Change is the only constant in life

Heraclitus

On Friday morning the first thing that caught my eye on Twitter was the happy announcement that we finally had a biotech acquisition taking place. Yep, Friday was April Fools Day.

April 1st was also, on a monthly basis, the two-year mark of the pandemic. Thinking back over those two years it’s amazing how much has changed in the world. Although it continues to resurface, as a society we finally seem to be moving beyond Covid-19. We’re just over it.

Meanwhile, inflation is now the scary buzzword of the day, Russia is attacking Ukraine and threatening nuclear warfare, the potential for a global famine is rising, as supply chain issues increase the age of globalization is over, and unionization is making a reappearance in the US. Did I miss anything?

If you ignore the fact that Donald Trump is still asking Putin for dirt on political opponents, not much going on now resembles April of 2020. The world has changed in ways no one could foresee. Being an investor during these times has been tricky at best.

Yet, it is within this constant change that opportunity lies. In a static world, we all buy IBM, GM and Walmart, and sleep well at night. There wouldn’t exist Google, Tesla or Amazon. At the risk of sounding like Cathy Wood, change is good and within which opportunities lie.

Lately (okay, since August) performance around here has suffered. I’m a growth investor and growth gets hit in rising rate environments. I’m content to sit that out. (And, in my defense, I’ve been negative on the market environment and preaching caution for a very long time.)

At TW, I take a long-term view and, despite those concerns about the market, am going to try to own a group of stocks that have 3-5 years of exciting times in front of them. It’s truly a FOMO portfolio. «Public Venture Capital». If we hit on just a few, performance will be outstanding.

I track my performance in a spreadsheet and occasionally I play the «what if» game. You know, the game where you say, «what will my performance be if X, Y or Z happens?» It’s a great way of feeling better as you wait for catalysts to unfold.

So, in that vein, here’s a list of the biggest «What Ifs». Every company in my universe has optionality but these are the biggest possible catalysts that could occur before YE 2023; if one of these hit, we have the potential for a couple good years. Several hit and it’s going to be a great run. The exciting part for me is that I believe multiple of these catalysts appear quite likely to come to fruition and this is what excites me about the micro-cap growth sector of the market and the investment strategy I pursue.

What if Anixa (ANIX)‘s breast cancer vaccine hits their biomarker targets in phase 1? A vaccine for triple-negative breast cancer would be worth billions eventually. Success in phase 1 would likely cause a potential partner to take on the program and easily push ANIX into double digits. We will know in Q3.

What if Anixa (ANIX)‘s CAR-T shows success in ovarian cancer? While CAR-T is not as «hot» an investment as it once was, it is still attracting strong industry attention and being the first CAR-T to demonstrate success in solid tumors would be huge. Depending upon the level of success in the trial, this would likely be worth hundreds if not billions of dollars. Like the vaccine, we will know if they are on the right path in Q3 of this year.

What if Atomera (ATOM) inks multiple distribution licenses? These are the licenses that would be signed if/when a customer intends to go into production. This happens and ATOM hits new highs, likely heading towards, if not through, $100 per share. It’s possible we get one license this year, next year for multiple.

What if INmune (INMB)‘s INKmune demonstrates efficacy against multiple forms of cancer? Company’s like Fate Therapeutics (FATE) trade at multi-billion dollar valuations with only phase 1 results in hand. INmune is suffering through slow enrollment but expect to have completed phase 1 in MDS and to have started it in ovarian cancer this year. Results have been excellent so far and we can expect to see continual updates as the programs progress. With around 20 million shares outstanding, a billion dollar valuation is $50. That’s a minimum target if phase 1 in MDS is successful and a starting point if ovarian works. We will hopefully see results from the first this year and the latter in 2023.

What if INmune (INMB)‘s X-Pro1595 shows cognitive success in phase 2 in Alzheimer’s? That trial is starting now and results should be out sometime in 2023. Biogen (BGEN) and Eli Lily (LLY) both gained between $10 and $20 billion in market cap based on minimal phase 2 success. INmune would be a minimum of $500 stock in that scenario and we’ll know if the drug, which has amazing data to date, has an effect on cognition sometime next year.

What if enVVeno (NVNO) hits their endpoints in their pivotal trial? This stock is the biggest conundrum in my portfolio. The data in their first-in-man trial was outstanding. There’s no reason to think the product won’t pass the bar easily in the current trial. Meanwhile, despite a big week (+34%) it still trades just slightly over cash per share. If they do replicate the results in their current trial, the product likely sells for a minimum of $300 mllion, which is a 5X return based on the current share price. I suspect there’s a lot more upside and we’ll know if the trial is a success sometime in 2023.

