Nyheter

Global Energy Briefings – En rapport av Investornytt

Obs! Denne saken er over 12 måneder gammel.

Preface

With May 2023 in the rear-view mirror, we can ascertain that it was a month of big energy headlines reflecting on a surprise cut of 1.16 million barrels per day from Saudi Arabia and other OPEC+ producers at the start of April.

Volatility has dominated the oil price in recent months and the voluntary cut from OPEC+ producers was aimed at supporting market stability. This is the second OPEC+ cut since US president Joe Bidens visit to Saudi Arabia in July 2022.

Looming bank crisis and risk of global recession is weighing heavy on the global oil market, and despite draws in US inventory oil price is still in a downward trend. May EIA data, shows a draw in US oil inventories, despite a 5 Mbbl build in the week ending May 1

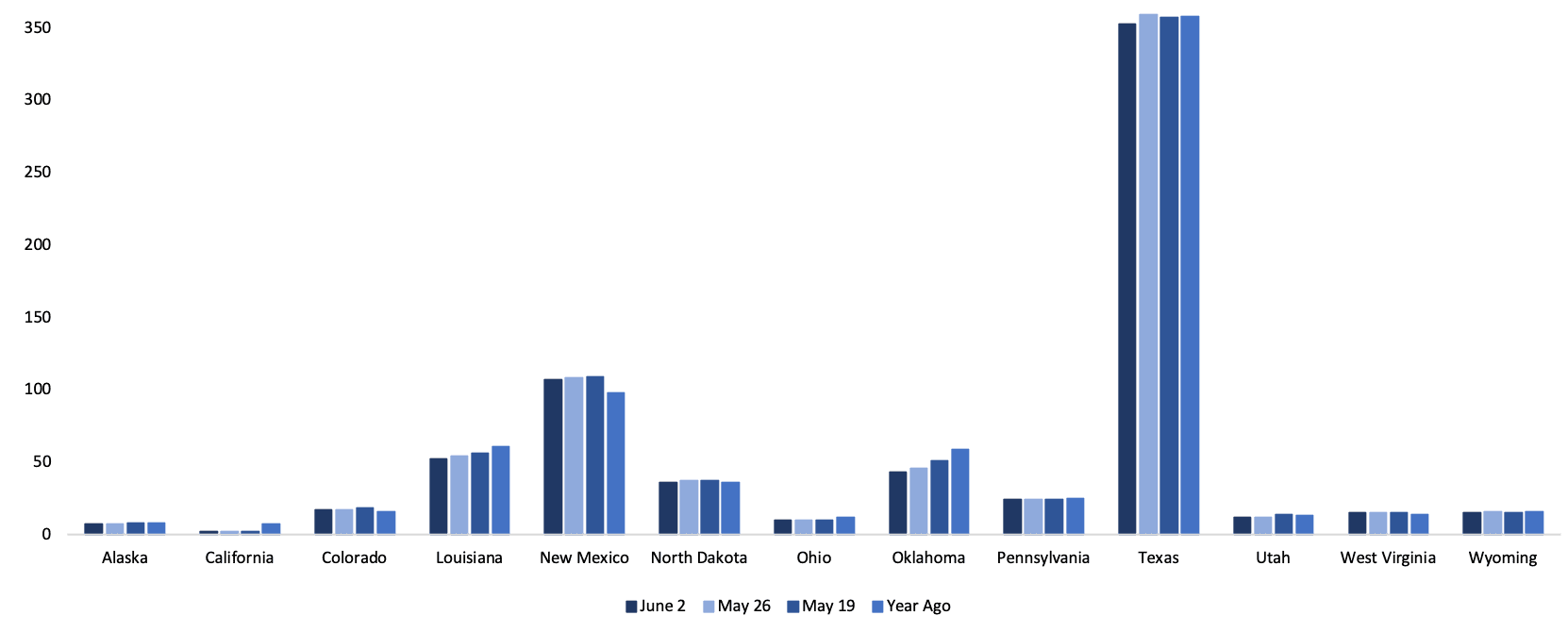

The U.S rig count is continuing to decline and number of active rigs in the U.S is now almost 5 % (31 rigs) lower than a year ago. The first count in June showed a decline of 15 rigs drilling I oilfields, and a unchanged count for rigs drilling for gas.

Saudi Arabia announced a new voluntary cut of 1 Mbpd for July only, but vocal on extending the cut further

