What a week in the markets, right? The past five days saw the biggest ever one day loss by a single company, followed shortly thereafter by the largest ever single day gain. Facebook’s pummeling led to Amazon’s surge. All of which led to continued volatility which included a very nice rally for the TW universe.

The one constant in life is change and that’s what highlighted the moves of the last week. In a market that has been dominated by fear of interest rate hikes, investors are now starting to worry about a slowing economy. Which of course would curtail the number and size of rate hikes and that makes long-dated assets like biotech suddenly more palatable.

As I said last week, «I guess you could say that, for the TW universe, I firmly believe the worst is over.» For the last five days, it certainly seems like the right call. But, I don’t think it’s really going out on a limb to suggest that stocks which are well funded, achieving great things, and down massively over the past year, could rally. Markets are cyclical…these stocks are destined to rally.

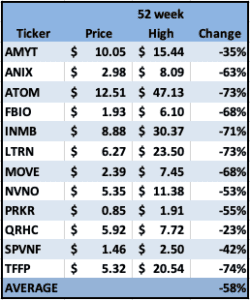

Here’s where my universe sat at this time last week versus their 52 week highs.

I won’t argue that, in many cases, they were priced for perfection at the peaks. Or, in other cases, simply overbought and due to correct. What I will say is that since those highs, much good has happened to the companies and much damage has occurred to their stocks. This gulf can only increase in breadth for so long. As I keep saying to impatient investors, reversion to the mean always occurs.

Check out this chart…

Every time the P/E ratio for small cap has gone below 16, there has been a very large rally. We have seen the fastest collapse in this group relative to the S&P ever and are trading at the lowest level in 27 years. Taking the other side of that trade is a no-brainer.

I also said last week that I expect the market (meaning the S&P 500) to be down in 2022. Looking at Facebook (aka Meta)’s crash, one can see that the large tech leaders are priced for perfection. There’s still lots of risk to valuations for the big boys and I think the market’s rolling correction will be taking them down one by one.

Meanwhile, small cap continues to base and companies with catalysts may see their shares rally on news. There was an ongoing joke in my Slack chat room that we didn’t need any more good news…we couldn’t take the pain it caused in the share prices. Hopefully those days are now over.

The term Metamorphosis means the process of transformation from an immature form to an adult form. This is exactly what we hope will happen to our micro-cap companies. We expect them to go from cash-burning, venture-like startups to companies with sustainable businesses that eventually generate substantial profits.

There’s a tipping point involved in this transformation. A moment when suddenly the larger investors glom on to a stock, realizing that a small company is actually doing big things. At that point in time a company can make incremental gains but a stock can absolutely launch.

My best example of this, from TW’s investing past, is Cryoport (CYRX). When we invested in Cryoport at $2 a share, CAR-T was just emerging as a successful treatment and companies that supplied goods and services to CAR-T biotechs were overlooked. I discussed this in a blog piece in 2017 where I said, Cryoport was «delivering shovels to biotech miners.»

Shares of Cryoport went from $2 to well over $50 in a very short span. I, sadly, got out at $16 as I didn’t understand just how strong the tipping point phenomena could be. When a company makes the leap from public venture capital to becoming a small or mid-cap company, the gains can be quite dramatic.

It’s certainly my hope that all the companies in TW’s universe make this leap. Not all will. But, some will make the metamorphosis and those investors who happen to be there before the change will be well rewarded.

Which companies that I cover stand a chance at metamorphosis soonest? I’m glad you asked. Here’s the list as I see it, in terms of likelihood to occur in 2022.

TFF Pharma (TFFP): what would send TFF from being a platform with the potential to change the delivery of many therapeutics to being a proven commodity with a brilliant future? One of two things, in my mind: successful phase 2 trials of their compounds and/or a partnership with a major pharma company.

At this time, TFF is looking for validation. If Pfizer, or another major pharma, were to write them a $5M check to license their thin film freezing platform for just one compound, along with several hundred million in milestone fees plus a royalty on the back end, this would prove the technology is unique, game changing and highly disruptive.

Or, if either the VORI program or TAC program demonstrate good phase 2 results, leading to a partnering of the program with upfront fees in the tens of millions, along with big back end fees, the TFF platform would again be proven out.

In my opinion, it’s only a matter of time before both these events happen. Until we see evidence that the technology isn’t working as planned, one can only assume that success is a matter of «when not if».

This is shaping up as a transformational year for TFF. I expect them to finally close on a partnership before the end of Q1 (maybe even in February) and I also expect them to partner off at least one internal program. These are only a few of the many shots on goal that TFF has but they are the most likely to lead to the tipping point happening soon.

Meanwhile, due to missed deadlines for partnering in 2021, the stock is on its butt. The company has a lot of work to do to restore investor confidence. This represents opportunity for forward looking investors. I remain very bullish on TFFP and think they represent a great risk/reward investment at this time.

Atomera (ATOM): I admit, I thought that 2021 would be the tipping point for Atomera. All it takes to push this over the edge is visibility into their first product going into production. I thought we would be there last year. I’m convinced we’ll get there this year.

When the potential for your product is billions in high-margin license fees, the execution risk lies solely in product development and getting adoption. Once the writing is on the wall, similar to Cryoport, everyone will be lining up to use your services. Atomera has demonstrated great success in improving performance of microchips…in test runs. Once in production, it’s not hard to see MST becoming ubiquitous.

INmune Bio (INMB): I know you’re thinking their Alzheimer’s data is two years off, so what will make them inflect in 2022? The answer is simply that it’s not the AD data, which will probably cause them to go hypersonic in a couple years, it’s the INKmune program that is completely overlooked by the market, but not for long.

Cancer programs are very different from AD programs. Results come quicker and, if you cure cancer in just a handful of patients, success can be easily extrapolated to a bigger audience.

INKmune is demonstrating great persistence in the handful of patients treated. This is the holy grail for NK programs and where other, larger companies, have continually failed. What INMB needs is more data and on a larger pool of patients. It’s been painfully slow but 2022 will mark the year where things pick up. When they do, so should the stock in a massive re-weighting.

I’ll also throw Quest Resource Holding (QRHC) out there in the metamorphosis category but not as a company about to undergo one. Instead, I think that process started in 2021. The company has now reached a size and scale where it’s becoming obvious they are a leader in their space and have a sustainable business model that should grow rapidly for the foreseeable future.

The inflection point having been reached is evident by the 274% return since we picked up coverage, with most of those gains happening in 2021. I expect to see QRHC dramatically outperform the market here in 2022 as they are well positioned for the future; an ESG play that benefits from inflation. That sounds about perfect for the next few years…

This past week we caught up with management at ParkerVision (PRKR), INmune Bio (INMB), TFF Pharma (TFFP), DeFi Technologies (DEFTF) and Anixa (ANIX). Notes from those meetings will be published on Monday for premium subscribers.

* Disclaimer: DFC Advisory Services LLC, dba: Tailwinds Research, owns shares in companies mentioned in this report. For a full list of disclaimers and disclosures, please visit http://tailwindsresearch.com/disclaimer/.