General:

Another week charterers managed to push the product tanker rates lower and yet we are still to see charterers take full advantage of LRs as MRs are still the top earners.

Looking at the second-hand market, confidence in the market is there, especially as MR tanker asset prices are increasing fast due to the lucrative spot market.

The VLCCs are slowly but surely catching up to their colleagues as rates increase for another week, while at the same time the Suezmax and Aframax market is looking healthier.

Chartering and Spot market:

VLCC: Overall a good week for the VLCC Owners as rates continued to climb across the board. However, with the market on its way up, the scrubber fitted, and eco-tonnage are stealing all the good rates and seeing almost double the earnings that non-scrubber fitted units receive. The nonscrubber/non-eco tonnage is still struggling to make breakeven in some areas, but general market conditions are increasing.

SUEZMAX: The Suezmax segment remained steady this week after dropping a few points the previous week. We remain bullish for the short to long-term outlook for dirty tankers in general, as Suezmax vessels are already seeing fine returns and only now have charterers started to make use of the VLCCs snapping up a few possible cargoes from the Suezmax’s.

AFRAMAX: Afras are again moving upwards this week after a few weeks with decreasing rates. In the North Sea, we saw a rebound back to previous firm levels with TD7 around WS 210. Cross-med were down a little this week, but much is contributed by the fact that 5 Libyan ports remain offline.

LRs: The LR segment saw a bit of a strange outcome this week as westbound LR2s were put on subs for less than an LR1. We have seen the market softening over the last few weeks as demand has been declining and cleaned-up ships are entering the still firm product market.

MRs: The MR segment also softened a bit this week, as rates in most areas saw a decline due to less product demand. The activity was best in North Asia and Singapore where Owners managed to push for more while the West MRs had a little less activity this week. The MR segment is still outperforming the earnings of LRs, but it seems that the LRs have started to see their bottom, and charterers should soon start to take more advantage of the economy of scale provided by the LRs.

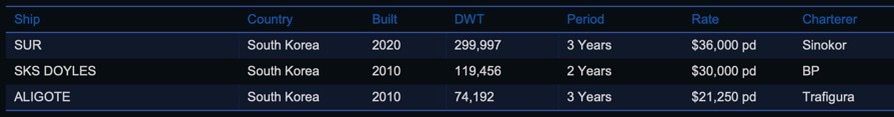

Period market

We saw a longer period concluded by Trafigura this week, which can be seen as an indicator of traders’ belief in the long term of the market, that they are willing to fix long with these rates.

On the dirty tanker side, Sinokor is yet again in play with its 3-year period, Sinokor has both expressed but also clearly shown its commitment to the VLCC over the last couple of months.

List of highlighted fixtures this week:

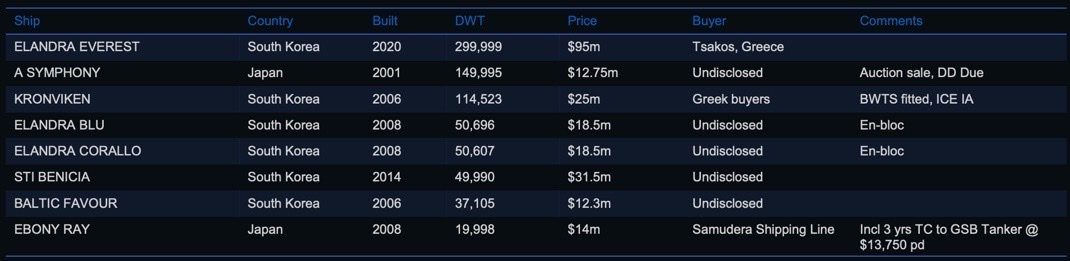

Second-hand market:

Second-hand prices are steadily climbing as some of the rumored negotiations are getting finalized and setting new benchmarks for the market to follow.

MR tankers remain the most sought after, hence it’s where we see the biggest price movement.

List of highlighted transactions this week:

Newbuilding market:

Another week with a couple of tanker newbuildings contracted. Even though it is smaller chemical/products tankers, the sentiment for tanker newbuildings looks better and better with owners biting the bullet and ordering amidst elevated newbuilding prices due to steel, equipment, and labor costs. This week Taizhou Wuzhou reported receiving an order for two firm 3700 DWT chemical/products tankers from Shanghai Jinghan Shipping which are scheduled for delivery in H2 2024.

Recycling market:

Recycling rates took a beating this week with rates being hammered across the sub-continent. The number of vessels hitting the beach continues to be very scarce and scrappers being desperate for tonnage has created somehow fuzzy market conditions which leave the market in a confused state with each owner, cash buyer, and scrapper having their own ideas as to where the market is headed.

Turkey rallied 8% and settled at $270 per ldt as the only price-positive benchmark this week while Bangladesh declined sharply and settled at $545 per ldt falling 9.2%. Pakistan follows Bangladesh with a heavy decline in the rates and settled at $540 per ldt falling 8.5%. India remained somehow stable and settled at $555 per ldt, “only” 1.8% decline w-o-w.

There were no reported tankers sold for scrap this week.

Crude oil market:

The August contract for WTI Crude did not start very well with an early decrease due to further concerns of a global recession on top of the energy crisis. WTI Crude (August contract) settled at $104.79 being down 3.35% w-o-w. September Brent Crude contract’s first week is not something to be excited about as well, with a steep decline of 4.16% settling at $107.02 just after falling below $100 for the first time in months. This is the second consecutive contract month starting with a decline.

The question as to whether key economies will enter a recession is creating more fear in the global energy and oil markets and was evidenced by the fact that WTI fell below $100 for the first time since April due to concerns of demand reacting to a potential recession. It seems that commodity markets have managed to weather the storm without much change due to supply constraints and strong oil demand but could be more difficult in the next 6-9 months depending on how economies react to increasing inflation and interest rates, while many countries undergoing energy crises.

While China is taking advantage of western sanctions on Russia’s oil and gas sector the same way it has done with Iran and Venezuela, China is surprisingly also importing from the U.S. SPR which has been drained for about 1 mbpd since October and is at the lowest levels since 1986. China is by doing so, benefiting directly at the expense of US consumers, which the US politicians seem to have no credible answer to other than stating the obvious fact that if a regular release of the U.S. SPR hadn’t taken place, the state of the energy markets would have looked more chilling.

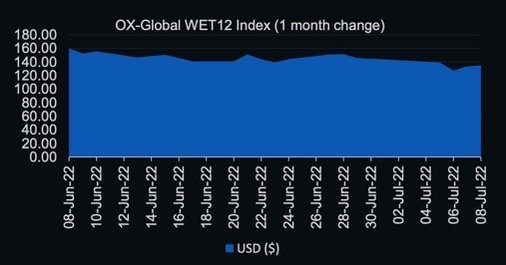

OX-Global Shipping Indices:

The OX-Global WET12 index saw a decrease of 4.37 points or 3.13% w-ow settling at $134.95.The index continued its downward trend again this week amidst further concerns about a looming global recession.

The index fell below $140 which is the first time since 17th May 2022 which suggests that investors are getting more anxious as to whether we are indeed in a bear market.

Even though the index is declining, it is still one of the more stable and best-performing indices just after the OX-Global DRY12 index.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.