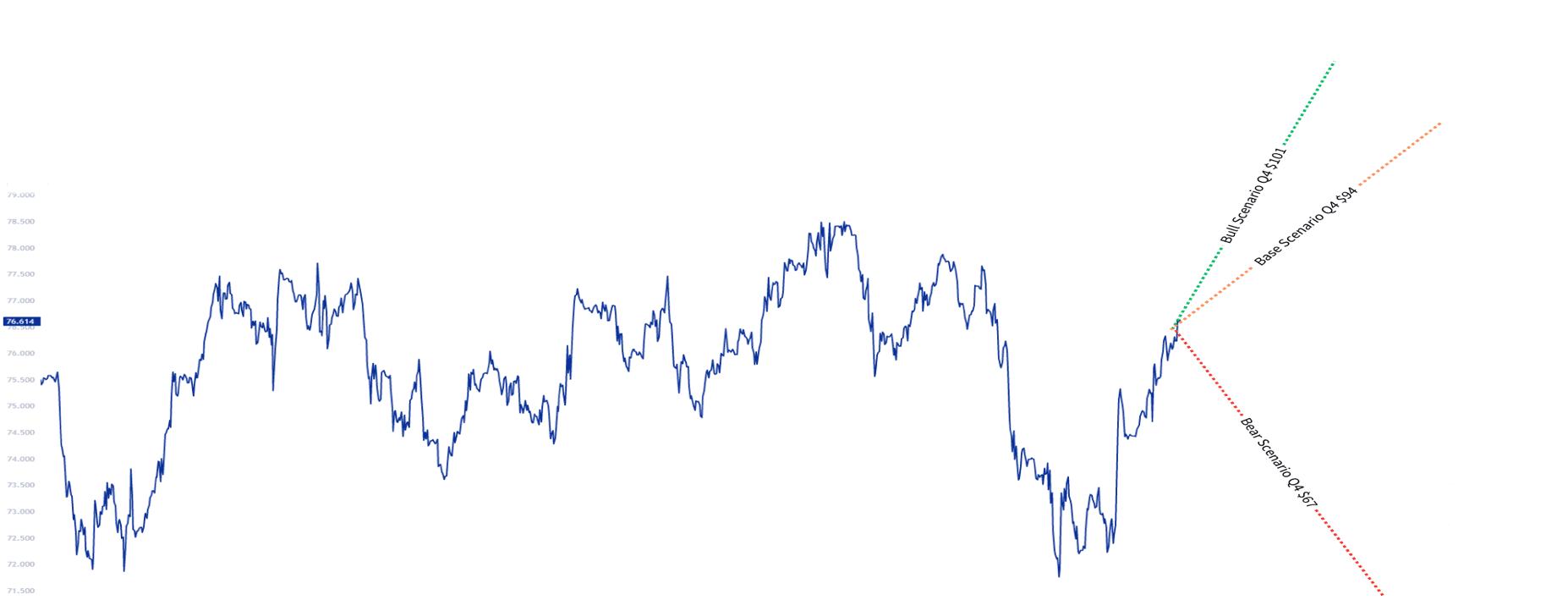

Signal deck

Bullish or Bearish

Oil price

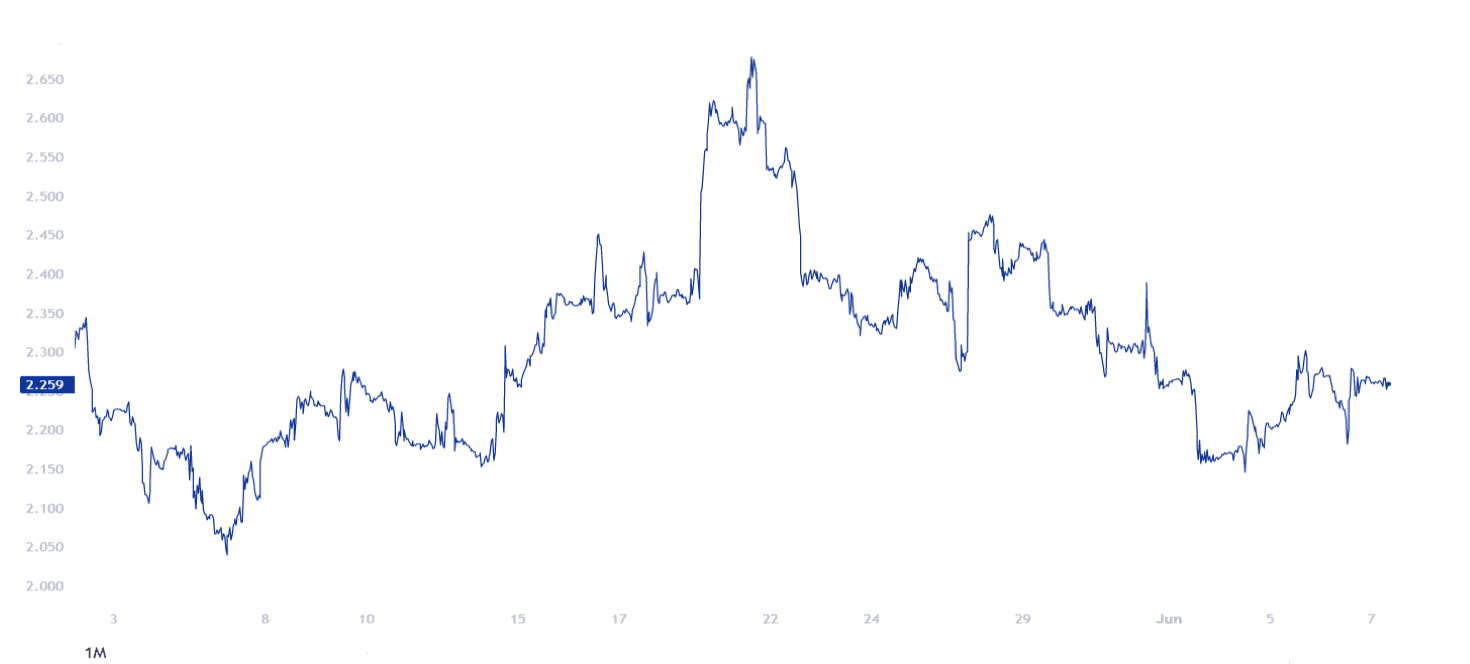

The oil price surged after the surprise voluntary cut from OPEC+ oil producers in early April.

Brent crude, the global benchmark, jumped 5.31% to $84.13 a barrel, while WTI, the US benchmark,

rose 5.48% to $79.83. Both were the sharpest price rises in almost a year. Since then the oil price are back below pre-announcement levels.

We think the macro-pressure globally and uncertainty in Chinas recovery weighs down the oil price and the tight fundamentals is not yet priced in. It seems like Saudi led OPEC+ willingness to cut production in support of oil price is stronger than first assumed.

