The Iran backed militant group Hezbollah has vowed retaliation against Israel after the coordinated attack Tuesday against members of the Lebanese paramilitary group. The attack killed more than 12 people, this including an 8-year-old girl and wounded almost 3000 more. Thousands of pagers exploded simultaneously in Beirut and several other regionsTuesday, wounding Iran’s ambassador to Lebanon in the process.

The group blamed Israel for what it called “this criminal aggression” and vowed that it would get “just retribution”.The Israeli military declined to comment.

Then on Wednesday, even more pagers, walkie talkies and other telecommunications devices exploded causing more casualties, according to the state-run National News Agency and videos circulating on social media. Hezbollah and Israel have been in a tug-of-war over the 11 months since the Hamas terror attack and the following war in Gaza, but the latest attacks could be a tipping point for a wider spread of the conflict.

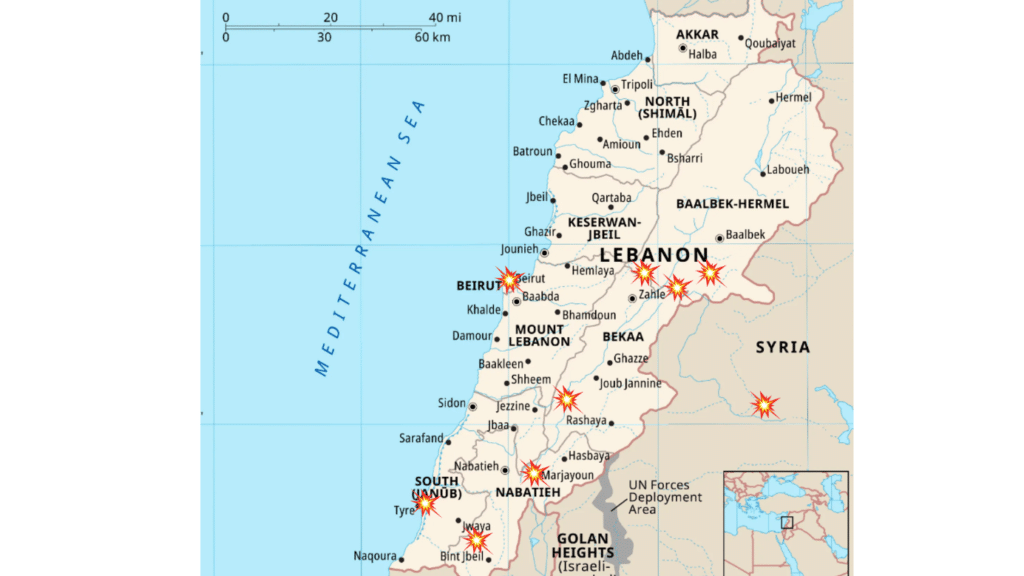

The threat of escalation of a wider regional war has reached a new level after the sophisticated attack on the terrorist group. The Israeli defense minister Yoav Gallant has called for a new phase of the conflict and announced that Israeli troops would be sent to the Lebanese border. With heavier military forces stationed at the border, fears of further escalation might be realized.

Energy Implication in a wider region conflict.

A wider war between Israel and the Lebanese terror group Hezbollah could have a substantial higher global risk than the war in Gaza. Hezbollah is a sophisticated terror group with close ties to Iran and the Iranian proxies like the Houthis and militias in Iraq.

The war in Gaza has come with a high price tag for the Israeli economy and the credit agencies S&P, Fitch and Moody`s has downgraded Israels credit rating due to the geopolitical risks.

A wider war in the region would have major implication for gas installations in the Mediterranean and throughout the country of Israel that are important for the economy. Israel had nearly $600 million in revenue from natural gas and minerals in 2023, with the gas exported to Egypt and Jordan from the Tamar and Leviathan fields through three pipelines. Israel and Egypt signed a MOU for Israel to supply gas through Egyptian LNG export infrastructure to the European Union.

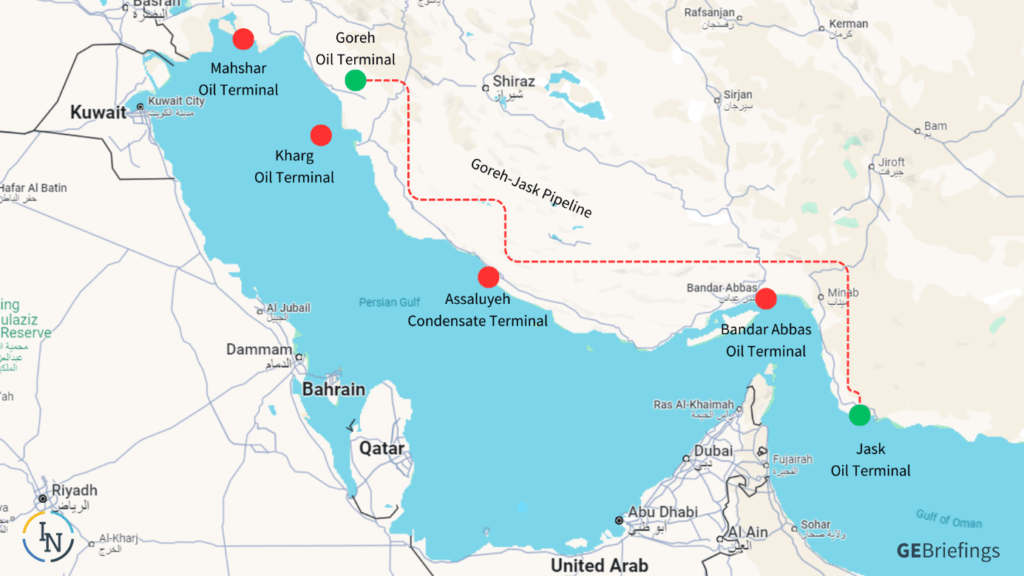

If Iran should be drag further into the war concerns that the region`s O&G infrastructure could be dragged into conflict. China is the biggest buyer of discounted Iranian crude and buys nearly 90 percent of Iranian oil. Iran exported 1.59 million bpd of crude and condensate in August, down from July were Iran exported 1.64 million bpd. Last year Iraniancrude and condensate export averaged 1.35 million bpd, and this year exports have increased to 1.56 million bpd. Keep in mind exact Iranian export and production data remains difficult to verify.

With disruption in the important Strait of Hormuz, Iran has some export options in Jask port outside the strait on the Gulf of Oman. The Jask port has an estimated export capacity of 350 Kbpd, but with more Iranian investment looking to increase the ports capacity substantially.

The terminal on Kharg Island in the northern Mideast Gulf is Iran’s main export terminal with an alleged capacity of 8 million bpd and ships 90 percent of Iranian crude.

In 2023 Iranian crude and condensate export reached their highest levels since the US sanction from 2019, and according to data from shipping and tanker trackers Iran isn`t slowing down. With most of export reaching China as the final destination, via ship-to-ship transfers off the coast of other countries like Malaysia.

Iran`s estimated production capacity is 3.6 million bpd with approval to raise outputs to 4 million bpd. Approximately 50 percent of production is being processed in domestic refineries.