Disclaimer:

HC Andersen Capital receives payment from Hafnia for a Digital IR/Corporate Visibility subscription agreement. Philip Coombes, primary author, and Rasmus Køjborg, secondary author, have no ownership in Hafnia. This is not

a piece of advice to buy, sell, or not to sell shares. The material has been read by the company before publication. HC Andersen Capital assumes no responsibility for correctness of the contents of the material.

HAFNIA:

Hafnia provides and operates transport vessels for refined oil

products and easy chemicals. Hafnia was listed on the Oslo Stock

Exchange (OSL) on 8/11/2019; after completing the merger between

Hafnia Tankers and BW Tankers.

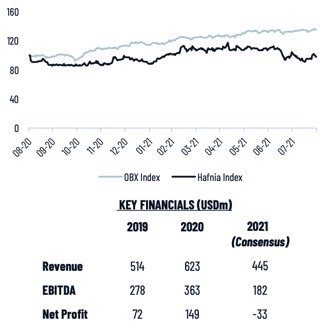

Ticker: HAFNI

Share price (NOK): 17.02

Market capitalization (NOK): 6.3bn

INVESTMENT CASE

• Investment case: Hafnia differentiates itself from its closest direct competitors by focusing on a low-cost structure centred around vessel

ownership and third-party vessel management. Hafnia has the lowest break-even TCE rate of its peers and boasts a young fleet compared to

the industry average. Hafnia’s pool management platform delivers additional revenue through third parties’ fees and commissions, totalling USD

10m for H1 2021. Hafnia is committed to a high dividend payout ratio of c.50% earnings. The strong dividend case builds on Hafnia’s competitive

advantage in funding cost and return on equity compared to its peers.

• Oil supply: is consolidated in a few nations. Transporting oil products and easy chemicals from refineries to distribution centres requires the

product tanker industry.

• Oil demand: Product tanker demand is guided by global oil demand. Decreased oil demand during the Covid-19 pandemic disrupted product tanker

revenues. However, as global lockdowns ended, oil demand increases and is expected to near pre-pandemic levels by the end of 2021.

Increased demand for oil and tankers creates upwards pressure on spot prices.

• Tanker supply: Low order book values generates low tanker fleet growth projections for the next 2-3 years. Higher steel prices are

accelerating the recycling of older vessels, enabling low fleet growth. Further favourable supply conditions exist from the completed unwinding

of floating storage. Total product fleet growth is projected to be low for the near future enabling expectations of higher spot prices.

• Management: CEO Mikael Skov founded Hafnia Tankers in 2010 and has over 37-yrs in the shipping industry. CFO Perry Van Echtelt has over 20

years of experience in investment banking and ship financing. EVP Thomas Andersen was vice president at Torm from 2005-2010 making his move

to Hafnia Tankers when founded to join Mikael Skov. He is now EVP and head of investor relations, research and performance management.

KEY INVESTMENT REASONS

• The move away from fossil fuels is slow; global oil demand likely to

remain strong.

• Market conditions create a positive outlook for demand and supply.

• Strong dividend case for the company with best commercial

performance, financing cost and return on equity of its peer group.

KEY INVESTMENT RISKS

• The transition to green energy may decrease global oil demand. ESG

investors may also avoid the stock for its fossil fuel association.

• Exposure to spot prices risks large revenue fluctuations, currently

exacerbated by uncertainty associated with Covid-19 and geopolitics.

• An increase in new vessel orders could affect marginsin the future.

MARKET OVERVIEW

Product Tanker Overview

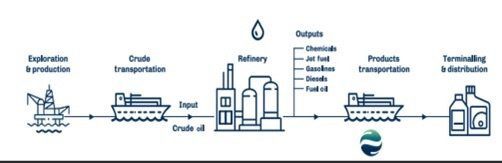

Product tankers transport oil product and easy chemicals primarily from refineries to end user

distribution centres. Product tankers often carry multiple different products simultaneously,

requiring complicated pumping and piping systems to facilitate a separate handling process for

each type of cargo.

The product tanker market requires use of smaller vessels than that of crude transportation

because product volumes post refinery are smaller. Product tankers also typically cover smaller

distances, however, consolidation of producers is increasing demand for longer duration

vessels, primarily the LR2 vessels (See ship size overview on page 8).

