I guess I should have been more specific about who was in charge of the markets while I went on vacation. Because, whoever took over things in my absence did a terrible job!

Right before heading to Portugal, TW was up over 10% in September and the markets overall were in higher territory. While I was drinking port and eating seafood in the northern part of the country, stocks reversed dramatically with TW closing the month down 5% while the S&P 500 and Russell 2000 suffered bigger hits of -9% and -10% respectively. It turned ugly quickly.

This performance, however, shouldn’t have come as a surprise to my readers. As I said on Sept. 3rd in my piece titled, “Don’t Fight the Fed“…

Make no mistake about it, the overall market is likely heading lower for the foreseeable future. However, I am sticking with the belief that most of my universe hit sustainable lows earlier this year, I think the larger stocks are vulnerable to retest lows and I’d stick with the cautious investment approach I’ve been recommending for over a year.

I’m sticking with my belief that stocks will trend downwards for the rest of 2022. Until inflation is under control, and that could be a LONG time from now, making money in the market is going to be extremely tough.

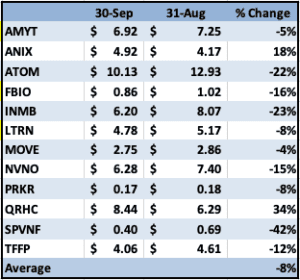

September is a good example of how tough it is to make money right now. Despite cheap valuations and solid business progress in many of the companies in our portfolio, only two traded higher on the month. Anixa ($ANIX) and Quest Resource Holding ($QRHC) were up 18% and 34% respectively in September and are well positioned to continue their march…more on them below.

Here’s how the whole TW universe did last month.

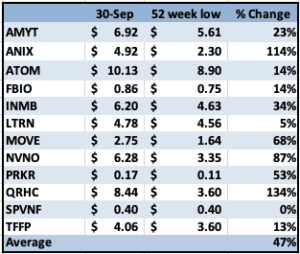

With an overall performance of -8%, TW’s stocks as a group outperformed the market. This is the third month in a row in which this took place. As I mentioned earlier in the year (and reiterated in that Sept. 3rd quote), while I don’t like the market, I think the lows are in place for the TW universe. While only time will tell if that statement is true, the numbers show that our stocks in general remain well off their lows. Here’s how they all look relative to 52 week lows.

The average TW stock is up 47% from the lows set earlier this year. This has enabled TW’s portfolio to recoup the vast majority of its underperformance relative to the overall market, now only 3% below the indexes. I continue to think that we’ll be ahead of the market by year end with the combination of positive developments in the portfolio and strong catalysts enabling continued outperformance.

The two stocks that were up in September deserve a little more attention. Let’s start with $QRHC as, with a 34% return, this company is seriously bucking the market’s trend.

I’ve been very positive on Quest for quite a while, but turned more so this year despite my concerns about the market. In a note to premium subscribers in February, this is what I said about Quest…

Quest has been and currently is the best positioned stock in our universe for the current market. We are in the midst of a strong economy and the reopening of America. At the same time, inflation is running hot. All of this plays straight into Quest’s hands.

I believe that QRHC is just becoming discovered by the market and is now hitting critical mass that will put them in the sights of larger companies looking to expand ESG compliant offerings. With the winds in their sails, QRHC is still a strong buy at these levels and I expect this stock hits double digits at a minimum here in 2022. I believe I’ll double my money from here over the next 18-24 months in what is a relatively low risk (for micro-cap) stock.

At that time, Quest was trading around $7, a level from which it traded down with the overall market for several months. I’m nothing if not early.

Now, however, the street is catching on to what I’ve been saying for many months. Quest is a well positioned company not only in terms of the underlying business trends but their ability to benefit from inflation in how they structure contracts. If you are going to own an economically sensitive stock, this is certainly one of the best ones out there.

Meanwhile, biotechs tend to be smacked pretty hard in times of rising interest rates yet $ANIX is up 66% on the year. What gives?