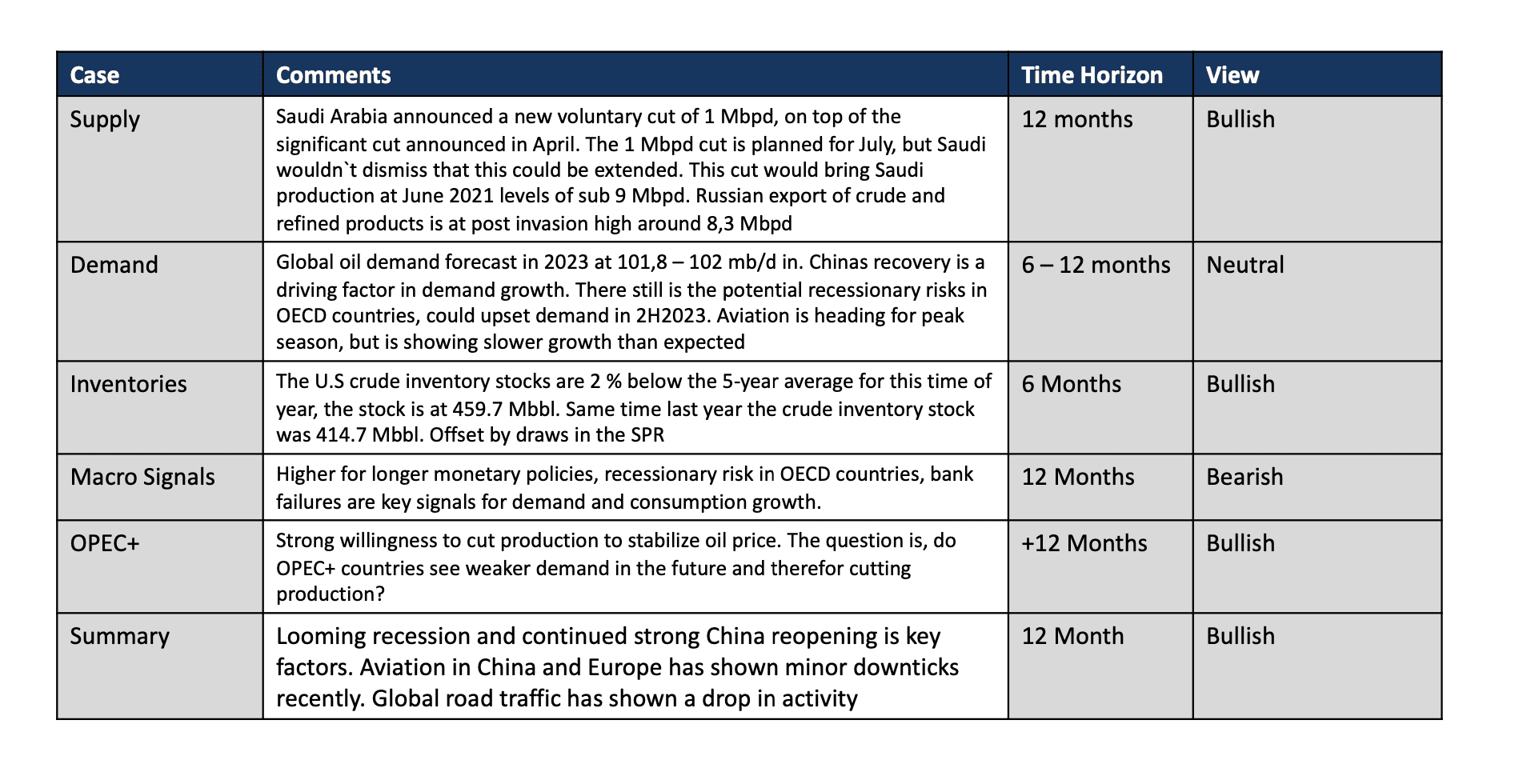

Figure 1: Brent Crude Price movements May

Price movements Brent and WTI, month of May. The announcement of Saudis voluntary cut of 1 Mbpd planned for July is likely to deepen the market deficit to more than 3 Mbpd, this can add pressure to the upside as we move in to peak season and further in to the second half of 2023

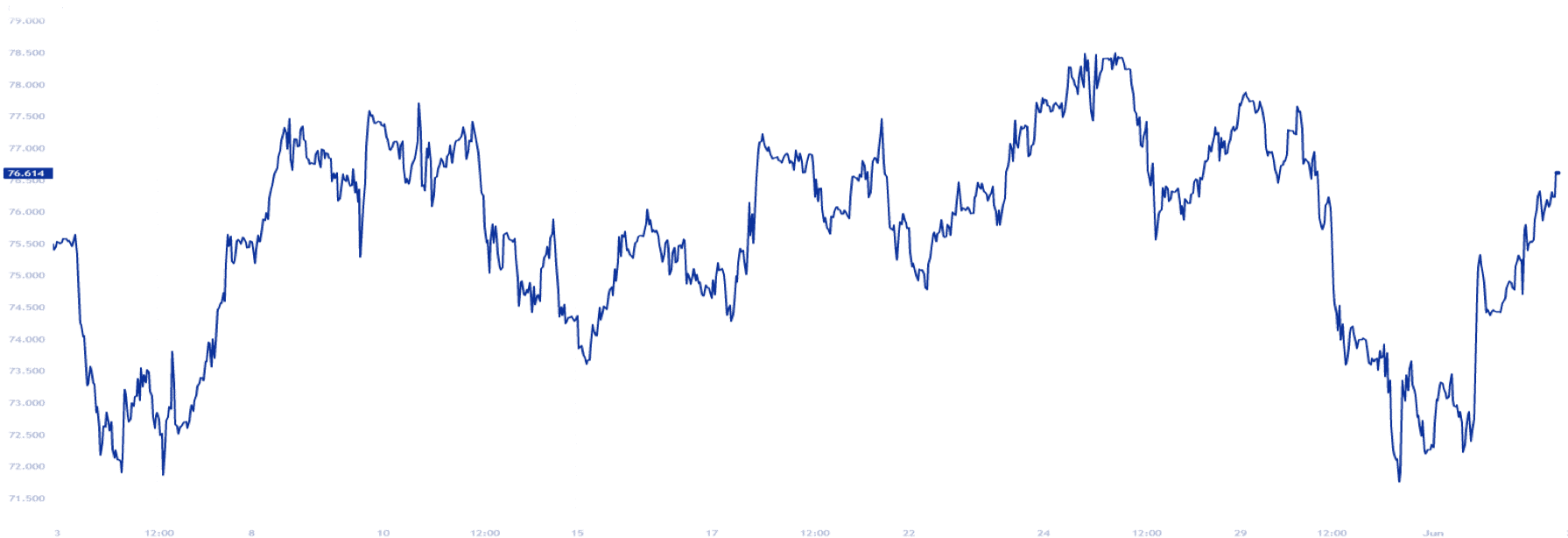

Figure 2: Brent Crude and West Texas Intermediate Price movements May

Brent and West Texas Intermediate future curve has flattened but contracts are still in a slight backwardation (If the futures curve is downward sloped). Backwardation tends to occur when commodity markets are undersupplied. Falling oil inventories and dwindling spare capacity caused by oil demand reaching a new record high this year are supporting a steeper curve in the future. Front-month price volatility is historically very low when the Brent futures curve is flat, since late 2022, however, the flat futures curve has coincided with high volatility in Brent’s daily returns.

