Av: Philip Coombes & Rasmus Køjborg

H+H INTERNATIONAL A/S

H+H International A/S is a wall-building materials provider in Europe. It specialises in aircrete (AAC) and (CSU) wall blocks. H+H was listed on Nasdaq Copenhagen in June 1985.

Ticker: HH

Share price (DKK): 228.5

Market capitalization (DKK): 4,122m

Bli medlem av vår Facebook gruppe Investorforum for å diskutere og lære av andre investorer HER.

DISCLAIMER:

HC Andersen Capital receives payment from H+H for a Digital IR/Corporate Visibility subscription agreement. Philip Coombes, primary author, and Rasmus Køjborg, secondary author, has no ownership in H+H. This is not a piece of advice to buy, not to buy, sell, or not to sell shares. The material has been read by the company before publication. HC Andersen Capital assumes no responsibility for correctness of the contents of the material.

INVESTMENT CASE

- H+H International A/S is a growth investment case built on its sustained ability to maintain or increase EBIT margin, consistently exceed its 14% long-term target for ROIC and realise continued growth, both organically via factory upgrades and by acquisition. H+H has achieved a ROIC of 18% in recent years as it acts as a consolidator in a fragmented market. H+H allocates capital with pursuit of a healthy balance sheet and value-adding investmentstaking priority over dividend/share-buy-backs

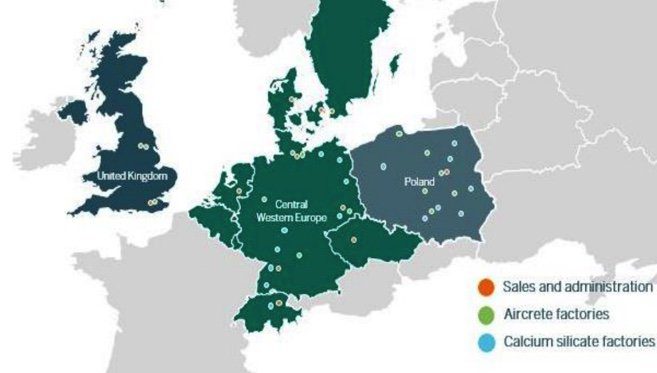

- H+H International is a market leader or leading challenger in its major markets throughout Central and Western Europe. Operating locally via its 30 factories H+H provides wall building products to customers. H+H leverages a network of local suppliers to mitigate large transportation costs and ensure a steady supply of raw materials.

- Structural undersupply of housing in Europe creates a positive demand outlook. Continued demographic growth, urbanisation, governmentstimuli programmes and changing work patterns all contribute towardsstrong future demand for newbuildsin H+H’s markets

- H+H products have a lower energy-intensive production method and embodied emissions per cubic meter than substitutes such as concrete (aggregates) and clay blocks. In addition, H+H projects carbon neutral and potentially carbon negative emissions by 2050.

- Partners in Wall Building gives H+H a differentiated market approach; it adds value not only from its products but also from the service of providing expertise at every stage of the building process. The approach helps maintain H+H’s high customer retention rate.

- Management: CEO Michael Troensegaard Andersen has led the company since 2011 having previously been president of a global business unit at Trelleborg Group. CFO Peter Klovgaard-Jørgensen joined H+H in 2019, previously holding numerous finance related positions at ISS

KEY INVESTMENT REASONS

• Growth case built on strong EBIT margin, ROIC and growth via both

acquisition and organic means.

• Strong industry demand outlook, driven by a structural undersupply of housing in H+H’s primary markets.

• H+H products have an environmental advantage over available

substitute products giving H+H an ESG edge.

KEY INVESTMENT RISKS

• The newbuild market is largely cyclical, therefore, an economic

downturn in Europe would negatively affect earnings.

• Shortage of skilled labour supply in Europe, especially in Germany

creates uncertainty. Materialsinflation also weighs on newbuilds.

• Price pressure from competitors may reduce H+H’s EBIT margin.

H+H IN BRIEF

H+H was founded in 1909 as a gravel mining company, it is now a leading producer of wall building materials in Europe.

