General

Winter came early and VLCCs are turning up for the heat, finally. We saw quite a jump on some of the significant lanes in the VLCC segment and it more or less reflected all across the dirty tanker segments. If we look at the product tankers, things were a bit cloudier, and MRs came out as the big loser of the week. If not much change in the spot market on the product tanker side, we would not be surprised if we started to see a general slowdown in terms of second-hand transactions and period fixtures.

Chartering and Spot market

VLCC: Crude is pushing ahead as VLCC rates climb fast this week. We are now starting to see the earnings that we have been hoping for, for a long time. Most noticeable is USG/East which went up over $2mill this past week and is now over $9mill.

SUEZMAX: The Suezmax’s are trying to ride on the VLCC wave and we have seen some improvements here as well. In general, it seems there has been a strong momentum push in the dirty tanker segment and our midterm outlook for the Suezmax’s remain positive.

AFRAMAX: Aframax’s also improved slightly this week. The USG remains strong while the north sea is down a bit and cross-MED is slightly up. Overall, we expect to see a few more vessels head across the Atlantic to even out the USG and European markets.

LRs: The LR segments were up and down this week as LR2s slipped a bit and then quickly tried to return to previous rates, but with few fresh cargoes coming to the market, it’s hard for Owners to hold on to previous levels. LR1 was a bit more positive as a few more cargoes entered the market, but not enough to push rates much higher.

MRs: The MRs in the Far East saw a general slowdown as the North Asian market looked rather dull, but not much change to rates. West of Suez the story is not much better as UKC took a nosedive, TC2 saw a decline in the range of 30% w-o-w.

Period market

We adjusted our MR time charter benchmark rates down this week, as we saw a few new fixtures that pushed us in that direction. On the dirty tanker side, it seems that things are starting to shape up in the spot market, but we are waiting for a few period fixtures to come in and we need to see if the spot market has legs before we will adjust our benchmark noticeably.

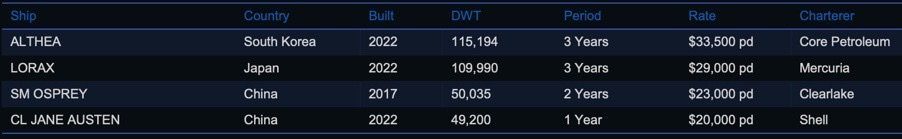

List of highlighted fixtures this week:

Second-hand market

Probably one of the most stable weeks we have had within the secondhand market this year, as few transactions were recorded really, but also, we did not see much change in prices w-o-w and the transactions that were confirmed, were much in line with last done.

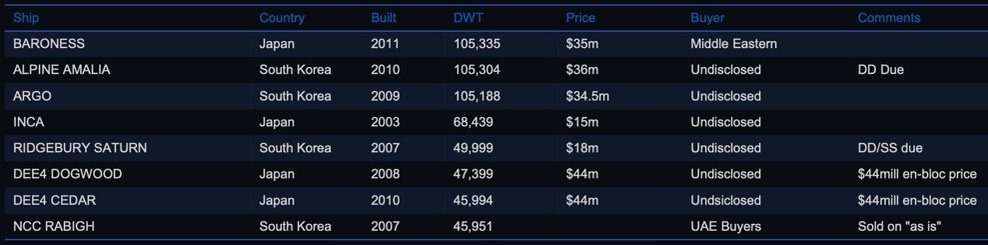

List of highlighted transactions this week:

Newbuilding market

Once again, some modest tanker newbuilding activity was recorded this week with Furetank and Algoma’s joint venture company FureBear ordering two firm LNG dual fuel propulsion and ICE Class 1A 18,000 DWT Chemical Tankers at CMJL Yangzhou which are scheduled for delivery in 2024 and 2025.

In the past couple of weeks, we have recorded to some extent increased interest in newbuilding rather than second-hand tonnage due to the increased asset prices and continued optimism amongst owners, not letting go of their vessels cheaply, which has resulted in increased investments in newbuilding programs.

Recycling market

While the financial situation in Bangladesh and Pakistan is creating havoc for larger vessels luckily not much activity has been seen which suggests that owners are holding on to their vessels for now and waiting for stabilized terms.

India remains the only hub being able to take tonnage for prompt delivery, leaving Pakistan and Bangladesh in the dust forcing both hubs to increase prices which we saw during this week.

Turkey increased to $260 per ldt being up 4% w-o-w while Pakistan increased to $580 per ldt matching Bangladesh and increased 3.6% w-o-w. India remained stable this week with no changes and settled at $570 per ldt.

There were finally some benchmarks this week with a total of 3 tankers being recycled.

LUX’ (Japanese 1994 built, 3,348.3 LDT) was sold and delivered in Bangladesh. ‘NEW SMILE’ (Singaporean 1995 built, 2,227 LDT) was sold and delivered in Bangladesh. ‘XING TONG YOU 59’ (Chinese 2003 built, 2,100 LDT) was sold ‘as-is’ in Vietnam.

Crude oil market

WTI Crude 89.70 -1.07 (-1.18%)

Brent Crude 95.36 -1.36 (-1.41%)

OX-Global Shipping Indices

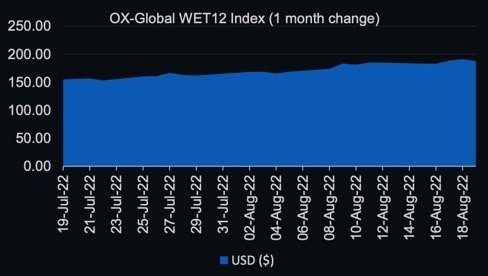

Another week with further increase in the OX-Global WET12 index. The Index rose to an all-time high and touched $191.09 on Thursday before settling at $187.71 on Friday. The index rose 2.41% w-o-w and is currently the best performing index throughout the OX-Global Shipping Index family with an increase of approximately 87% since inception.

With increasing optimism and listed tanker companies rallying (both product and crude) we continue to see capital being diverted from container and dry bulk into tankers with a promising outlook of increased earnings and dividend payouts.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.