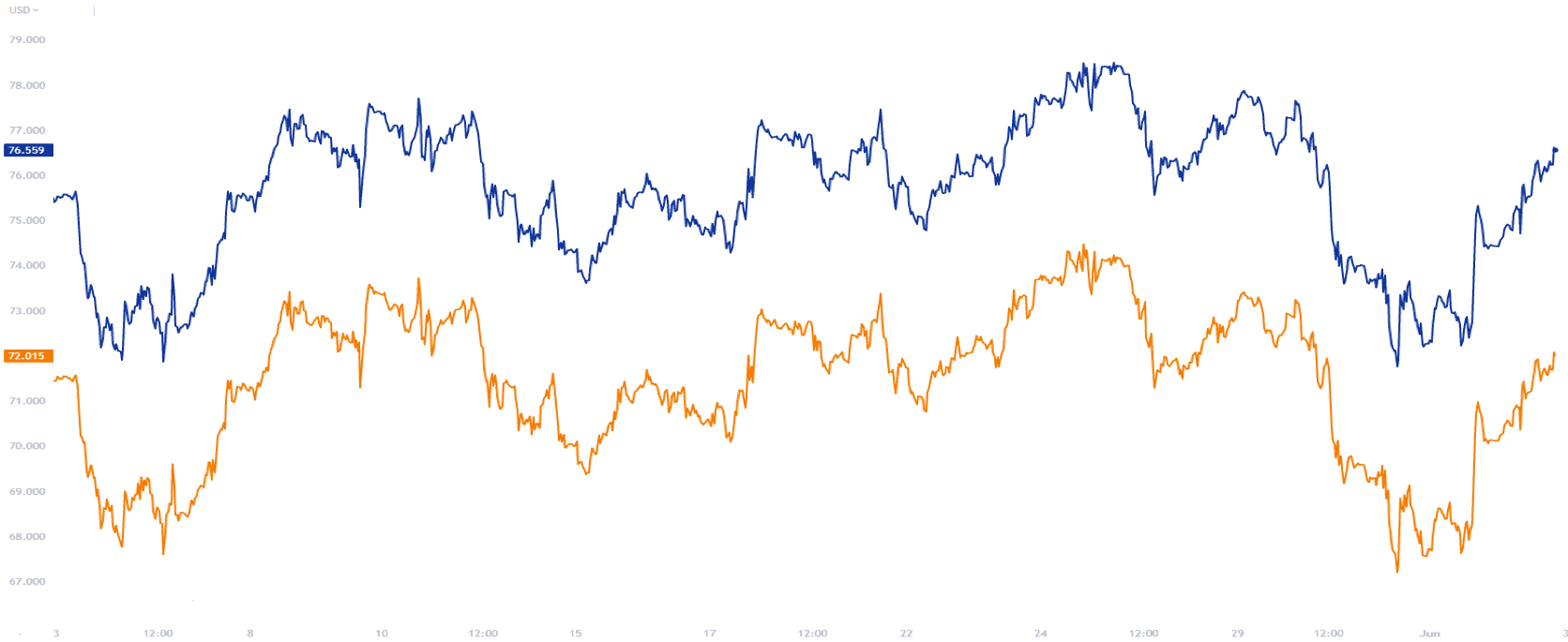

Figure 3: Brent and West Texas Intermediate Future Contracts

Our base scenario is that Brent will average around 94 USD/bbl in Q4 2023. We predict OPEC+ will continue to support price level until the fundamentals Can no longer be overlooked.

The $ 94 estimate is revised down from previous estimates of around 95 USD/bbl.

Our bull scenario is that Brent will average around 101 USD/bbl. Our fundamentals for crude and liquids remain tight, and if looming recession is short lived, and the deficits in the market continue to deepens

We believe that Brent could hit our bull case.

Our bear scenario is that Brent will average around 67 USD/bbl. If demand due to recession keeps falling and OPEC+ doesn’t protect the price we could see

Price average even lower than 69 USD/bbl.

Figure 4: Bull, Bear and Base Scenario. Brent Crude

Supply

Russian exports of crude and refined oil products edged up in April to a post-invasion high of 8.3 Mbpd. Shipments of crude oil increased by 250 kb/d, offsetting a decline in product exports of 200 kb/d. Estimated oil export revenues increased by $1.7 billion to $15 billion on the back of higher crude oil exports and a narrower Urals discount. We expect a supply growth of 1,2- 1,4 Mbpd. Saudi Arabia announced a new voluntary cut of 1 Mbpd, on top of the significant cut announced in April. The 1 Mbpd cut is planned for July, but Saudi wouldn`t dismiss that this could be extended. This cut would bring Saudi production at June 2021 levels of sub 9 Mbpd.