Quite simply, this company is firing on all cylinders. In fact, despite the recent gains, if Anixa’s programs continue to show excellent clinical results, this stock is poised to have massive performance through the end of the year.

This past week saw the Company’s solid tumor CAR-T presented at the American Association of Cancer Research’s 14th Biennial Ovarian Cancer Symposium. With the caveat (and, to be clear, it’s a fairly big caveat) that this data was only on their first patient, what they presented is truly astounding.

Solid tumor CAR-T treatments have universally failed. This is generally due to lack of a qualified target for the treatment. They have, in many cases, attacked the tumors well but the off-target effects can kill a patient. What good is treating the tumor if you also trash the heart, kidneys, liver, etc.?

In Anixa’s case, the safety profile of the drug is excellent. The patient, who was nearing death as other treatments had failed, is doing great. They are eating better and walking around, enjoying life. Most importantly, their lesions, which had been growing rapidly, have stopped their growth! This is in a sub-therapeutic dose, which the first patient always receives. It’s truly amazing!

About 3 years ago, CAR-T treatments were all the rage in the market and companies like KITE and JUNO got acquired for many billions of dollars. These companies were in the crowded space of liquid tumors, yet valuations were eye-popping. For Anixa, they are in the much larger space of solid tumors and, as of now, they are the only company that has shown this level of success. While CAR-T is not as exciting as it once was, if Anixa continues to demonstrate a potentially successful therapy, they should rapidly approach billions in market valuation.

On top of this, the Company also has their breast cancer vaccine that is working great in early trials and should be putting out data sometime in Q4. This program is also a potential blockbuster for the company. And, the combination of two programs both generating very positive data, with more to come this year, makes Anixa an incredibly compelling stock entering Q4, regardless of the market.

A couple random thoughts.

I spent two days in Montreal with CJ Barnum of INmune Bio ($INMB). CJ’s knowledge of the industry is impressive. Even more impressive is his understanding of XPro and how it impacts users. The confidence he has in this drug is off the charts and its inevitable success seems predestined in my mind after our time together.

TFF Pharma ($TFFP) was down on Friday after a board member resigned and sold his 40,000 share position. While this is not good news, it’s not really meaningful at all in my opinion. Randy Thurman was a small holder and is basically stepping back from commitments as he focuses more on his grandkids and charitable endeavors and less on business. If nothing else, probably a buying opportunity, his selling.

Here’s a video from a large Quest Resource Holding ($QRHC) holder. Well worth a look if you aren’t up to speed on why this is a timely and compelling investment.

A name from the past, Harrow ($HROW) got an approval from the FDA this past week and the stock has been very strong. Nice to see a stock working even if it’s not a name here anymore.

If you noticed that TW’s performance is different than the average stock in our universe, this is a reminder that the performance published is based on our managed accounts, which holdings are all in the universe but the individual position sizes are wildly varied.

If you want to know what stocks are owned or in what quantity, premium membership is for you. This also comes with access to all Zoom calls and the TW chat room.

I got my start in the market working on the Boston Stock Exchange in the summer of 1987. That summer turned into a crash in the fall, with my boss calling me at school to come work part time due to the overwhelming market conditions. It was certainly an interesting time to get your feet wet in the market.

Most people think of October as a very bad month as that is where a couple of crashes, including 1987, occurred. The truth is different however. September is traditionally a very weak month and, in the crash years, October started poorly with a major downdraft but ended being a reversal month.

Are we setting up for that this October? It certainly feels like a pressure point is going to be hit soon. In Britain, the s*** seems to have hit the fan recently. Investors are flocking to the dollar which is helping the US out a lot in the near-term but increases pressure globally for many assets. Meanwhile, inflation is a real bugaboo and rates are going to remain in an upward movement for the foreseeable future.