Key Industry Terminology

Oil Spot Prices: are the rates attainable in the futures market for the transportation of oil.

Bunkering: is the process of refuelling tankers using the tanker fuel ‘bunker’. Managing the cost

of refuelling is an important component in the product tanker market.

Floating storage: is the act of using an oil tanker for storage purposes, this occurred at mass

during the Covid-19 oil demand shock as onshore oil storage rapidly reached capacity. The

market typically maintains floating storage capacity at around 3%* of global carry capacity.

*Figurefrom Hafnia Annual Report 2020

DWT: stands for deadweight tonnes. DWT is the industry standard unit of measure for how

much a tanker can carry

TCE: stands for Time Charter Equivalent. TCE is a shipping industry measure used to calculate

the average daily revenue performance of a vessel.

Market Dynamics

Hafnia primarily trades in the product spot market where it operates a fleet of owned and

externally-managed vessels. All vessels are managed through operating pools which enables the

benefits of economies of scale. Pool management allows participants to reduce risk through a

revenue/loss sharing mechanism which Hafnia controls. The pool management is responsible

for operations, finance & control and chartering of all vessels in the pool. Hafnia receives pool

management commission as a fixed fee and a percentage of all net pool income.

The operations department involves managing vessel performance, compliance as well as the

active management of voyage costs to optimise vessel earnings. A key feature of this process is

the procurement of bunker – the fuel tankers use for propulsion. Hafnia’s Bunker department is

responsible for procuring bunker at competitive prices, Hafnia then charges a fixed fee

commission to third parties per ton of bunker purchased.

Hafnia’s ESG Strategy

Air: Hafnia aims to reduce its carbon emissions by outpacing the IMO’s carbon intensity targets

with ambitions to be two years ahead of the 2030 target. Their strategy involves continued

investment in new vessels which are equipped to run on duel-fuels, enabling use of carbon

neutral fuels like ammoniac. Hafnia’s current trajectory is to reduce CO2

intensity by 3% per year.

Land: Hafnia is committed to reducing plastic waste both at sea and at its on land facilities.

Sea: Hafnia is committed to zero spills at sea, protecting oceans from hazard.

SUPPLY SIDE DRIVERS

Supply Side Overview

Supply Side Overview

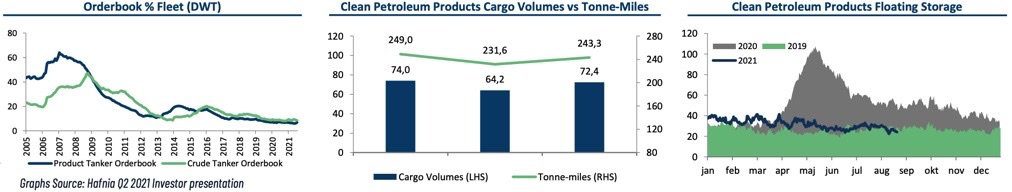

The supply of tankers for oil transportation is one of the determinants of the spot price.

The tanker industry orderbook is at historically low levels, driven by lack of available shipyard

space and by uncertainty surrounding the future of tanker propulsion technology.

Low fleet size growth creates favourable price push conditions as oil demand increases.

With ships typically taking 18-32 months to complete from order initiation there is little risk of

unforeseen supply shocks. Total fleet growth for 2022 expected at 2.4%

Floating storage utilisation reached historic highs during 2020, with almost 400m barrels

(c.10% of tanker utilisation) of tanker capacity utilised for floating storage. The unravelling of

excess floating storage created a supply shock to the tanker market, that has recently returned

to pre-pandemic levels.

Shipbuilding Capacity

Industry average product tanker fleet age is currently at two-decade highs. The potential for a

significant overhaul of old vessels is therefore high. Capacity at shipyards is largely occupied by

orders of LNGC/ULCV crude tankers. In addition, recent shipyard closures exacerbate the

capacity problem resulting in little opportunity for a new order supply shock to the product

market.

