General:

Owners’ confidence seems to be paying off on the period business and of course, it’s supported by a spot market that keeps on performing, especially on the product tanker side, while on the dirty tanker side Owners had to put up more of a fight to keep rates stable this week.

Looking forward, we are excited for the tanker market as we approach the autumn/winter and expect it to be the time for dirty tankers. With oil prices getting more comfortable under $100/barrel we also expect a natural increase in imports from countries who have been tapping from their inventories.

Chartering and Spot market

VLCC: The VLCC market is looking steady, and demand seems to be increasing. The AG is busy this week, while WAF is a little bit quieter than the week before. USG/UKC also increased a bit this week and we expect to see further increases on this lane in the near term.

SUEZMAX: The SUEZMAX segment is looking softer this week as both the AG and WAF is down, and it looks like the softening might extend into the coming week.

AFRAMAX: Activity in the MED was softer throughout the week forcing rates to feel a bit of pressure and a few ships to ballast to the USG for better returns. The North Sea looks somewhat similar to the week before.

LRs: LR2 Owners managed to keep rates at steady levels even though cargo volumes are down. On LR1 charterers, on the other hand, managed to keep rates steady as cargo volumes seem plenty and we are likely to see increases in the coming week.

MRs: The MRs are looking a bit better in the East this week after a period where rates were pressured a bit, especially in Singapore. In the West, the tide is slowly turning as the USG has been filled with sufficient tonnage and we now see a few ships heading toward Europe while the USG rates are correcting downwards.

Period market

The period business is looking firmer and seems to be breaking away from its parallel to the spot market almost, the confidence amongst Owners is clearly reflected in period rates, and it accounts for both dirty and clean tankers. We saw a few Afra fixtures at excess $30k/day from major traders, which shows profound confidence in this segment.

List of highlighted fixtures this week:

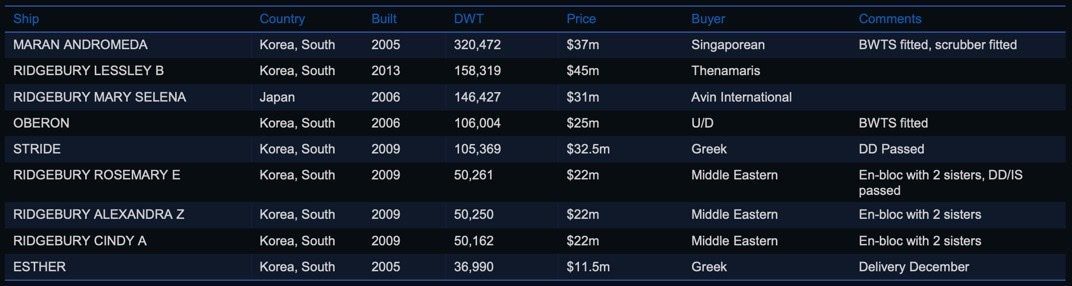

Second-hand market

A few regular weekly increases in both dirty and product tankers, but in general the market is getting more stable, and feel that we are seeing more sales at repeat levels, which could suggest that even though buyers are optimistic, they manage to keep asset prices stable for the time being.

List of highlighted transactions this week:

Newbuilding market

The focus was on smaller tankers this week with Singfar International ordering five firm 7,000 DWT LNG dual-fuel propulsion bunkering tankers at Lianyungang Shenghua which are scheduled for delivery in 2023. The agreement also includes five optional 7,000 DWT bunkering tankers.

Furthermore, it was confirmed that SC Shipping placed an order for two 11,300 DWT chemical tankers at Chongqing Chuandong which are scheduled for delivery in 2024.

The increase in orders over the past week comes after rising asset prices and a stronger belief that both product and crude markets will continue to be at elevated levels which could suggest that asset prices will increase even further, pushing owners to bet on newbuildings rather than modern tonnage. The market is already scarce for modern tonnage which could mean that we will see more newbuilding orders piling up in Q3 and Q4 2022.

Recycling market

Another week with mixed market sentiment and no recycling deals in the tanker segment to give us a better feeling as to where the true market is and to have a concrete benchmark shedding light on the current state of the market. There are a couple of factors affecting the market making it unclear to both Sellers, cash-buyers, and yards and the current ongoing LoC restrictions in Bangladesh and Pakistan aren’t making it easier for market participants to engage leaving India as the only hub able to recycle larger tonnage in the sub-continent.

The rates this week took a jump with Pakistan increasing a mere 1.8% settling at $560 per ldt, while India settled at $570 per ldt and increased 2.7% w-o-w. Bangladesh settled at $580 per ldt being the highest payer due to the complications of the Letter of Credits. Turkey settled at $250 per ldt and increased 4.2% w-o-w.

While we are still waiting for new benchmarks to give us a better understanding of the actual market conditions, we don’t anticipate seeing much activity throughout August due to the holiday season and generally less activity in August.

No recycling deals were reported this week.

Crude oil market

WTI Crude 88.83 -3.26 (-3.54%)

Brent Crude 94.88 -3.27 (-3.33%)

OX-Global Shipping Indices

The OX-Global WET12 index continues to increase amidst a general optimism amongst investors that crude and product markets will continue to increase leaving the listed companies with elevated profits and increased dividend payouts, which are considered a bullish sentiment that the listed tanker companies are doing well, and they too are optimistic about the short to mid-term outlook.

The index settled at $185.11 this week being up 6.4% and leaving the container and dry bulk index in the dust.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.