I have been thinking that we will get another “taper tantrum” sometime soon. It really feels like that will happen. Earlier this year I wrote that the true lows won’t be in place in the bear market until the VIX spikes over $40. That lack of a climactic selloff was what convinced me we were in a bear market rally over the summer.

So, watch the VIX. If it does spike, that’s when the market will hit lows and the water will be safe to swim in again. Until then, tread cautiously overall in your investing.

Entering Q4, it’s time for an update on the whole TW universe. There will also be some changes in the universe as I’ve got several stocks I have followed but not owned for quite a while now. I’m not going to keep them on the list if I’m not likely to buy them again. This will also free up bandwidth to bring on new names soon, which is something I’ve not done for a while.

So, here’s brief thoughts on every company along with the ones falling out of the TW universe.

Amryt ($AMYT): I like the team and the valuation here but, with the market so low, I want names that have greater upside potential so Amryt is not going to be covered any more.

Anixa ($ANIX): to reiterate the prior comments, I’m expecting positive data from both their lead programs in Q4 and think this stock is poised for a big move higher.

Atomera ($ATOM): someone told me recently that my comments were so positive on ATOM that it justifies a higher weighting in the portfolio. My response was that, I love the stock but, until they announce a deal, nothing happens…and we have zero visibility into when that will take place. So, I remain very optimistic but not aggressive here.

Fortress Bio ($FBIO): having not had a position in here for well over a year, I’m removing this from coverage.

INmune Bio ($INMB): I expect to see some positive developments from INKmune (data from compassionate use patient in particular) in Q4, but the reality is INmune stock is in the penalty box until the FDA greenlights their AD trial. This could happen any day now, or sometime in early 2023. Only the blackbox that is the FDA knows when this will happen. When the FDA gives them the go-ahead, I expect to see INmune stock do very well and I remain positioned for this event as I’m willing to wait for it rather than risk missing it.

Lantern Pharma ($LTRN): Lantern has a brilliant CEO, strong balance sheet and a solid pipeline. It’s also too early stage to entice investors at this time. Love the company long term but, while there are catalysts coming, the stock likely stays moribund until the market improves.

Movano ($MOVE): Q4 could be a very big quarter for Movano as they should be reporting data from trials on glucose monitoring. My due diligence leads me to think they will have positive results and this stock should do quite well in that case.

enVVeno ($NVNO): while the stock didn’t do much on the new product announcement, I’m more encouraged than ever. The VenoValve trial is progressing nicely and the new product greatly expands the market potential. Valuation remains incredibly reasonable and I’m more than content to wait for the market to awaken to the potential here.

Parkervision ($PRKR): we await the Intel trial next year. I’m optimistic but the stock likely sits until we get closer.

Quest Resource Holding ($QRHC): Q3 earnings will likely cause the street to raise forecasts again. Plus, it’s been a while, so maybe another acquisition comes soon? As discussed above, best positioned stock in my universe for the current market environment.

Spectra7 ($SPVNF): with the debt issue behind them, Spectra7 still needs to see their business return to rapid growth. In a “show-me” market, they have yet to do so. When that finally happens, this stock is very cheap.

TFF Pharma ($TFFP): this is without a doubt the most confounding and controversial name in my coverage universe. Everyone loves the technology and the pipeline remains robust. At the same time, the company has yet to get a significant deal over the goal line. We have VORI and TAC data coming up soon. This should be positive and the valuation based on these two programs alone is reasonable. We also have the long-awaited UNION decision likely coming in October. That appears to be more of a toss-up than anyone could ever have imagined a few months ago. TFF stock will likely trade with the general market until we see a deal inked. The valuation is crazy cheap…The promises continually pushed out. Will Q4 be when the worm turns here? Dang I certainly hope so.

If you go to Portugal make sure to visit the city of Porto. Definitely a highlight of the trip.

TW Research’s Disclaimers & Disclosures: TW Research may have been compensated for writing this article. For a full list of disclaimers and disclosures, please visit http://tailwindsresearch.com/disclaimer/.