As war continues in the Ukraine the repercussions are just beginning to be felt globally. The longer this battle continues the more it will have a lingering effect on the world. One of these will likely be a dramatic reduction in the global production of wheat. Higher food costs in the US and an increase in hunger in 3rd world nations awaits us. The aftermath of this travesty will be terrible.

I intentionally only focus on growth stocks, leaving commodity investments to others. I’m a firm believer that there are incredibly exciting, and virtually undiscovered, opportunities in micro-cap companies and am focused on finding these stocks. If I’m able to do so, long-term the portfolio will outperform regardless of the near-term global macro scenarios that are unfolding.

The term «Separate the Wheat From the Chaff» is a biblical term that means a judge will choose the good people and discard the bad people. It also applies to stock picking for obvious reasons; one hopes to invest in good companies avoiding bad ones. Over time, the market will do this. The goal of an investor is to get ahead of the market.

At a time when virtually every micro-cap growth stock is down, there is a world of opportunity in front of investors. Growth stocks will return to favor eventually and there is no bell that signals the bottom.

My thinking is that we are seeing a bear market rally and stocks will likely have another leg down. However, valuations are crazy low for a number of stocks and, if you’re taking that long-term perspective, now is a great time to be building positions in the stocks you want to own when looking out a year or two.

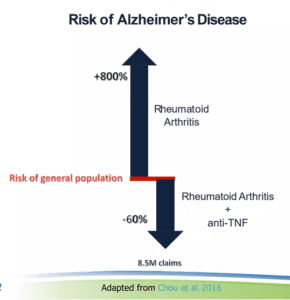

I frequently highlight INmune Bio (INMB) as a favorite selection here. The company is funded through phase 2 in their Alzheimer’s trial and the historic success of TNF inhibitors in preventing Alzheimer’s is documented over tens of millions of cases. Check out the picture below…

If INmune hits their targets in this phase 2 trial, the stock will likely be worth well in excess of $10B. We will know the results in around 18 months. With a current market cap of $160 million, perhaps it’s time to take the long-term perspective and put some stock away.

Insiders certainly think this is the case as they purchased around $700,000 in stock this past week. In a direct purchase from the company at Tuesday’s closing price, the CEO, CFO and two others all increased their holdings. They aren’t doing this as a trade, rather building their long-term holding at what they believe to be a crazy low price.

«Signal to Noise Ratio» is another term that applies to stock picking. There’s always lots of news and chatter around every stock. But, what pieces of information are the most important?

Insider buying could very well be the most telling signal presented to investors. As they say, there are many reasons insiders sell stock but only one reason they buy. Management owns a lot of stock in INMB already yet they stepped up in a big way to purchase more. They know the company and the programs better than anyone else and they are obviously excited. In a world full of noise, that’s a very compelling signal.

Another company that seems to always have a lot of noise around it is TFF Pharma (TFFP). Most of the «noise» here relates to the Company’s failure, so far, to close on a major partnership. Self-inflicted is this noise as they did guide to two partnerships in 2021.

Recently I wrote about giving companies hall-passes for covid-induced delays and I believe much of the concern around TFF also falls into that category. CV-19 is possibly the biggest headache to ever face our healthcare system (unless you’re a vaccine manufacturer that is). Trials are delayed, the FDA is overworked and understaffed, and internal priorities at major pharma are constantly being shuffled. There is a ton of noise related to covid for every healthcare company.

But, there are also many signals that things are going well for TFF. This past week they had a shareholder update call. It lasted over an hour as the number of programs they are working on is constantly expanding. And, they are making progress on many fronts.

Looking through the noise of no major deals, the Company discussed four new signals in their update. For those looking at the big picture and willing to ride out the near-term choppiness, these signals demonstrate great progress towards ultimate success.

Signal #1: voriconazole is being used in compassionate use patients and has had been very successful so far.

Both of their most advanced internal programs, VORI and TAC, are in phase 2 trials, having entered them around the first of the year. Interim data from both trials is expected in late Q3 and there is already a data room open for perspective partners along with an investment bank engaged to run the partnering process. The value of either of these programs will likely exceed the current market cap when partnered and that’s on this year’s agenda.

Now we learn that VORI is being used under a compassionate use program. The key to thin-film-freezing has always been increased efficacy at lower dosages. This is what is attracting patients to it under compassionate use and, so far, it’s meeting these high expectations.

