Overall, a good week to be a tanker Owner. After a few slow weeks, the product tanker market came back alive, and the same goes for the dirty tankers, as the market came back strong this past week after the negative news from OPEC+ the week prior.

There have recently been many skeptics about the long-term tanker market as we saw some decline in the CPP spot market and fear of lacking oil/products demand, but our view remains unaltered, and we have great expectations for the upcoming winter season.

DPP Market

We are approaching the most bullish season of the year and we expect this year’s season to show its hand early. After the dampening news of OPEC+ cuts the week prior the VLCC market got a nice little boost this week with stronger rates going from AG to the Far East and the continuation of a strong USG market where fixtures at plus $10mil are still getting done for Far East deliveries. While the VLCC’s did not have a great week in WAF, it was quite the opposite for Suezmax’s as rates climbed steadily throughout the week. In the East, things were a bit slower but still, Owners’ ideas remain firm and the sentiment is good.

The Aframax Owners had a great week with the fast-moving market in the MED as rates soared, similarly in the North Sea, we saw great improvements as the tonnage list was very thin.

CPP Market

The product Owners are kicking back. After a few weeks of falling rates from a previous firm LR market, Owners put their heads together and cut the tonnage supply short pumping up rates in a real monopoly fashion. The MRs also had a great week with new cargoes coming to the market creating a strong sentiment in the market. In the west, the tonnage list shortened noticeably which helped push rates higher, in East the market started slow but with fresh Chinese export cargoes arriving, the market quickly picked up towards the end of the week.

Period Market

We did not record much activity on the period side this week as recent news from the OPEC+ cartel might have scared long-period charterers as to how sustainable the market will be a year from now. However, news comes and goes, and we feel this one will be easily forgotten if rates remain steady and healthy.

Second-hand market

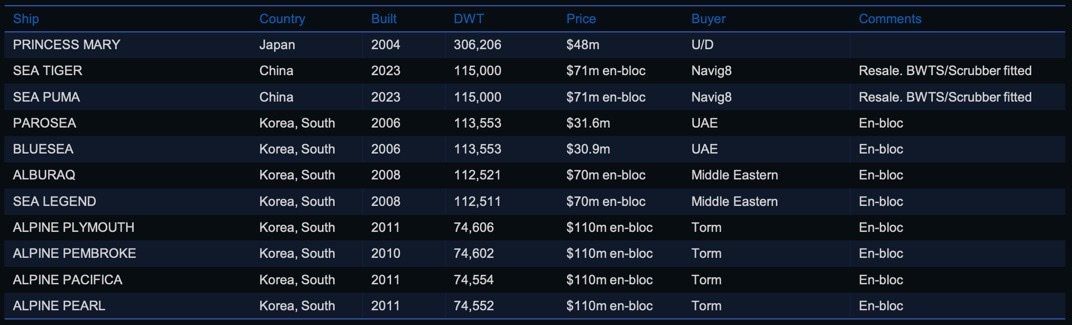

The second-hand market continues to be very much active with benchmarks increasing by the day. This week we saw a handful of transactions concluded and negotiations taking place reflecting the current state of the market with Buyers outbidding each other to secure tonnage promptly for further trading. We have aligned benchmarks this week with what we understand is under negotiation and last done to align with the market.

List of highlighted transactions this week:

Newbuilding market

A very quiet newbuilding market this week with very little activity compared to the last few weeks. In terms of new contracts, the only reported newbuildings were from Fairfield-Maxwell (Fairfield Chemical Carriers) who declared an option for two 26,300 DWT STST Chemical Tankers from Fukuoka Shipbuilding with scheduled delivery in 2024.

In terms of prices for newbuildings we are seeing a slight increase in some segments due to limited yard availability, increasing labor costs as well as parts. We have throughout the past couple of weeks seen more owners contracting newbuildings rather than buying expensive eco tonnage from the second-hand market.

Recycling market

Not much to see here. The recycling market continues to be inactive with multiple factors playing in resulting in very limited amount of tonnage being sold for recycling or to cash buyers. The ongoing Letter of Credit issues have still not been resolved and only a very limited number of recyclers can offer to open Letter of Credits making it more difficult for end users to attract interest and vessels to their empty yards. The rates remain stable across the board this week with no major changes and seem like everyone is waiting for a solution to solve the ongoing issues but nobody knows what and when.

There were no reported tankers sold for recycling this week.

Crude oil market

The news of OPEC+ cuts last week is still creating havoc this week as the decision might lead to a supply deficit in the foreseeable future. As we continue to see oil inventories decline and the global energy crisis affecting regular households and businesses even more. The production cuts which OPEC+ announced last week of 2 million barrels per day will more likely be around 1 to 1.1 million barrels per day nonetheless still having a significant effect on indices, rates, and the short-term outlook as owners are fearing that the current market conditions will withdraw and ultimately affect the earnings. The U.S. signaled that there will be consequences for the decision made by the cartel as there is on one side energy starving Europe with limited options as JCPOA-negotiations seem to be on halt for the time being and other options seem to be failing as well. As OPEC+ was the only reliable solution to increase output and support Europe and the rest of the world in keeping oil prices down to a stable level, officials from the U.S. and European countries accused the cartel of economic greed rather than supporting diplomatic ties. Shortly after the announcement of OPEC+ and reactions from Biden the Kingdom released a press release calling the decision to be purely based on an economic standpoint and no politics were involved. Whether we are going to see less support for the cartel from the West we do not know yet, but the ties between the cartel and the West have been damaged in times when energy security is more important than ever. Time will tell.

OX-Global Shipping Indices

The OX-Global WET12 index finally bounced back this week and saw an increase of 11.51% or 22.17 points settling at $214.78. The increase comes after enhanced optimism and buyback programs especially seen by $STNG. Everyone knows that the tanker market (both crude and product) is blasting its way through the market with elevated earnings and expected profits to exceed expectations. As we have entered the last quarter of the month which usually is the peak season for tankers we can only wait for further news and insight from the listed companies.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.