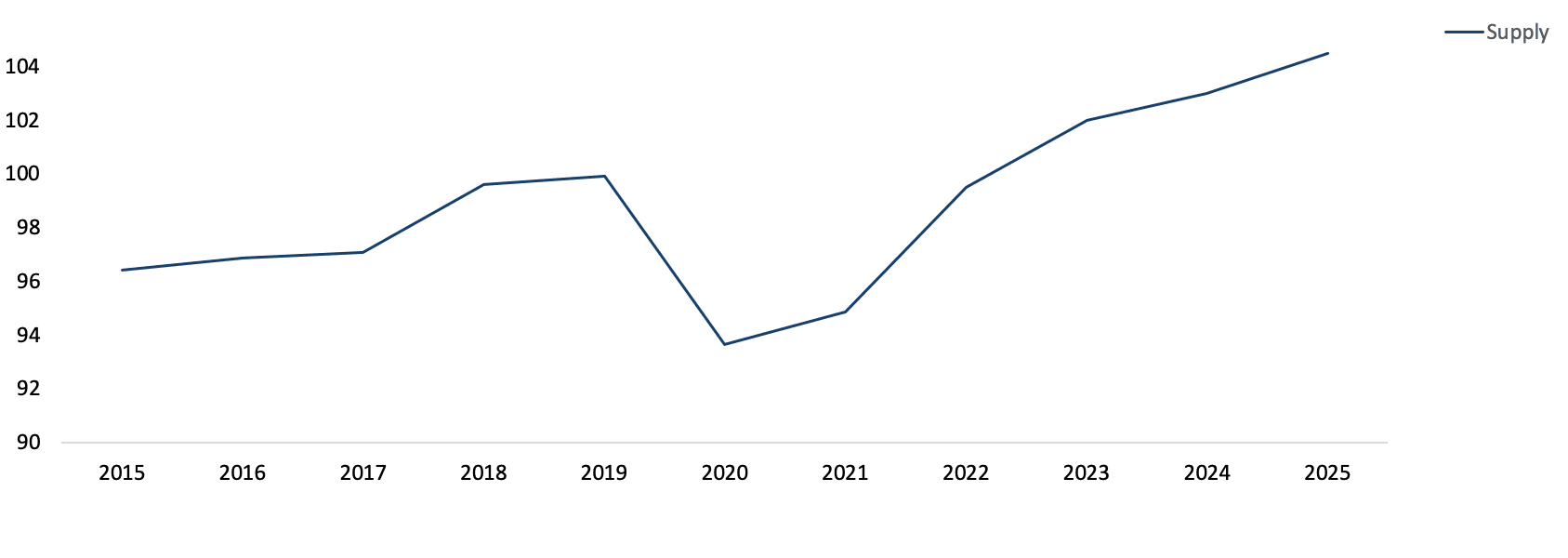

Figure 5: Supply forecast Mbpd

Demand

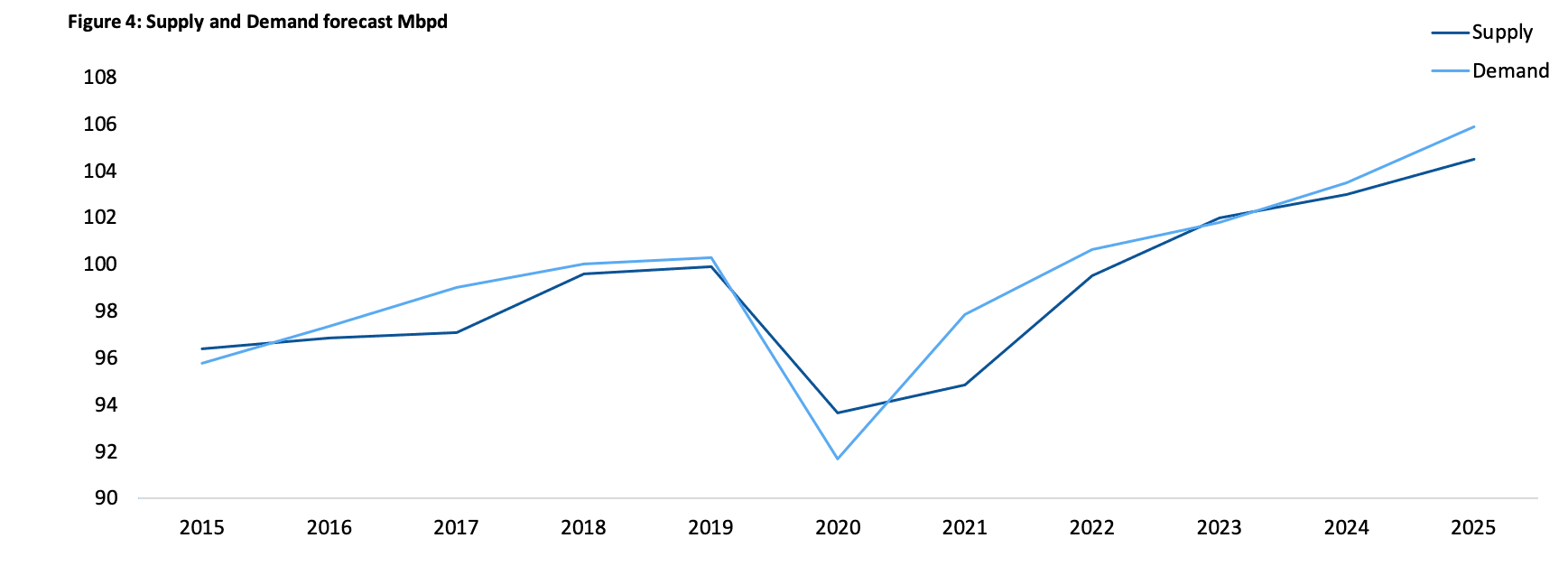

Global oil demand is forecast to rise to an average 101,8 – 102 mb/d in 2023. An increase of 2.0 – 2.2 mb/d year-on-year. China`s recovery is the main driving factor in global demand growth and the major consumer is showing positive signals. There still is the potential recessionary risks in OECD countries, caused by tight monetary policies by central banks, this could upset demand in 2H2023. Aviation is heading for peak season, but is showing slower growth than expected, but could still be a main driver for demand going forward.

