their tonnage until the markets bounce back to better levels, compared to the last 3 months.

Crude oil market

WTI Crude (June contract): Settled at $115.07 and saw an increase of 4.84% w-o-w. Brent Crude (July contract): Settled at $119.43 and increased 6.49% w-o-w. Oil prices reacted this week to the news of the steep decline of Russian exports and an expected decision as to whether The European Union can agree on a Russian oil embargo, which could result in a drastic increase in oil prices.

Germany announced earlier this week that it is expected to reach a breakthrough with the European Union as to whether the 27 strong union can impose an oil embargo on Russian oil. Hungary continues to be a strong opponent of the suggestion, as they are heavily dependent on Russian oil even being armed with a $2b of funds to support their transition into alternative sources. Germany also said that it would support a decision to implement the embargo without Hungary necessarily agreeing to it, and if the oil embargo becomes a reality, oil prices could surge towards the $150 mark.

While Russia’s shipping and energy sector is now under sanctions and finding it difficult to export their oil to buyers such as India another hub has emerged for Russian oil via STS loadings, being Greece. Even though many shipowners steer clear of any involvement with Russia, it is not illegal to be involved in the trade of Russian crude and oil products which have become a lucrative business for some Greek shipowners setting aside any ethics of supporting the revenue stream of Russia’s state-owned energy companies.

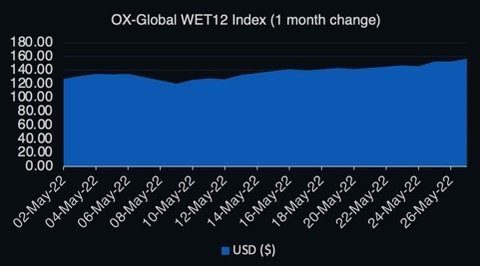

OX-Global Shipping Indices

The OX-Global WET12 index saw an increase of 9.67 points or 6.57% w-ow, which is one of the highest increases recorded throughout the last couple of weeks, as markets have seemed unbothered by micro and macroeconomic factors including but not limited to rising inflation, inventory draw and supply issues

Short term outlook for the WET12 index suggests that an even further increase might be just around the corner as rates continue to climb both within product and crude and investors react positively towards the fact that more capital is pouring into O&G development projects as well as a handful of middle eastern countries including UAE and Iraq looking to increase their output.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.