Floating Storage

The Covid-19 demand shock initiated a surge in floating storage, which, at its peak, tied up

c.10%* of product tanker fleet – an industry high. As floating storage was unravelled the

liberated vessels created a supply shock placing downwards pressure on spot prices. Floating

storage has since returned to pre-pandemic levels, removing the supply shock.

*Figurefrom Hafnia Annual Report2020.

Uncertainty

The future of green propulsion technology is unknown. Risks associated with future regulation

and alternative fuel availability creates uncertainty when commissioning newbuilds – deterring

orders. Recent industry developments, such as A.P. Moller-Mærsk ordering eight methanol

propelled container vessels, guides future ‘green fuel’ expectations. However, biofuel supply is

currently low, and the scalability of alternative fuels is debated.

DEMAND SIDE DRIVERS

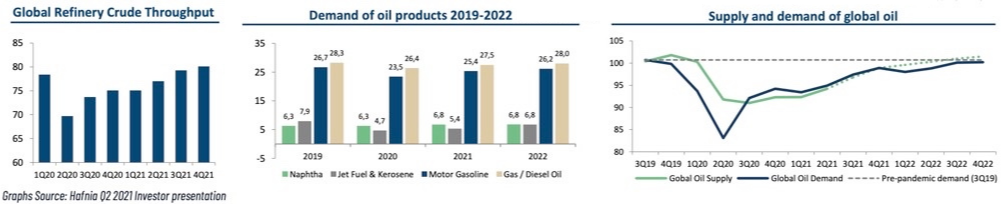

Demand Side Overview

The demand for oil is a key determinant of the spot price for oil transportation. Increased

global oil demand increases the demand for oil transportation

Oil demand is expected to recover to near pre-pandemic levels by the end of 2021, following

large falls in oil demand during widespread global lockdowns.

The structure of oil supply is expected to shift towards export-oriented capacity as

inefficient local refineries increasingly close thus improving average tonne-mile demand.

Oil demand growth is expected to outpace oil supply growth creating favourable market

conditions for the tanker industry.

Increasing Oil Demand

The Covid-19 oil demand shock in ‘black-April’ reduced global demand by 22 million barrels per

day (mb/d); total 2020 oil demand fell by 8.8% yoy. However, according to the International

Energy Agency (IEA), demand is forecast to return to pre-pandemic levels by the end of 2022,

rising 5.4 mb/d in 2021 and a further 3.1 mb/d next year. The IEA reported global refinery

throughput declined 15% in Q2 2020. In January 2021, throughput remained 5-6% down yoy,

contributing to a weak recovery for the tanker market.

Increasing Oil Supply

Seaborne products trade volumes are expected to grow 6% yoy; as oil demand improves.

However, this remains below 2019 levels; trade in some fuels, e.g. jet fuel, is taking longer to

recover fully. Total product tanker tonne-mile trade is projected to grow 7%* as continued

disruption to trade flows raises the average haul length.

*Figurefrom Hafnia Annual Report 2020

Export Refinery Capacity Increasing

Recently, outdated close-to-shore refineries (especially in Europe) have closed, favouring larger

export-oriented alternatives. China and the Middle East are leading in refinery capacity

additions and are projected to bring 1.3m barrels a day of new export-oriented trade to

market. Adjusting refinery sector dynamics should lengthen the average tonne-miles for the

product market.

