General:

Many Owners/principles were left with their hands full the past week with Posidonia week, or at least the product tanker Owners. It seems the biggest issue for product tanker Owners is to decide whether to fix or wait, while on the other hand crude tanker Owners are looking for things to fix.

We made an overall adjustment on the asset price side this week, as we have been reluctant to increase our benchmark prices simply to asking prices until we saw concrete proof that buyers are willing to commit at these levels and this week, we saw more of such commitment from the buyers’ side.

While Owners in the Crude segment have seen better days in the spot market, we see that periods are getting concluded at fair levels still, indicating Charterers’ trust in the mid/long term strength of the market.

Chartering and Spot market:

VLCC: With Posidonia undergoing the market did not exactly pick up in activity, instead it seemed even quieter than the week before. Bunker prices keep adding pressure to VLCC’s already none existing earnings.

SUEZMAX: The Suezmax segment was also rather quiet this week. The only factor that really pushed rates up this week was the soaring bunker prices, however, rates were otherwise kept steady even in a slow market, which usually is a good sign of the strength of the market.

AFRAMAX: The Aframax market has been under pressure for a couple of weeks with rates going from being firm to slightly worsening every week, and this week did not seem to be any different.

LRs: The market is still completely split in two, as product tanker Owners keep taking in returns that their colleagues in the Crude market would only dare to dream of these days. The LR2s which were struggling to keep up with their competitors in the smaller segments, made a great comeback this week as rates saw a significant increase. The LR1 Owners also saw rates pick up after a few slower weeks and are now faced with a luxury problem, whether to fix or hold on, to see if rates increase even further the next day.

MRs: The MR market is as firm as ever, with rates pushing higher this week and we see charterers trying to fix forward as long as possible, in fear of getting caught in a bad storm. The Far Eastern market is very firm, seeing a few ballasters from the Indian Ocean coming to join the party. In the Med, the MRs also saw a further increase this week, and overall, the market seems just as firm west of Suez.

The product market saw rates soar even further over most of the segments this week while on the other hand the crude tanker market was quite inactive, however, it does not seem that the period market is as split as the spot market, which most likely is bound to the conviction that many Charterers and Owners share, that the crude market is set to make a swift comeback. Nevertheless, overall, there are very few longer periods getting concluded on the product market, making it difficult to set concrete benchmarks.

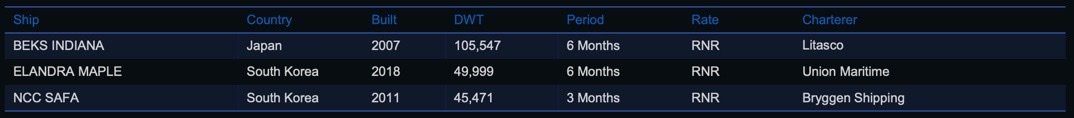

List of highlighted fixtures this week:

Second-hand market:

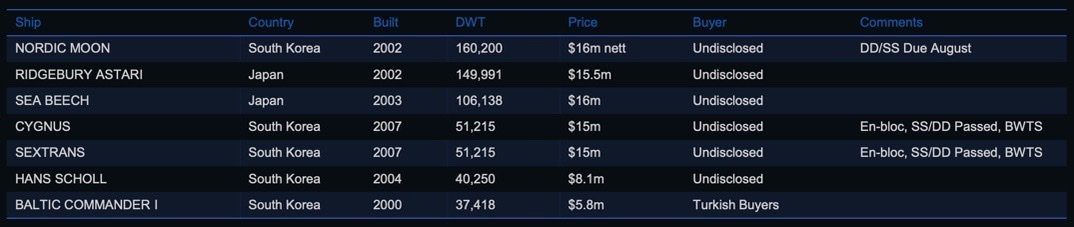

We made an overall adjustment on the asset price side this week, especially on the product tanker side, where we have been more reluctant to move our benchmarks too high before seeing more concrete deals. We also saw some new highs on the crude side which made us adjust our benchmark prices accordingly.

List of highlighted transactions this week:

Newbuilding market:

Another stable week in the newbuilding market with not much activity other than owners wishing they had contracted newbuildings when things were simpler. The tanker newbuilding market continues to be in a state of prostration with orders flooding in for LNG carriers, container vessels, and dry bulk carriers pushing prices upwards and taking away equipment and slots retained for tankers, making it even more difficult for tanker owners to risk elevated newbuilding costs in a market being volatile more than ever.

No newbuilding orders were recorded this week.

Recycling market:

The recycling market seems to be divided as to what direction it is headed for with some major hubs increasing their rates, but others reducing theirs. It must come as no surprise that the recycling market is thirsting for candidates, but with historical markets across sectors, there may be a need for further increase before the scarcity of candidates is satisfied. Tonnage owners who are considering recycling have been met with harsh negotiations and reduced rates compared to expectations which is also another factor leading to the relatively low amount of scrapping candidates, as owners are now not willing to let their tonnage go sub $600 per ldt.

During this week Turkey settled at $300 per ldt being down 9.1% while India “only” saw a decrease of 1.7% and settled at $585 per ldt. On the other side of the scale, Bangladesh settled at $620 per ldt being up 1.6% while Pakistan added another $20 to their benchmarks settling at $610 per ldt being up 3.4% w-o-w.

There were two reported tankers sold for scrap this week:- IZABELLA (Korean, 2004 built, 1627 LDT) U/D price. Delivered in India.- SMOOTH SEA 2 (Japanese, 1983 built, 1096 LDT) U/D price. Delivered in Bangladesh.

Crude oil market:

WTI Crude (July contract): Settled at $120.67 and saw an increase of 0.21% w-o-w. Brent Crude (August contract): Settled at $122.01 and increased 0.50% w-o-w. Oil prices maintained relatively stable this week with no major changes. Once again OPEC+ didn’t maintain production targets according to Platts survey after missing its target in April by 2.7 million barrels per day. Some of the OPEC+ members accounting for the missing production targets include Angola, Equatorial Guinea, and Congo which have produced well below agreed production levels.

EIA has announced that Russia’s oil production could drastically decrease by up to 18% by end of next year leading to a decline from 11.3 million barrels per day in Q1 2022 to 9.3 million barrels per day in Q4 2023. Even though Russian oil continues to flow to Europe and Asia, the drastic effects will come into play once all seaborne imports of Russian crude oil are banned which will happen within 6 months, and refined products within 8 months, which could lead to an energy rationing this winter according to IEA.

Russian crude oil is set for a harsh ban and could alter the Russian oil industry with some wells being out of production and may never be utilized again, Russia is already preparing itself for the shadow trade, replicating Iran’s smuggling tactics and the Islamic Republics 40-years of expertise in this evading sanctions via a plethora of methods including rebranding and change of specifications over and over again before it reaches the end destination.

OX-Global Shipping Indices:

The OX-Global WET12 index remained around the $150-160 mark and saw a decrease of 3.42 points or -2.14% w-o-w after a turbulence week with the index reaching 162.09 on Wednesday only to go back to mid 150s.

Data from our OX-Global Indices showcased last week a clear difference in how investors have reacted to the Russian invasion of Ukraine with listed tanker companies being most affected with an increase in the index of 51.73% since 24. February 2022 to date. In comparison, the dry bulk index only saw an increase of 14.62% while the container index decreased by 6.31% since the invasion.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.