There’s been an ongoing joke in the TW Slack chat room. It goes like, «please tell [insert company name here] not to issue any more bullish press releases…we investors can’t take any more pain.» While the joke might not sound tremendously funny, it’s quite ironic how spot on that sentiment has been for the last 12 months.

That’s the definition of what happens in a bear market, right? Stocks that go down on news, be it good or bad. Every time there’s volume, it’s a selling opportunity. In riskier, long-dated assets, which is certainly an apt description of TW’s universe, we have been in a year-long bear market. It has been a classic risk-off situation. And, it’s been painful.

As I say quite often in this newsletter, markets are nothing if not cyclical and there is always reversion to the mean. We have seen one of the strongest bull markets in history and it was destined to come to an end. What goes up must come down.

However, the inverse is also true. Stocks can’t go down forever; eventually they go higher. And, while we are in the early stages of what appears to be a nascent bear market for the S&P 500, micro-cap stocks have been under pressure for quite a while. I believe we are getting close to the end of the selling pressure for stocks in TW’s universe.

February has seen a failed rally in the S&P. There was a nice bounce starting on January 28th, but those gains have been largely retraced and the market is now testing support. I suspect it will fail and the broader market continues downward into full blown bear market territory.

While this has happened, TW’s stocks are actually starting to outperform. The Russell 2000’s loss of 1% in February is besting the S&P’s -4% return. For TW in particular, we are up 3% for the month. These gains having been driven by two stocks in particular, Quest Resource Holding (QRHC) and Atomera (ATOM).

What I find particularly encouraging here is that both companies reported good news recently which caused their share price to increase. Importantly, they have held on to gains! This doesn’t seem like a major accomplishment in normal times but represents a sea-change from the last 12 months. The constant selling pressure in micro-caps is finally easing; we are nearing the end of this rotational bear market.

This is not to say that we are completely out of the woods yet. A continued sell-off in the larger companies will always have spillover effect into our stocks. It’s not suddenly a «risk-on» environment.

But, it now looks safe to be sticking your toe in the water. Well-capitalized companies with upcoming catalysts might actually see increases in valuation as they execute. Biotechs trading below cash value, of which there are many, could see value buyers surface.

Another well known adage in trading is, «buy the rumor, sell the news». In the case of risk assets, the rumor was the impending increases in interest rates. We know rate hikes are coming and that they are directly responsible for the selling pressure in stocks. We should see the first rate hike next month; my guess is the first hike could be the turning point for the XBI and, once investors realize it’s not the end of the world, a sustainable rally could start.

Sentiment is definitely showing a turn in the biotech space. There are many market advisers that are suggesting what I am, that biotech is going ripe for a turn. Here’s one headline from this weekend.

Helping Atomera (ATOM) continue its recent strength was the news that Resonant (RESN) was being acquired. I have long said that Resonant’s partner Murata would end up owning the company and that was finally consummated this past week.

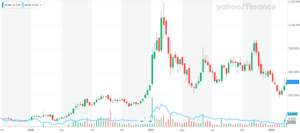

The price paid by Murata, $4.50 per share in cash, sounded nice since it was a premium of over 300% from the recent trading levels in Resonant. However, investors who owned Resonant over the longer term would likely have a rather mixed feeling regarding this transaction as it is still below levels seen both last summer and almost any time prior to 2019. Here’s the 5-year chart.

I have owned RESN several times over that 5-year timeline and made quite a nice return each time I was invested. However, I grew disenchanted with the constant delays and the high burn rate. I knew it was very likely Murata would buy them (this is my last note on Resonant, Murata Is Likely To Buy Resonant (In Two Years)) but, in the meantime, felt it was dead money. This certainly proved true…until this past week.

Instead of sticking around RESN, over the past two years I’ve made a bet in a different, early-stage technology company, Atomera. While both are exciting technologies, I prefer ATOM’s model of developing a new process for improving performance of most all microchips. They have no competitors and, if adopted, MST will become ubiquitous and a major cash cow. On the other hand, Resonant is taking on incumbent players, making their road much tougher.

One could argue that RESN is further along since they have products being sold now. But, the two-year chart shows that the market is more interested in what Atomera is bringing to the table.

Over the last 24 months, ATOM is up 393% versus 53% for RESN.

So, why is ATOM showing some strength now on the back of RESN’s news? Lou Basenese of Disruptive Tech Research had been a bull on RESN for a long time. ATOM is a much bigger bet of his, however, and he was out pounding the table on it again, saying that it is a likely takeover candidate as well

It makes sense that larger companies will start looking to make acquisitions with small stocks having been beaten up. Is ATOM a likely takeover? Assuming that a major like TSMC is one of the licensees, it’s not a big stretch to suggest that successful product development could lead to acquisition talks in an effort to lock up the technology before its use has become widespread.

I often refer to Atomera as my FOMO stock. If M&A is going to increase, I want to be here that much more than ever.

Craig Hallum initiated coverage of Quest Resource Holding (QRHC) this past week with a target of $13.

For our premium subscribers, I put out a note on INmune (INMB) and TFF Pharma (TFFP) last week with input from recent calls with both companies’ managements.

* Disclaimer: DFC Advisory Services LLC, dba: Tailwinds Research, owns shares in companies mentioned in this report. For a full list of disclaimers and disclosures, please visit http://tailwindsresearch.com/disclaimer/.