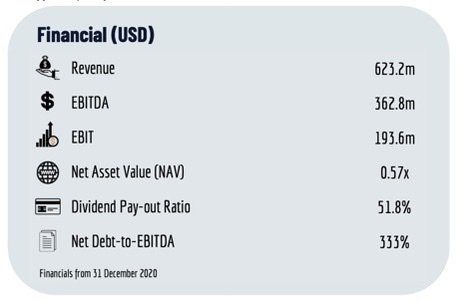

FINANCIALS

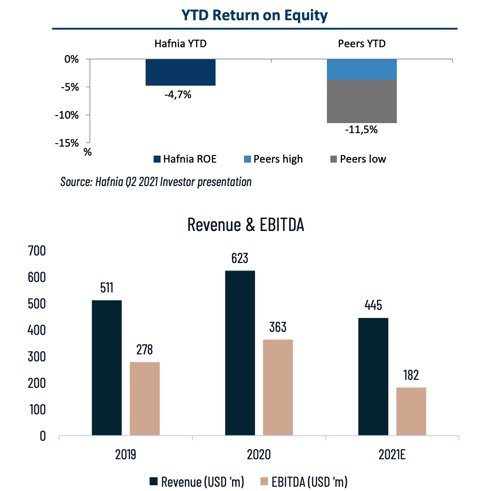

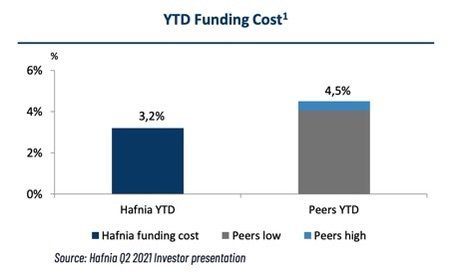

Hafnia have developed a low cost structure which allows them to maintain a positive expected

EBITDA figure despite facing negative market conditions for much of 2021.

Hafnia stress the importance of targeting a dividend pay-out ratio of around 50%. Hafnia

believes when they are successful, their shareholders should also enjoy notable returns.

Hafnia’s low cost structure came as growth through acquisition enabled economies of scale.

The strategy explains its high debt-EBITDA. However, this figure is competitive with industry

norms.

Hafnia’s Return on Equity is strong compared to its peers, however, the industry as a whole has

struggled to yield gains thus far in 2021.

PEER GROUP ANALYSIS

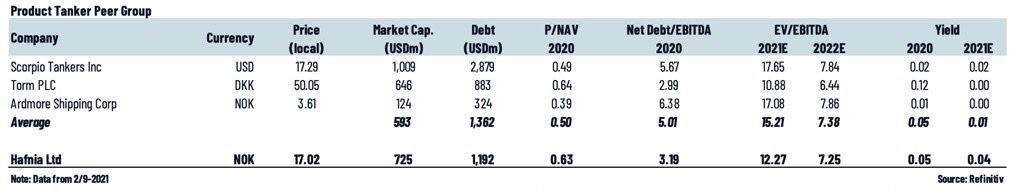

Hafnia identifies Torm, Scorpio Tankers Inc and Ardmore Shipping Corp as its closest competitors.

As can be seen in the peer group table below the Product Tanker companies are characterized by

having a relatively high debt compared to their market capitalisation. Hafnia and Torm are those

that can best cover their debt with current earnings. Additionally, Hafnia mitigates its corporate debt

and high leverage ratio by having a low cost of funding.

Hafnia’s trades with near identical NAV multiples as Torm whilst Scorpio Tankers and Ardmore trade

at a discount in comparison.

When considering EV/EBITDA ratio, Hafnia, seems to be trading at a discount against its peers. As of

2021 Hafnia had the lowest EV/EBITDA ratio, but numbers are projected to align in 2022.

Hafnia offers a very attractive estimated yield for 2021 with only Scorpio Tankers also expected

to offer some cash return in 2021.

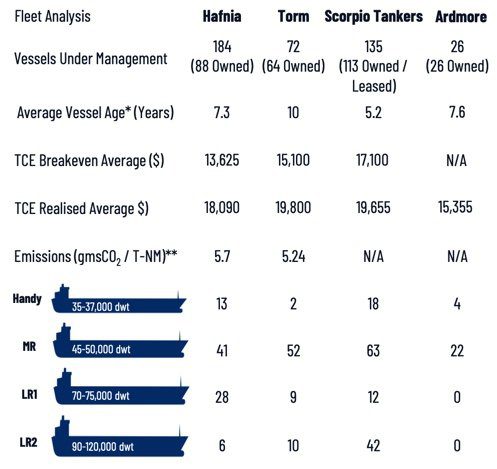

FLEET ANALYSIS

Ownership

Hafnia differentiates itself through its pool management. Hafnia have the largest fleet under

management through operation of their four shipping pools. By leveraging expertise and

economies of scale, Hafnia derive additional profit from commercially managing vessels on

behalf of third-party owners. In 2020, Hafnia generated USD 23m from pools and other fee

generating streams, of which USD 13m were profit.

