General:

The tanker market is looking healthier with each week that passes right now. All product segments are firming up, week after week and while we saw quite a few ships available on the spot market in terms of LR2s, Owner’s confidence along with the LR1 list being maxed out, just pushed rates upwards.

Reserves are low, jet fuel demand is increasing, and fuel prices are high, the basic outlook is very firm for the product market and also the crude market since domestic reserves have to be filled at some point, however, with inflation at this rate and economic forecasts, there is a looming threat that tells us that the tanker market won’t be able to ride out the market as long as the container Owners have done.

Chartering and Spot market:

VLCC: With fuel/bunker cost increasing we were hoping to see a bit more increase in rates as well, however, it seems that activity levels are not strong enough. Globally the market is still dragging its heels, but Owners wait patiently for the storm to arrive.

SUEZMAX: We saw some significant improvement in WAF this week with WS climbing to 115, also the USG is still looking tight giving Owners some optimism for the week that lies ahead.

AFRAMAX: The Aframax segment firmed up almost globally. Cross-Med Owners have seen a nice increase over the last two weeks, now at WS 200 for TD19. Also, the Baltic and USG are looking good and with good expectations for the coming week.

LRs: Sentiment is very strong in the LR market and Owners’ confidence seems to be a lot higher than usual. LR1s started the week off with an extremely tight list which pushed rates further up and towards the end of the week cargo demand calmed slightly but rates remain firm.

MRs: The MR market is as its LR sisters still very firm. In far east Asia the market continued to climb, while in the west the market was a bit more clam during the last week. The product market is definitely at a point where charterers will have to re-evaluate their positions to see if anything can be done to lower shipping costs, however, at this given point, it seems demand is holding them hostage.

Product tanker rates have reached a point where it is starting to have a direct and meaningful impact on the price of the product it is carrying. We have already seen soaring petrol prices and expensive plane tickets, while we know this is mainly due to expensive crude, importers are now dealing with a cost factor that is independent of crude oil prices and it will be interesting to see how they will try to combat this.

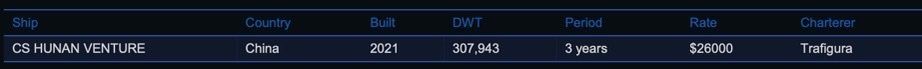

List of highlighted fixtures this week:

Second-hand market:

The second-hand market is becoming a very unpredictable place with the current product tanker market leaving both Sellers and buyers in a tough spot. With most second-hand prices up more than 40% across product tankers this year, it seems that every transaction is a new high.

The crude tankers are also affected and especially on the Aframax and partly Suezmax side, we see that prices try to follow the product market. Even though Aframax’s and Suezmax’s are making fair returns at the moment, it seems that much is still tied to buyers’ expectations for the short-term future of the crude market.

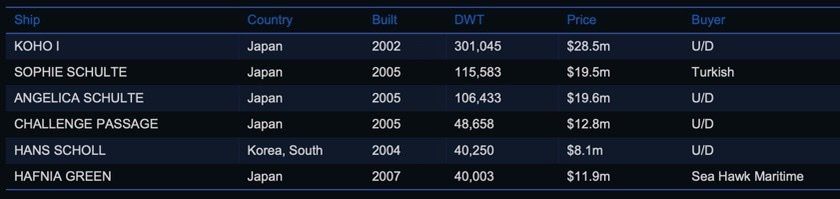

List of highlighted transactions this week:

Newbuilding market:

Two newbuilding orders were recorded this week after a long and dry period. With newbuilding prices at the levels we currently see, it had to take a very good market to make Owners order ships again, and it seems that we have reached this level.

Thenamaris ordered two LR2s at Hyundai Vinashin, Vietnam with delivery 1st half of 2025. Knutsen NYK Offshore Tankers placed an order for one shuttle tanker at Zhoushan COSCO Shipyard with delivery in Q2 2024.

Recycling market:

The recycling market seems to be reluctant to much change as scrap buyers and recycling yards are being pushed by Sellers to increase prices, leaving Buyers with limited options as they can either increase prices or reduce and have less tonnage being sold, which seems to be the case right now. A very limited amount of tonnage is being sent to the beach amidst a historic market for many segments and extreme optimism in the tanker market with the product segment going through the roof while crude players still awaiting their turn.

Not many changes this week as all rates were maintained except Pakistan which settled at $600/ldt being down $10 (-1.6%) w-o-w. Turkey maintained at $300/ldt, Bangladesh at $620/ldt and India at $585/ldt.

There were two reported tankers sold for scrap this week:

-HIKARI (2003 built, Japanese, 300,667 dwt) has been sold to scrap Buyers with UAE delivery at $606/LDT. -KYOTO (2000 built, Japanese, 281,050 dwt) has been sold to Scrap Buyers with UAE delivery at $606/LDT.

Crude oil market:

WTI Crude (July contract): Settled at $109.56 and saw a decrease of 7- 85% w-o-w. Brent Crude (August contract): Settled at $113.12 and fell 5.89% w-o-w. Oil prices took a tumble this week after multiple weeks of steady levels, without much changes compared throughout the week.

Russia is now the second-largest oil supplier to India and overtakes Saudi Arabia as of May 2022 as Russia exported an avg. 819,000 barrels per day in May. The strategy of India switching focus and now buying Russian oil and leaving Saudi Arabian crude in the dust comes amidst a time when India is facing an energy crisis and can reduce the pressure by buying Russian crude which is being sold at discounts of around $30 per barrel. The discounts however do not affect the Russian export revenues just yet as the west had hoped due to the elevated oil prices and Russia already exports half of its oil to Asian countries and focusing to export even more to Asia according to Gazprom Neft’s CEO Alexander Dyukov, while this may be an issue as analysts doubt Asia’s ability to absorb all 4 million barrels per day of Russian oil which was being sold to Europe.

OX-Global Shipping Indices:

The OX-Global WET12 index saw a steep decline this week like every other index, settling at $141.03 and being down 5.59 points or a 3.81% decrease since Monday.

The main reason for the steep decline across all indices should be found in the fact that the securities and equities markets have been through a bull run since the summer of 2020 and with an energy crisis, increasing inflation and the FED raising interest rates, the question remains as to whether we are only months away from a global recession… or if it has already begun.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.