History: H+H international was founded in 1909 as a gravel mining company by constructor Henrik Johan Henriksen and brickyard-owner Waldemar Kähler. It began production of aircrete and mineral wool in 1937. Growth was sustained and in 1962 the company split to focus on its core products; it split into H+H and I/S Kähler & Co., which later became Rockwool International A/S. H+H listed on the Copenhagen Stock Exchange in 1985.

H+H Beyond Aircrete: Post listing H+H focused on Aircrete production, expanding throughout Europe, moving into Finland and Germany in 2000, followed by Poland in 2005. Then in 2018 H+H expanded its product portfolio through acquisitions into the CSU market. H+H purchased Grupa Silikaty in Poland and HDKS in Germany and Switzerland, making them the second biggest European CSU producer.

Expansion Strategy: H+H foresee continued expansion through acquisition and organic growth. Market fragmentation in Germany allows for consolidation opportunities. H+H continues to pursue market share growth in all markets, with particular focus to Germany and continuously seeks new value-adding investments.

Partners in wall building: H+H are partners in wall building supporting clients from the first drawing to the final installation. Using its skills and knowledge in the industry H+H helps clients to optimise workflows, improve energy efficiency and ensure hassle free planning.

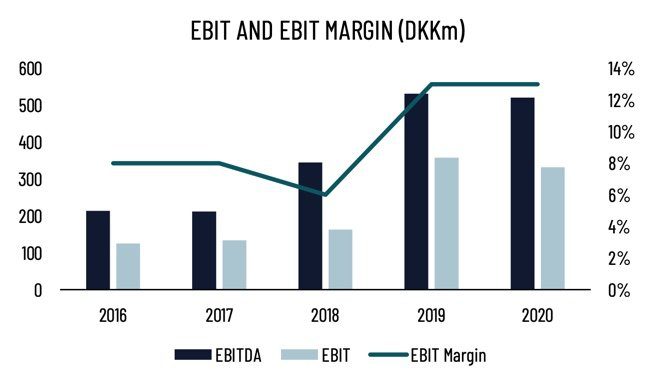

Financial Targets: H+H have long term financial targets centered on maintaining margins, ROIC and a healthy debt ratio. In 2020 H+H realised an EBIT margin of 13%, a ROIC of 18% and its net debt to EBITDA was 0.4. These figures all beat the long-term targets, which are respectively, an EBIT margin of 11%, a ROIC of 14% and a net-debt-to-EBITDA of ~1-2x.

Share information: H+H was listed on the Nasdaq Copenhagen stock exchange in June 1985 raising DKK 68m. As of 12 October 2021, the market cap of H+H is DKK 4.1bn and the stock trades at a price of DKK 228.50 per share. At the end of 2020 H+H had a total of 4,749 registered shareholders. Retail investors were appx 15% of this ownership.

PRODUCT OVERVIEW

H+H produced over four million cubic meters of wall building materials in 2020 across its European AAC and CSU factories.

H+H is a is a wall-building materials provider that manufactures autoclaved aerated concrete (AAC), known as aircrete, and calcium silicate units (CSU) in Europe. H+H manufactures blocks for walls, primarily used in the residential new-building segment. The product portfolio also includes more advanced products also used for wall building such as, high-insulating blocks, larger elements and a range of traded goods used for wall building.

Product segmentation:

Aircrete / Aerated Autoclaved Concrete (AAC)

AAC is made from, sand, lime, cement, water and aluminium, in a process which aerates the mixture giving it lightweight and insulating properties. The mixture is then heated in an autoclave to give it strength. The aircrete products are used in residential newbuilds usually 1-2 stories. They are lightweight, fire-resistant, environmentally advantageous, thermally insulating and excel for low-story buildings. However, AAC’s brittle nature makes it unsuitable for high-rise buildings.

Sand-Lime / Calcium Silicate Units (CSU)

CSU is made by mixing quicklime with silica sand and water to create a malleable mixture which is heated in an autoclave to create strength. CSU blocks are typically used for high-rise buildings of 7-8 stories. They are high-strength, high-density blocks which are fire-resistant and have an environmental edge over its substitute products given their natural materials. Because CSU blocks are heavier their transportation range is limited to ~150km.