Vessel Age & ESG

Hafnia has a young fleet and is operating below IMO’s carbon intensity target. In 2020, across

Hafnia’s owned fleet, carbon intensity as measured by Annual Efficiency Ratio was 5.6% below

the IMO’s 2020 target. Hafnia is well positioned to meet future emissions targets and therefore

reduces the risk of future penalties related to emissions.

TCE Rate and breakeven

Hafnia has the lowest cost structure of its peers experiencing the lowest breakeven average

TCE rate of USD 13,625. The low cost structure is a key feature of Hafnia’s competitiveness and

generates significant cash flow potential from an increase in spot prices.

Vessel Distribution

Hafnia operates a diverse fleet operating four categories of vessels: Handy, MR, LR1 and LR2.

Having a diverse portfolio of vessels ensures Hafnia can service their customers across all

transportation distances.

• * Age recorded as of 31 December 2020

• **CO2 emission in grams per ton nautical mile

• ***All four companies are within IMO emissions guidelines

Source: All information included in the fleet analysis is publicly available in the companies financial

reports

MANAGEMENT TEAM AND MEMBERS OF THE BOARD OF DIRECTORS

CEO Mikael Skov was co-founder of Hafnia Tankers and has more than 37yrs experience in the shipping industry

CEO Mikael Skov assumed the CEO role in 2019 after the merger between Hafnia Tankers and BW

Tankers. Mr Skov was the founder of Hafnia Tankers and has more than 37 years of experience in

the shipping industry. Prior to establishing Hafnia Tankers, he held various positions over his 25-

year career at Torm, of which the last two years he served as CEO.

CFO Perry Van Echtelt has over 20 years of experience in investment banking and ship

financing. Prior to Hafnia, Mr Van Echtelt was CFO of BW Tankers from 2017, a role he took after

leaving ABN AMRO Bank as Head of Transportation and Logistics Asia Pacific & Middle East. For 17

years Mr Van Echtelt had held various positions in the corporate finance and capital markets

group of ABN AMRO.

EVP Thomas Andersen was vice president at Torm from 2005-2010 making his move to Hafnia

Tankers when founded in 2010 to join Mikael Skov. He is now EVP and head of investor relations,

research and performance management.

Hafnia’s Major Shareholders

Hafnia’s majority shareholder is BW Group LTD (66.5%) which has a wealth of experience and

knowledge in the shipping industry, controlling over 400 vessels across many different

niches.

Hafnia’s Board of Directors

Board Chairman, Andreas Sohmen-Pao is also Chairman of BW Group and its other listed

entities, including BW Offshore, BW LPG, Epic Gas and BW Energy. He also serves as Chairman

of the Singapore Maritime Foundation and a trustee of the Lloyd’s Register Foundation. Mr

Sohmen-Pao was previously Chief Executive Officer of BW Group.

Director, Erik Bartnes was co-founder of holding company Pareto Securities AS and senior

partner from 1988 to 2010. He was also a co-founder of the original Hafnia Tankers in 2010

where he was executive chairman until 2018.

Director, Donald John Ridgway was CEO of BP Shipping from 2008 to 2015. He is a Chartered

Marine Technologist and a Fellow of the Institute of Marine Engineering, Science and

Technology, and is currently Chairman of Tindall Riley Ltd, a leading marine liability insurer.

Director, Ouma Sananikone is currently a non-executive director of Innergex (Canada),

Ivanhoe Cambridge (Canada), and Macquarie Infrastructure Corporation (U.S.). She also acted

as an honorary Australian Financial Services fellow for the U.S. on behalf of the Australian

government.

Director, Peter Graham Read is currently the non-executive Chairman of Welbeck Publishing

Group Limited. He is also a non-executive director and Chairman of the audit committees of

QMM Holdings Limited.

Innholdet på Investornytt representerer ikke Investornytt AS´ meninger, men er forfatterenes egne subjektive ytringer. Innholdet på Investornytt skal ikke sees som finansielle råd. Aksjehandel, kryptovaluta, kryptokunst og all form for trading er svært risikabelt og du kan i verste fall tape mer enn du har investert. Alle må gjøre sine egne vurderinger og ikke handle basert på informasjon på Investornytt.