U.S inventories

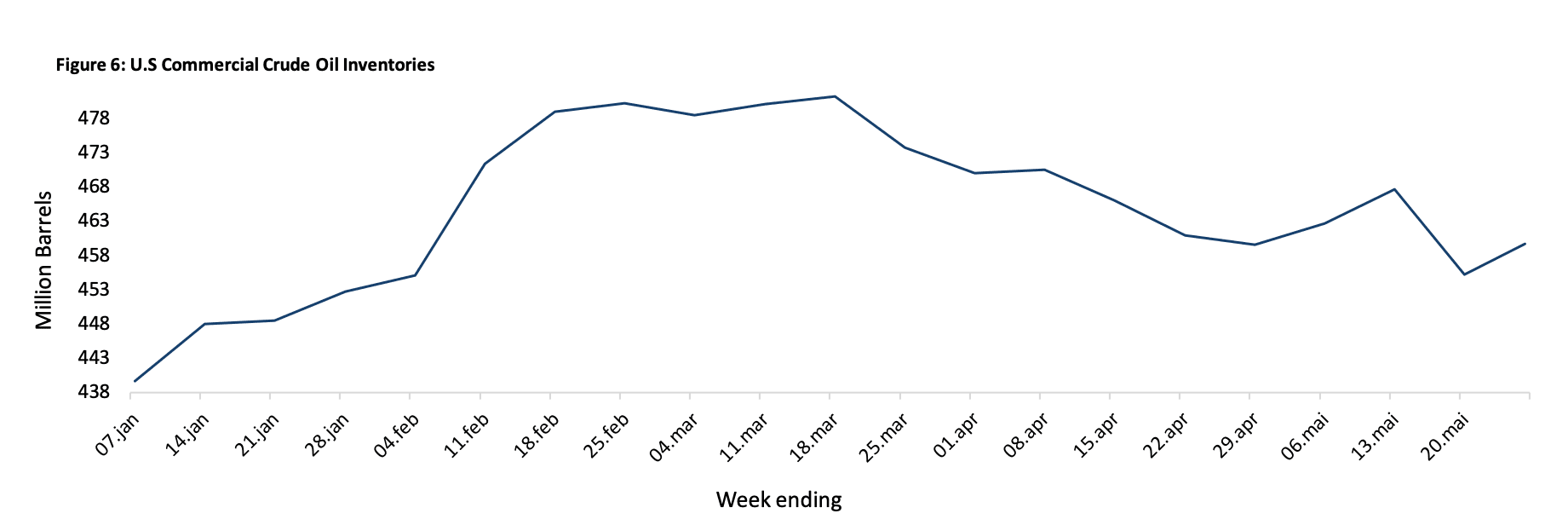

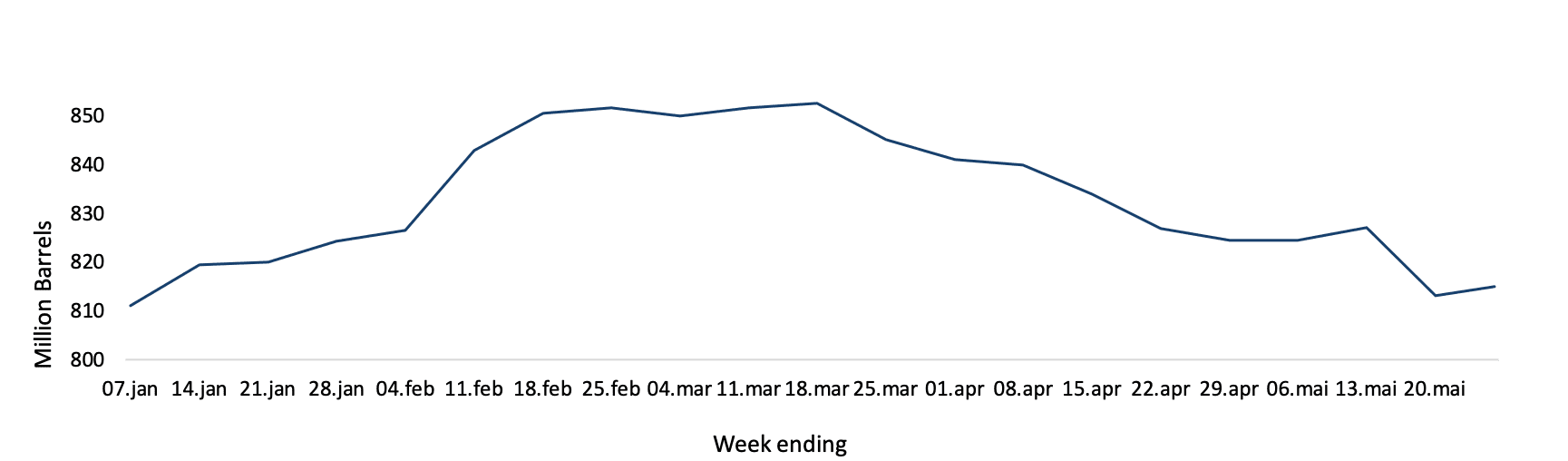

U.S. commercial crude oil inventories, excluding the strategic petroleum reserve inventories are still higher now than at the start of the year at 439,6 Mbbl, although we have seen a steady draw since mid-March with some exceptions. The stocks are 2 % below the 5-year average for this time of year and according to data from the EIA, Energy Information Administration, the stock is at 459.7 Mbbl. Same time last year the crude inventory stock was 414.7 Mbbl. If you include the SPR in the mix we have a total of 815,1 Mbbl on stock. A significant draw from last year at 951, 8 Mbbl

Figure 6: U.S Commercial Crude Oil Inventories

The latest data from EIA shows a significant build in the commercial crude inventories (4,5Mbbl), but partly offset by the draw of the SPR (2,6Mbbl)

Figure 7: U.S Commercial Crude Oil Inventories Including the SPR

U.S Rig market

The blurry macroeconomic environment have put pressure on commodity prices and smaller, private players are feeling lower oil and gas prices the most and they seem to be slowing down drilling operation. The plunged of oil rigs from Baker Hughes 6/2- 2023 Rig count is the sharpest reduction since the 2020 pandemic era. Larger operators in oil and gas fields shows caution as oilfield cost remains elevated and market outlook continues to look blurry. Draw in U.S oil rigs 6/2 -2023 at 15, and gas rigs remained unchanged.