Both products can be used for interior and exterior walls as well as for building foundations.

Revenue Split

H+H saw revenues split 68% to 32% for its AAC and CSU product lines respectively. This reflected increased diversification from the 2019 split of 71% AAC to 29% CSU.

Raw Materials

H+H are reliant on the supply of raw materials such as cement, lime and sand. By using local suppliers H+H reduces associated transportation costs and mitigates risks associated with international trade such as tariffs and foreign exchange. Its key raw materials lime and sand are naturally available in H+H’s major markets.

In 2020 direct production costs were approx. 55% of the cost base, of which two thirds were raw materials.

MARKET OVERVIEW

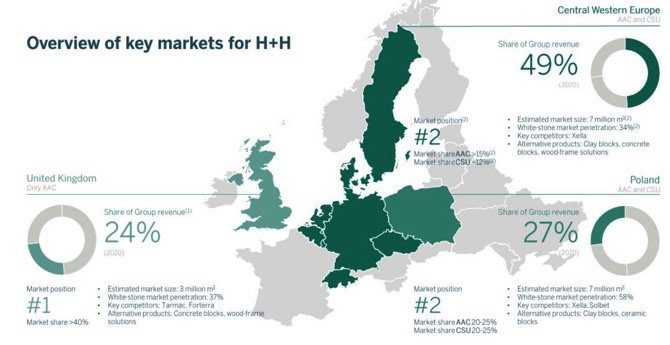

H+H is a market leader or leading challenger in all of its major markets, operating primarily in the UK, Germany and Poland.

Market segmentation

H+H services Northern and Central Western European markets with focus on the UK, Germany & Poland. H+H is the market leader or the leading challenger in all primary markets.

H+H’s primarily sells to builders’ merchants and residential buildings developers local to their primary markets. H+H services its customers from its 30 factories. Its factory footprint helps navigate the industry issue of high transportation costs and factory dependencies.

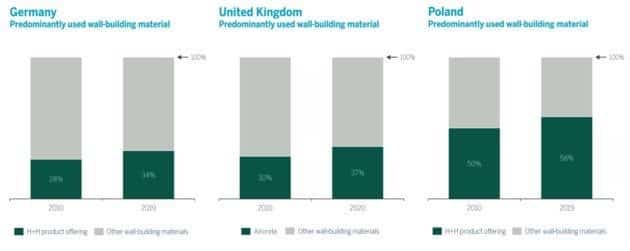

H+H sells AAC and CSU products in Central Europe and Poland. In the UK, where a CSU product market does not exist, H+H sells its AAC product line. H+H is the market leader in the UK, servicing over 40% of the market. In Germany and Poland H+H is the leading challenger behind Xella Group controlling 20-25% of the AAC and CSU markets in Poland and >17% of ACC and 12% of the CSU markets in Central Europe.

H+H has experienced increased market penetration in all markets; the average increase is 20%, primarily taken from timber and ceramics.

United Kingdom ~ 40% AAC Market Share

The UK experiences high demand and H+H is nearing full capacity utilisation. The market is driven by a general housing shortage and increasing demand outside of large cities caused by new work from home practices. The UK market has also benefitted from stimulus programmes such as the help-to-buy scheme and a stamp duty holiday from June 2020 – Sept 2021.

Central Western Europe >17% AAC & ~12% CSU Market Share

Germany has an undersupply of houses, driven by favouring of smaller households and Covid19 relocations. There is a strong order backlog of permitted newbuilds providing medium-term stability. Stimulus programmes in Germany are designed to ease the undersupply of housing, however, measures may be insufficient to overcome the market’s labour shortage. The demand outlook remains positive whilst growth is unlikely until the labour issues are resolved.

Poland ~ 20-25% AAC & CSU Market Share

H+H have a strong position in both product lines in Poland, a market which has seen 40% yoy growth of building permits positively affecting both products. The CSU market is characterised by strong competition and price pressure, however, the situation has stabilised. The AAC market is less competitive and positive price trends are underway.