What if TFF Pharma (TFFP)…well, there’s a ton of what ifs here that I’ll consolidate into one paragraph…what if they do one of the following in 2022; finalize sale of niclocasamide to UNION in Q2, sell VORI in Q3, sell TAC in Q3? Any of these returns multiples on the stock and all three programs are doing very well. Then there’s the ever-lingering partnering opportunities that will eventually land. Astellas was added to that list, joining Pfizer as the two majors closest to partnering with many others waiting in the wings. We are getting ever clearer indications of the inevitability of thin-film-freezing. We should see commercial success sometime this year. What would that mean to the stock? One hit is a minimum of $20 with multiples more if/when the platform takes off.

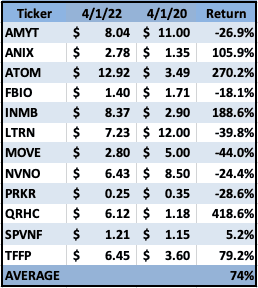

In the just for the fun of it, I ran the returns on all companies under coverage for the last two years, March 31-2020 through April 1, 2022. The market over that time has returned just under 60% for both the S&P 500 and the Russell 2000.

Here’s how our stocks did (Lantern, Movano and Amryt are based on IPO pricing that occurred more recently).

What can we learn from this? First off, our universe was really beaten up two years ago as global macro pandemic induced fear gripped the world. This allowed some of the two year numbers to be outstanding despite stocks being mired in a bear market. TFF Pharma is a classic example. It feels like it’s been down forever but the 2-year return is 80%?!? (And, if you’re curious (I was) the return jumps to 111% without those three more recent additions.)

The biggest winner is Quest (QRHC). This happens to be the company best positioned for a strong economic rebound and insulated from the effects of inflation. For those who moved from growth stocks to cyclicals (and energy) you probably had similar returns in a number of names over the last two years.

I think the biggest point of interest is that the average stock has beaten the market despite the last 13 months of pain. When one looks at the long-term goal of a portfolio that outperforms the market, even more so if you take out the IPOs which are all skewed negatively as most are over the last couple years. Bottom line, over two years the investment story is intact…despite feeling like I’ve been taken behind the woodshed for a long time now.

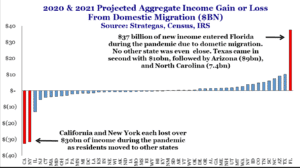

Speaking of the changes of the last two years, most of you know we left California for Virginia about a year and half ago. This chart crossed my desk yesterday and is very interesting.

In case you’re amazed at how much real estate is going up in Florida, this certainly helps explain things.

This past week, Anixa (ANIX) announced that they had initiated their phase 1 trial for CAR-T in ovarian cancer. This means that they have two ongoing trials in potentially blockbuster indications. Add in a low burn rate with plenty of funding and this is a great risk/reward scenario. Either of the programs hits and you’ll be happy investor.

As I discussed last week when INmune (INMB)‘s management bought shares, insider purchases is a great indicator of future success. Maybe the best. Which is why I’ll remind everyone that insiders have been acquiring shares of Anixa like clockwork. Every quarter CEO Amit Kumar and lead independent director Lew Titterton have been buying shares in the open market.

While things have been delayed here (what else is new for biotech during the pandemic), with both programs finally dosing patients, we are in sight of the finish line. Exciting times await. This week premium subscribers will have a chance to catch up with the CEO. Looking forward to that call.

The big winner for the week was enVVeno (NVNO) which gained 34%. What happened here? In a world of delayed trials and slow enrollment, enVVeno announced the had implanted 9 patients and, importantly, enrollment appears to be accelerating.

The implications of this are several. For NVNO investors, the stock is now trading above cash value. This uptick is just the beginning of the potential here. I suspect we are substantially higher over time as we approach a data readout in late 2023.

It’s interesting that enrollment is picking up as this implies hospitals are returning to normal. Very positive for every other company undertaking a clinical trial. We can only hope INmune sees this in their trials.

With the jump in share price, it’s obvious that fence sitters are watching for signs of success before jumping in. Again, companies like ATOM, TFFP and INMB seem to be stalled from covid-related slowdowns affecting them in different ways. However, as these start to diminish, I suspect there are fence sitters in many stocks that will decide to jump in.

The news for enVVeno was good but not that good. Stocks are discounting success in a big way; achieving that success could drive massive share appreciation from these levels across the whole micro-cap growth universe.

* Disclaimer: DFC Advisory Services LLC, dba: Tailwinds Research, owns shares in companies mentioned in this report. For a full list of disclaimers and disclosures, please visit http://tailwindsresearch.com/disclaimer/.