Figure 8: Rotary Rig Count by State

NCS Rig market

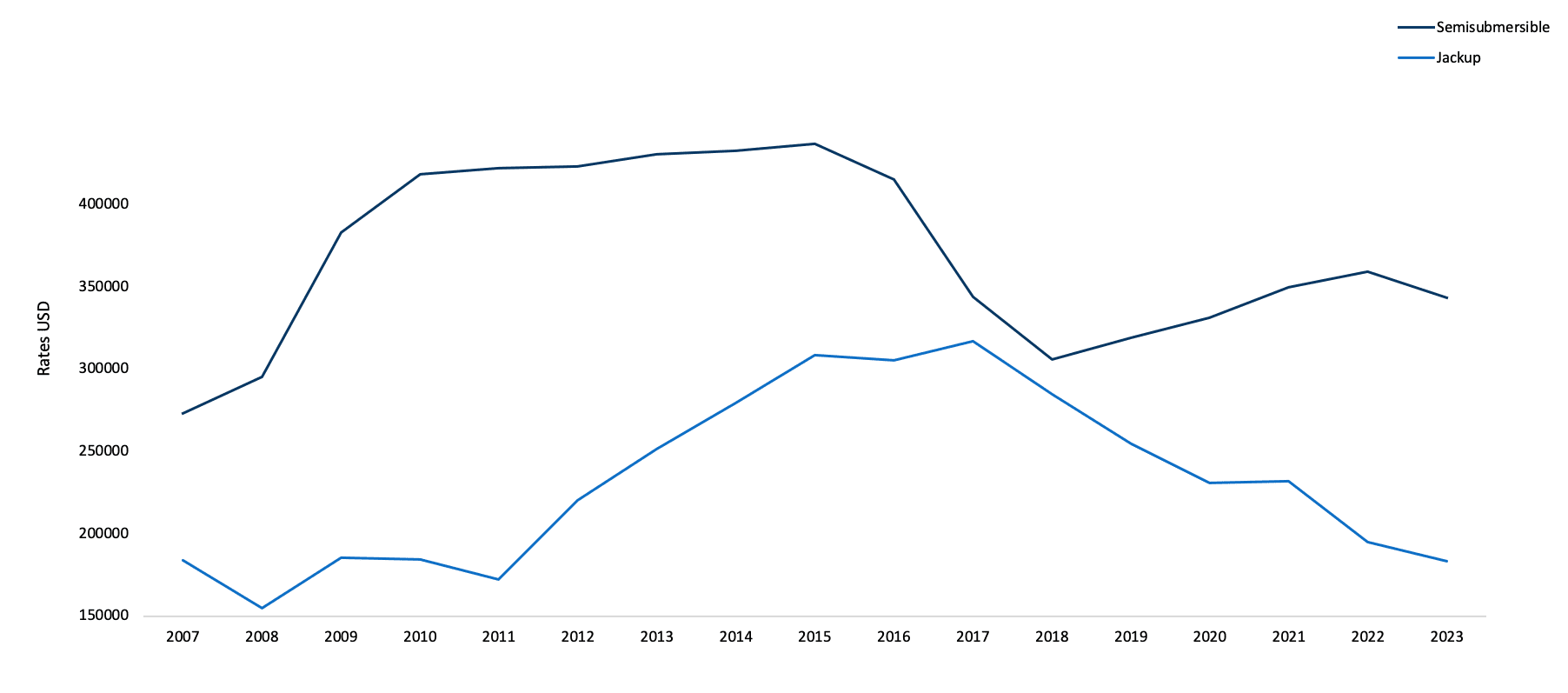

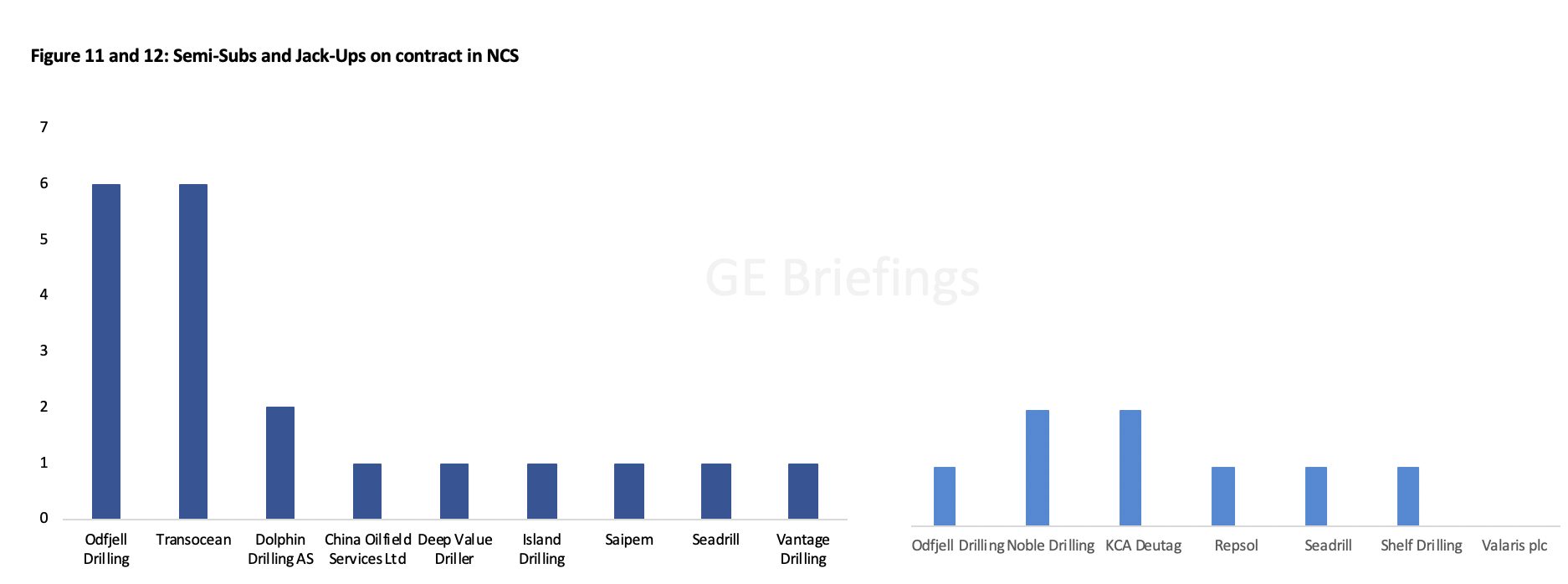

While the land rig market tends to be more volatile and more sensitive to short term price swings, the offshore market is less effected by short term swings in oil and gas prices. We see a tight rig market in the NCS in the future, as rigs get older and fewer newer is getting built. The major operators in NCS has signaled an increased number of exploration wells being drilled in the future

Figure 9: Rig Rates Semi-Subs and Jack-Ups

Equinor is the biggest player in the Norwegian Continental Shelf by far and the company has announced that they will drill between 20 and 30 exploration wells a year going forward. Around 80 percent of the exploration wells will be drilled in known, mature areas. Discoveries near existing infrastructure require less volume to be commercially developed and can be quickly put on stream and with low CO2 emissions. Equinor is set to maximize the value creation from existing infrastructure that has been developed over a long period on the NCS.

GAS market

The European storage levels were around 70% full, about 789 TWh of capacity in inventories. Same time a year ago the European storage were around 50% full at 550 TWh. High level storage keeps a weight on gas prices and EU nations is in no rush to refill inventories to meet their 90% inventory target by November 2023. The maintenance of TurkStream, Norwegian pipelines and the outage at Hammerfest has failed to push prices higher, showing a weakness in demand due to strong storage levels.