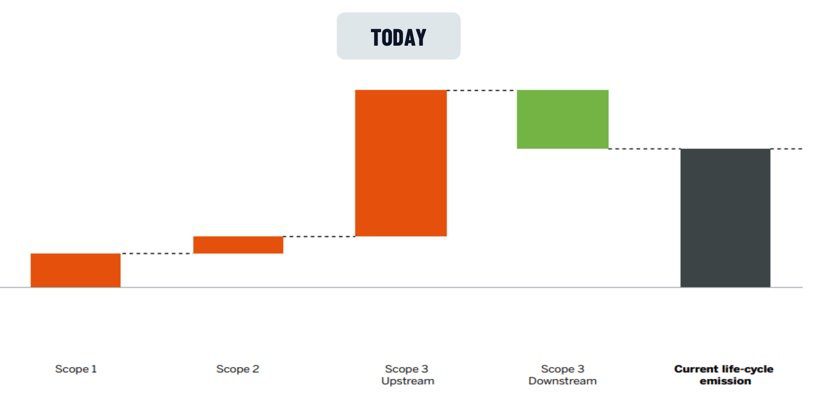

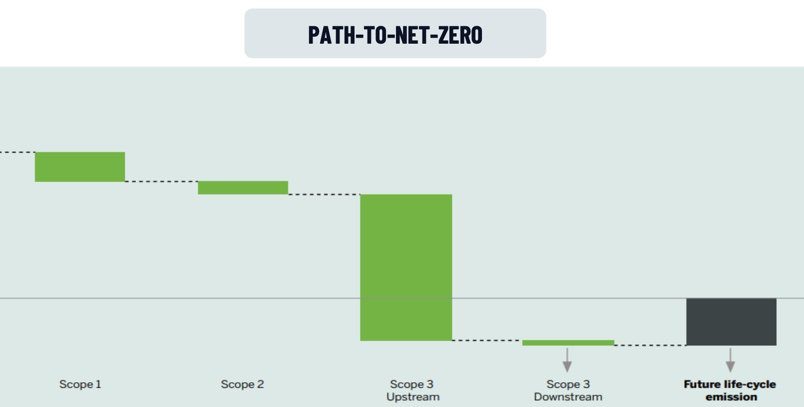

H+H ESG & PATH TO NET-ZERO

H+H has sustainability advantages over substitute products and has ambitions to be carbon neutral, and potentially carbon negative by 2050.

Environmental Advantages of H+H products

Production of AAC & CSU blocks uses natural materials and a relatively lower energy-intensive production process resulting in lower life-cycle emissions compared to substitute products. – Energias Market Research.

Emissions advantages of AAC

Production Advantages: The production of AAC has, according to Energias Market Research, been found to consume less than half the energy in production than other buildings materials. H+H expects to reduce production related emissions by operating factories via renewable energy.

AAC Density Advantages: Aircrete has low embodied energy per cubic meter because of its lowdensity properties.The per Kg embodied energy is similar to that of aggregated concrete, however, Energias Market Research suggests comparative

density is up to 1/5 th.

Life-Cycle Emissions: AAC has insulating properties, which reduces indirect emissions over the newbuild’s lifetime from reduced heating and cooling requirements.

Life-cycle emissions from AAC and CSU

Embodied emissions: AAC & CSU blocks embody lime which emits CO2 in the production process. Much of this emission relates to the use of lime in cement production – 75% of H+H’s emissions are upstream from the production of cement. Additional CO2 is released from the lime as products are heated in the autoclaving process.

Recarbonation: The embodied lime in H+H products reabsorbs much emitted CO2 over its 100– 150year use-life in a process called recarbonation. Therefore, lime and cement-based products act as carbon sinks. If the CO2 released in production can be captured, AAC & CSU blocks can in effect have net-negative emissions. H+H are committing to using suppliers that are working to implement carbon capture technologies in their cement production.

Path to Net-Zero: The pathway to net-zero emissions involves conversion of factories and transport vehicles to run on renewable energy and use of suppliers that are implementing environmentally friendly practices such as carbon capture.