The phase two trials are head to head against the oral versions of the drugs and are designed to show superiority. Not equal efficacy at lower dosages, but outright superiority. If they lower side effects, that’s great. But, if they are better, the drug will command premium pricing and take dramatic market share immediately.

I’ve always said that the base case for TFF was simple: VORI and TAC are worth much more than the current market cap alone. I still believe this is the case and, if I’m right, we’ll know in the next six months.

Signal #2: key hires.

With so many programs under way, TFF needed more firepower. The Company has now brought in four new hires. Not only are they all talented, but they have taken on a reduced income from their consulting roles to join the team. Obviously, they believe there’s great upside to the equity which more than offsets the current income differential.

Similar to insider buying, this is a very positive signal from the new hires in their confidence of the Company. It’s also a great sign from the current management who feels they need more help to manage the growing business. Signal to noise ratio, people.

Signal #3: Astellas.

On their last earnings call, TFF added Pfizer to their corporate presentation. Now they have added Astellas, representing the second major pharma company willing to have their name used in investor presentations. While the investment community frets over a lack of partnerships, major pharma is getting closer to TFF. Eventually the rubber hits the road; instead of worrying when the first deal gets inked perhaps we should be focused on how many can they get done over time?

Signal #4: omnibus spending package.

As CEO Glenn Mattes detailed on the update, there is specific language relating to thin film freezing powders in the recently passed 2022 US Federal omnibus spending package. This comes on the heels of a second CRADA with the US Army and the ongoing work the Company is doing with DARPA. Obviously, there is a very high level of interest in the federal government around thin film freezing.

The clear signal being sent here is that thin film freezing works and is a very disruptive technology. We are waiting for partnerships but they will never come if the technology doesn’t merit them. Before a deal is signed, the technology needs to be validated. The multiple opportunities within our federal government are highly significant signals of validation; the kind of validation that will eventually eliminate the noise around TFF’s stock.

On top of the signals that TFF is giving to investors, there are a couple other compelling reasons to look at the stock right now. First off, Lung Therapeutics’ sale is about to end. Recall that they are selling around 950,000 shares to Jefferies at roughly the average traded price for the first three months of 2022.

In my opinion, Jefferies has been selling close to 15,000 shares a day to hedge this trade. The ever increasing short interest since January 1 correlates with my hypothesis. With the stock trading near $6.50, there has been approximately $100,000 in supply coming into the market every day this year.

That changes next week. And, when it does, what do you think the stock will do? Share of TFFP bottomed in mid-February and are now establishing a nice little uptrend. That implies new demand exceeds supply on a daily basis. Now, get rid of $100,000 in daily selling and the stock looks poised to rip; all it needs is a catalyst.

Fortunately, there’s a big catalyst coming. Phase 1 data for niclosamide is due sometime in April. If this data is positive, which is highly likely, there’s a great chance UNION Therapeutics will be exercising their option to acquire the drug for $210 million in upfront and milestone payments, a highly significant event for the Company if it happens.

Shares of TFF have been penalized for their lack of ability to close a major pharma partner. This is justified as they had guided to having done so by now. However, all signs are pointing to future success for TFF. Ignore the noise and focus on the signals.

ParkerVision (PRKR) continued its rollercoaster ride, losing 43% last week. The judge in Orlando found for Qualcomm in their motion for dismissal, which was not a big surprise after the prior week’s ruling. This sets the stage for Parker to appeal and get in front of a new judge.

For investors, it’s time to focus on Texas. A win there versus Intel is likely worth several dollars per share; the first Intel case will go to trial later this year. Personally, this case has just reinforced everything I don’t like about our legal system. It takes forever and those with the deepest pockets tend to prevail. Ugh.

April catalysts: several of these await our companies.

- Anixa (ANIX) should dose their first CAR-T patient

- INmune (INMB) will release NK data at the NK Summit in San Diego

- INmune should also dose their first patient in their phase 2 Alzheimer’s trial

- Spectra7 (SPVNF) earnings are coming soon

- TFF Pharma (TFFP) will have data from phase 1 niclosamide trial

- TFF should also release data from their Augmenta partnership

* Disclaimer: DFC Advisory Services LLC, dba: Tailwinds Research, owns shares in companies mentioned in this report. For a full list of disclaimers and disclosures, please visit http://tailwindsresearch.com/disclaimer/.