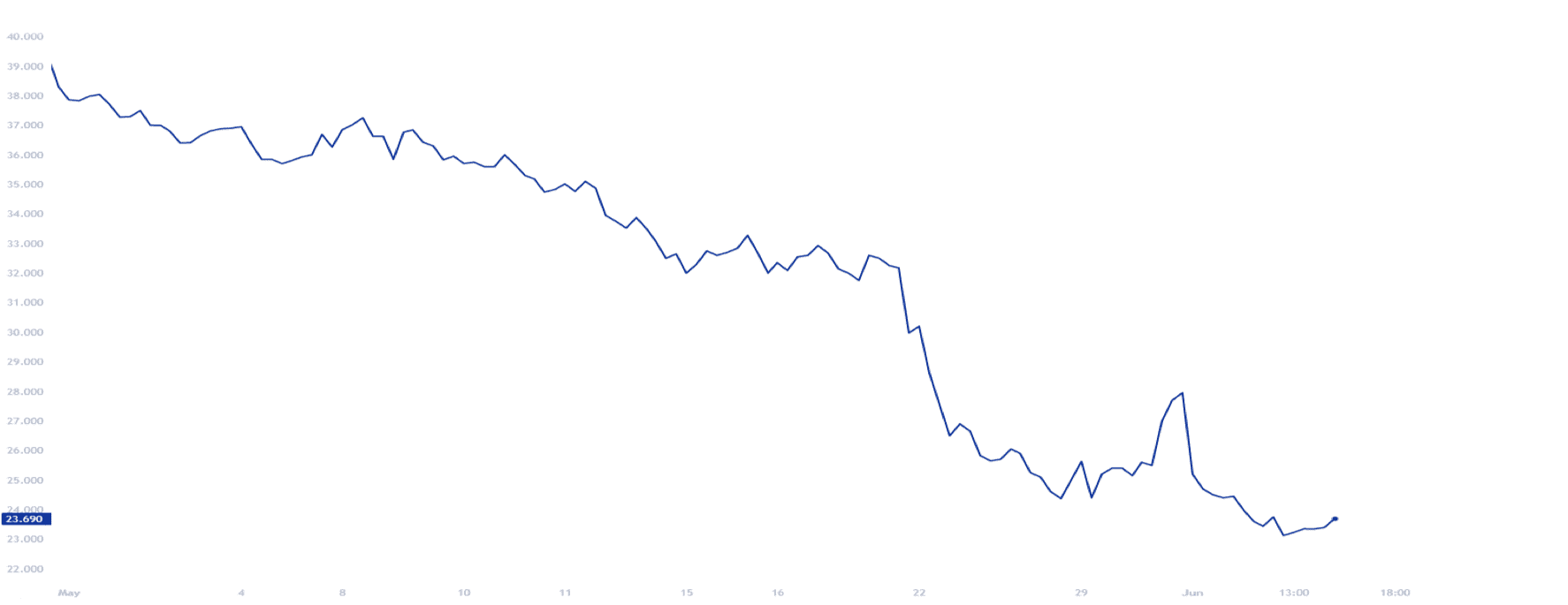

Figure 13: Dutch TTF Price Chart

Storage levels increased to 2,446 Bcf as of 26 May, which is 17% higher than the five-year average and 29% more than during the same period last year. The injection of by 110 Bcf is 10% higher than the five-year average injection and higher than the 82 Bcf injection last year. The high storage levels is suppressing the HH price

Sources

Disclaimer

This report is under no circumstances intended to be used for or considered as investment advice. This report is to be used as information and a general market guidance. The author, GE Briefings and Investornytt cannot guarantee that the information from sources is without incentives, but the author have taken considerable care to ensure that, and to the best of his knowledge, material information contained in the report is in accordance with the facts and contains no omission likely to affect its understanding. Please note that this report is the authors own research, opinions and conclusions, and the readers is recommended to draw their own conclusions based on other sources than this report, the facts and market picture can change in an instant and therefor the reader must do their own due diligence. The author, GE Briefings and Investornytt cannot be held responsible for the readers investments based on this report.