H+H FINANCIAL STORY

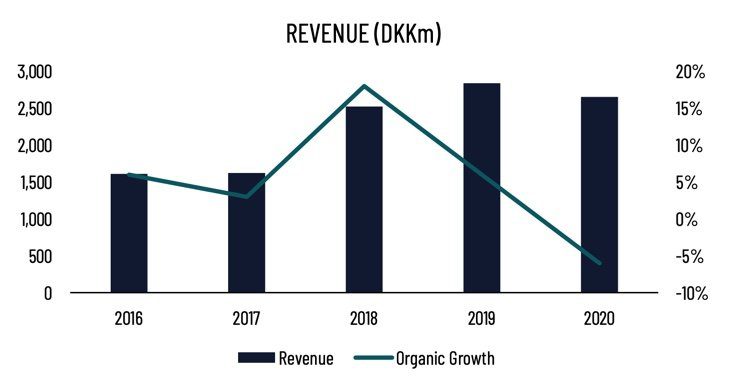

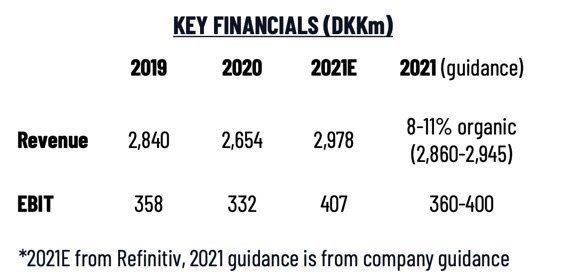

H+H has grown its EBIT margin in recent years leading to a strong cash position which underpins its acquisition strategy.

Financials Overview

Revenue: H+H have consistently grown its topline through organic growth and acquisitions. Organic growth was negative 6% in an exceptional year which saw construction volumes in Europe fall 25.4% in March and April, according to Eurostat.eu.

EBIT: H+H maintained its EBIT margin in 2020 at 13% despite a difficult year. EBIT margin has improved since 2016, a long-term target of 11% EBIT margin irrespective of growth has been set.

ROIC: In 2020 H+H demonstrated sustained value creation with an ROIC of 18%. H+H directs capital towards investments and/or acquisitions in pursuit of its ambitious growth strategy before returning any surplus capital to shareholders. In 2020 acquisitions were curbed by Covid19, in response H+H initiated a buyback programme of DKK 115m.

Financial Gearing: H+H has a sound cash position giving it headroom to expand its balance sheet in pursuit of future opportunities. Current leverage is below its long-term target of 1-2x. H+H has available financing of DKK 1.7bn in place until 2024.

COMPETITIVE LANDSCAPE

We have identified Xella Group as H+H’s closest peer and CRH PLC, Forterra PLC, Ibstock PLC, Rockwool International A/S and Wienerberger AG as its main publicly traded peers.

Xella Group: competes in the AAC and CSU markets and is H+H International’s closest peer. Xella the market leader in much of Central Western Europe, including Germany and also competes with H+H in Poland. The company is privately owned, headquartered in Duisburg, Germany and had a turnover of EUR 1.5bn in 2020.

Solbet: competes in the AAC market and is the market leader in Poland. Solbet is also privately owned. Last year it produced 2.5m cubic meters of AAC and other products which it sold primarily in Poland. Solbet also has a small presence in other European markets including Germany, Scandinavia, Belgium and Eastern Europe.

Forterra PLC: competes with H+H both directly and via substitute products in the UK market. Forterra produces wall building materials from concrete and clay. Forterra has one aircrete product in its product portfolio called Thermalite aircrete blocks and produces concrete and clay blocks too. Its primary product is the clay brick. In 2020 Forterra made 1.1m cubic meters of blocks for the UK market and realised revenues of GBP 291m.

Wienerberger AG: is the worlds largest producer of bricks and is present in all major European markets. It competes with H+H in the substitute product market via its clay block products. In 2020 Wienerberger realised revenues of EUR 3.3bn.

Rockwool International A/S: produces wall insulation from basalt rock. It is the worlds largest producer of stone wool insulation. Rockwool split from H+H in 1962 to become its own entity and is now a peer in the complementary goods market. Rockwool’s insulation is a key component to wall building and in 2020 Rockwool realised a turnover of EUR 2.6bn.

Ibstock PLC: is the leading producer of clay bricks in the UK. It competes with H+H in the substitute product market through its clay wall blocks and also its recently acquired concrete “Stepoc” blocks. In 2020 turnover was GBP 316m.

