General

It seems like vacation is over as the market gets busier again.

On the spot market, product tankers are aiming higher than ever with LRs having another good week and MR’s made a swift return in the middle eastern market. The crude tankers did not have as much excitement as inquiries were lower than usual, however, spirits remain high and fundamentals are good, and if the market still follows trends, then earning season is just around the corner.

Chartering and Spot market

VLCC: A quiet week for the VLCC’s which inevitably caused rates to drop as charterers made sure to take advantage. Overall, the market is still nicely above break-even now, which was a milestone looking only a couple of months back.

SUEZMAX: Suezmax’s were similarly down a bit this week due to slow activity, especially in WAF where we saw the more significant drop. In the AG we still see some healthy activity with a couple of westbound voyages keeping rates at ease.

There has been some chatter about the Forcados terminal reopening in Nigeria, and if the rumors were to come true, it would most likely kick some life back into the WAF.

AFRAMAX: The Aframax market was about stable this week, however, it does feel like a storm is coming unless we see some fresh inquiries in the market. North sea and baltic were looking more dull than usual which charterers could take advantage of in the week to come unless we see some thinning in the tonnage list.

LR: The LR2’s had a fantastic run last week, and it was almost impossible for some of that to not get carried on to this week. We saw on some routes from MEG to UKC, that LR2 Owners were making close to $80k pd, however, earlier in the week, it seemed that this number could easily have been higher, had the Owners played the game right. LR1’s are running on the heels of the bigger sister trying to catch on to the gains, and they seem to be doing a good job. With a wave of westbound cargoes adding to the market, LR1 managed to see some nice rate increases.

MR: The market East of Suez surprisingly outperformed the market to the west, especially the UKC MR’s. A batch of fresh cargoes was added to the AG market, making an instant impact on rates and quickly the Singapore MR’s caught on to the news which made a few ballaster go west, and simultaneously the Singapore market improved as the list was thinning.

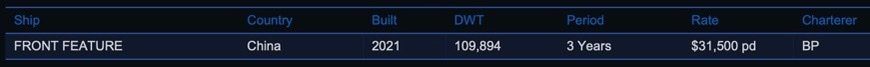

Period market

There was not much to report on the period front this week as only a couple of fixtures were reported, and mainly rumors. On the spot product market, we saw a lot of moments this week, which also forces Owners and charterers to evaluate their ideas on what should be obtainable.

List of highlighted fixtures this week:

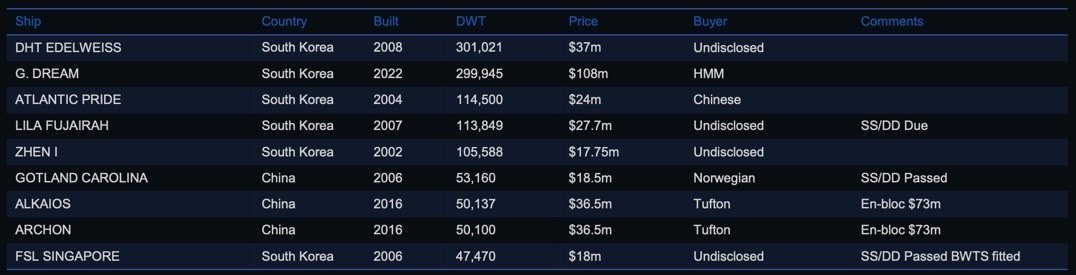

Second-hand market

The second-hand market was in particular buys this week as we saw a large number of transactions getting reported and overall, it looks like vacation time is over!

Price levels for younger tonnage are increasing while it’s fairly stable on the more vintage side of the table.

List of highlighted transactions this week:

Newbuilding market

September started slowly with no recorded activity in the tanker newbuilding market. However, we see more owners considering contracting newbuildings rather than buying second-hand as the optimism for a tanker super-cycle continues to push asset prices upwards, forcing owners to evaluate whether newbuildings would be a better call.

While asset prices are being affected by the increasing optimism and in particular the spot markets, the tanker newbuilding prices are also keeping up and are expected to increase even further during September and Q4.

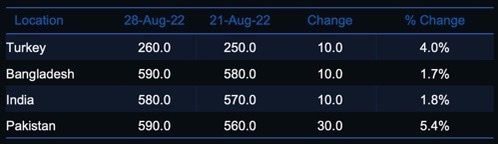

Recycling market

While the dry bulk market is in free fall and owners barely breaking even on the bigger segments, it looks different within tankers as the optimism persist and very few owners consider recycling. Even though rates increased this week it is still very unlikely that we are going to see many tankers being beached.

The Letter of Credit issue in Pakistan and Bangladesh continues to create havoc, but is expected to be sorted within long with yards being able to beach larger vessels – however, we should not expect any larger tankers to be sent to the beaches any time soon.

There was 1 reported MR2 tanker sold for recycling:

‘STOLT GROENLAND’ (Ukrainian 2009 Built, 12,154 LDT) was sold in South Korea on ‘as is’ basis.

Crude oil market

While the war in Ukraine has resulted in heavy sanctions on Russia’s energy sector, the country continues to bank record profits and exceed expectations for production and export due to a shift in end buyers from Europe to mainly China and India. Russia exported just under 160 million barrels in August via tankers owned mainly by Greek owners and found its way to the sub-continent and the Far East.

The JCPOA negotiations seem to be standing still as Washington and Tehran can’t agree to the last few remaining issues – even after Europe and Josep Borrel stated that the demands from Iran seemed reachable and fair. While the U.S. and Iran continue to negotiate and reach an agreement, it is clear that the most exposed party is Europe as winter is closing in and the risk of oil and gas deficit seems more realistic than ever resulting in European countries ‘ration’ energy consumption ahead of the winter.

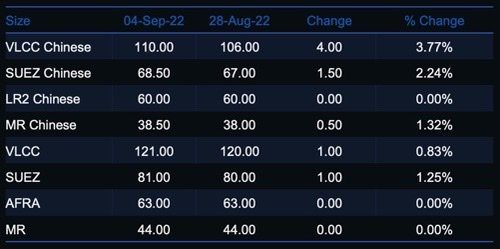

OX-Global Shipping Indices

The OX-Global WET12 index increased 2.93% this week or 5.46 points. The Index bounced back to +$190 after the first decrease w-o-w in 2 months last week. being the first weekly decline in over 2 months.

With both the product and crude market reaching historical levels and continuing to boost the optimism amongst owners – we also continue to see more capital flowing into listed tanker companies suggesting that investors are pulling capital out of dry bulk and container stocks and placing their bets in tankers as the next. For comparison, the CON12 index is now below the inception level and the DRY12 is at a 39% increase since inception while the WET12 index is at 91% increase since inception.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.