CRH PLC: is the leading building materials business in the world, it operates in many building niches and competes with H+H primarily through one of its subsidiaries, Tarmac. Tarmac competes with H+H directly through its Aircrete block products, however, Tarmac also operates in other niches also producing inputs such as cement and lime. CRH realised a turnover of USD 27.6bn in 2020.

PEER GROUP ANALYSIS

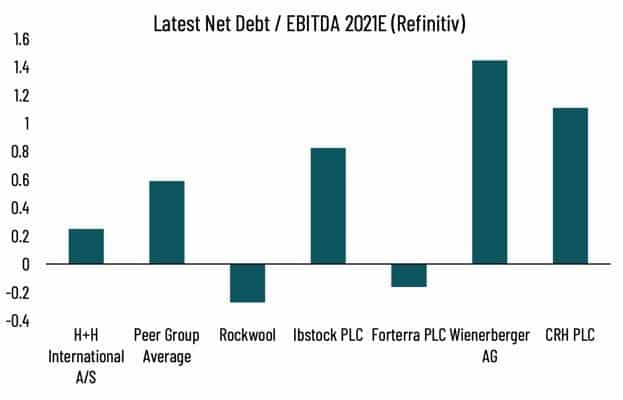

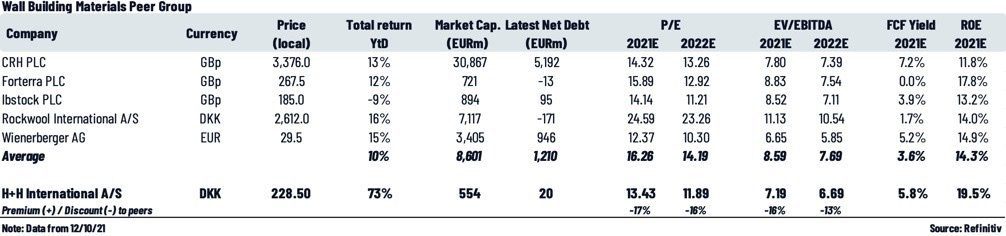

H+H trades at a discount compared to its peers with respect to P/E and EV/EBITDA, H+H also has less debt than the peer average.

Valuation: H+H has a strong valuation position when analysing it against its peers. Peer group analysis via Refinitv highlights a relative discount against the peer average in P/E and EV/EBITDA ratios. Analysts foresee this discount continuing into 2022. H+H is trading at around a 20% discount to the peer group average.

Cash Position: H+H has a strong cash position when analysing latest Net-Debt/EBITDA multiples. H+H are therefore well positioned among its peer group to make value-adding acquisitions/investments in pursuit of its growth and market consolidation strategy. Peer analysis of free cash flows further supports this view as H+H is also above its peer group average.

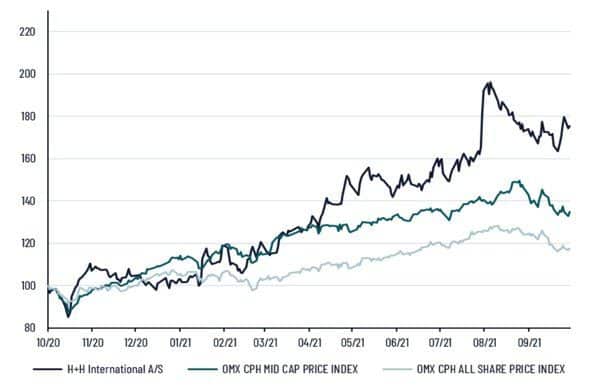

Share Price Development: H+H International has experienced strong share price development thus far in 2021 resulting in its total return YtD far surpassing the peer group average. H+H has the highest ROE of its peer group.

MANAGEMENT TEAM AND MEMBERS OF THE BOARD OF DIRECTORS

CEO Michael Troensegaard Andersen has headed the company since 2011 overseeing the company’s growth and expansion into the CSU market.

CEO Michael Troensegaard Andersen a position he assumed in 2011 after leaving his position as president of Trelleborg Group, a global business with 1500 employees. Mr Andersen is also a board member at Solar Group, a leading European sourcing and services company mainly within electrical, heating and plumbing as well as climate and energy solutions. He is also a board member at HansenGroup A/S, a leading manufacturer of Aluminium facades and in Solar A/S.

CFO Peter Klovgaard-Jørgensen assuming the position in 2019. Previously Mr KlovgaardJørgensen held numerous finance related positions in the Facility Services Group at ISS, including CFO from 2016-2019. From 2014-2016 he was head of Finance for ISS Denmark. He began his career as an auditor for EY.

Board Chairman Kent Arentoft has been chairman since 2013. He has broad organisation and management experience in the building materials and contracting sector, particularly within strategy development and M&A transactions. He is also Chairman of the Board of DSVM Invest A/S, Cembrit Group A/S.

Board Member Pierre-Yves Jullien has experience in management of a major global production company, including turnarounds and efficiency improvement as well as B-t-B sales.

Board Member Stewart Antony Baseley is the Executive Chairman of the Home Builders Federation and Board member at its four subsidiaries. He has experience in the international house-building and the developer industries, as well as international management experience.

Board Member Volker Christmann is Managing Director, Senior Vice President Insulation Central Europe, Member of Group Management ROCKWOOL International A/S. He has extensive experience within the building materials production sector of Central Europe, particularly in Germany.

Board Member Miguel Kohlmann joined the board in 2018 and has Extensive management experience in building materials and industry on a global scale.

Board Member Helen MacPhee is Vice President of Finance at AstraZeneca plc. She has extensive experience within strategic and operational finance as well as international experience in change management, financial oversight and control, governance and risk frameworks.

RISK FACTORS POTENTIALLY AFFECTING THE INVESTMENT CASE

We have identified general risks associated with the investment case of which we believe investors should be aware.

Share Price Development: The market price of the H+H share may develop negatively depending on several factors including financial results varying from expectations, economic downturns, changes in expectations, changes in geopolitical conditions, and the risk of declining global stock markets.

Competition: H+H is subject to competition from competitors, its only multinational competitor is Xella; others compete with H+H in domestic markets. If market supply outstrips market demand cost pressures could occur, damaging H+H’s margins. The risk of new entrants is low given the high barriers to entry. H+H mitigates its competition risk through being a market leader in its primary business regions.

Market Development: The demand for H+H’s products is cyclical and corresponds to the state of the housing market. A downturn in the housing market or European economy would reduce the demand for H+H’s products. The cyclical nature of the industry risks imbalanced earnings. Additionally, H+H is exposed to the cost of raw materials. The building sector in Europe is reporting raw material inflation because of increased demand and disrupted supply chains.

Operational: An incident at an H+H factory could mean a temporary production closure and a business interruption. However, H+H has insurance against business interruptions and a broad production footprint reducing the associated severity.

Raw Materials Inflation: H+H is exposed to raw materials cost. The primary raw materials are cement, lime, sand (PFA in the UK) water and aluminium. Most of these are sources from suppliers local to factories reducing risk of international trade tariffs, however, their cost could still increase above the average rate of inflation. Materials costs could rise if regulators increase the tax on CO2 in cement-based products.

Labour Market Risks: Central and Northern Europe faces a shortage of skilled workers in the construction industry. The pandemic caused many eastern European workers to return to their native homes and travel restriction bought about by the Covid-19 pandemic has prevented their return. This problem is exacerbated in Britain by Brexit.

Product Development: It is important that H+H surveys new industry developments. The Aircrete blocks currently have an ESG edge over many substitute products. However, with increasing scrutiny on carbon emissions there may be less polluting alternative products which come to market in the future.

Financing: There is a risk H+H could realise insufficient cash or financing to conduct business or execute the growth strategy. Additionally, H+H is exposed to exchange rate risk because it trades across many different countries in Europe.

Key Employees: H+H is dependent on key employees to develop its growth. If one or more key employees leave H+H, this may have an impact on the company, strategy, revenue, operating profit and financial position.

Cyber Attack: H+H has a growing dependence on technology. It has a reliance on its IT platform and if this were to be hacked and go down for a significant period of time it could result in delays or additional costs.