General:

There has been little excitement in the tanker market over the last few weeks, including this one. It indicates that the market once again has found its trend as period rates move very little, and the spot market starts to look more indistinguishable to the week before. Owners on the product tanker side continue to increase their second-hand price ideas, as some Owners might have looked back at the last month and regretted their past deals when it was not yet clear, what buyers were willing to pay.

Chartering and Spot market:

VLCC: While some might have wished for more movement in the VLCC market, this, unfortunately, was not the week. Overall, the global market was steady and followed the trend of the week before.

SUEZMAX: The Suezmax segment had a rather dull week with a poor east market and now other areas slowing down as well. The US gulf remains the core of activity right now, but who knows how long that will last if more ships reach the area.

AFRAMAX: It is a similar story for the Aframax Owners as the market moved sideways this week.

With the European Union’s final agreement in place to sanction Russian oil transported by sea (some pipeline export remain open), we await to see its impact on the market. The Owners that still dare to touch Russian cargoes will likely see more of these going to the East, but as we expect that more ships will be competing for the European cargoes, we also see a likelihood of rates getting affected negatively in the short-run.

We saw a few longer fixtures this week, but only really of crude tankers, while for product tankers we rarely see any new fixtures concluded at longer periods than a year. Mercuria was headlining the fixture list this week, with a couple of noticeable crude tanker fixures ranging from AFRAs to VLCCs.

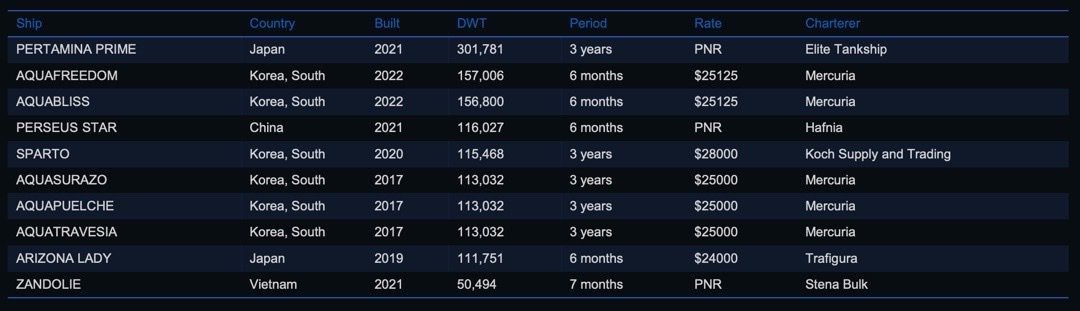

List of highlighted fixtures this week:

Second-hand market:

The increasing optimism continues to set new benchmarks at the secondhand asset prices as we see Buyers willing to pay above last done in order to secure tonnage in the upswing. The rising asset prices and general optimism are simultaneously affecting the number of candidates being placed in the market, as owners see a golden opportunity to hold tight to their vessels anticipating that even further price hikes are in reach, hoping to capitalize on the second-hand market, which is rare!

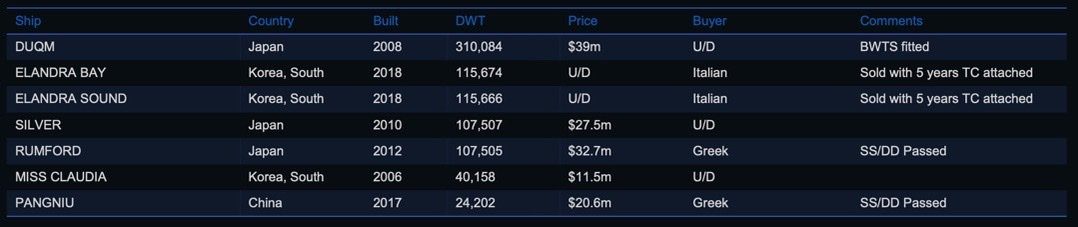

List of highlighted transactions this week:

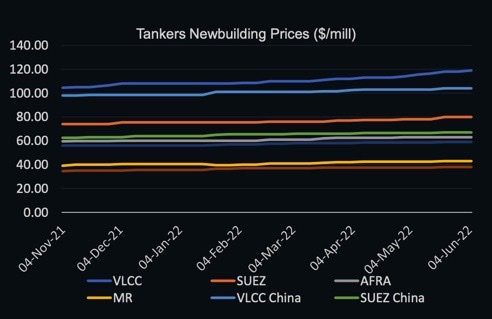

Newbuilding market:

The newbuilding market continues to be more or less the same as owners are on stand-by due to the increasing prices and look towards second-hand tonnage instead for fleet renewals. The uncertainty of the newbuilding market with regulations and price hikes has led to fewer orders being placed and less interest in contracting new vessels.

There were two newbuilding orders placed this week. SC Shipping placed two firm orders for 7200 DWT STST Chemical Tankers at Wuchang Shipbuilding with deliveries expected to be during the first half of 2024.

Recycling market:

A somehow stable week has ended with no major changes in the recycling rates across all major beaches. We continue to see weakened sentiment for owners to send their tonnage to the beach and now look towards docking vintage tonnage in order to continue trading. This week all yards maintained their rates as per last week except India which settled at $595 being down 10 dollars w-o-w or -1.7%. Turkey maintained $330/ldt as per last week and so did Bangladesh and Pakistan which settled at $610/ldt and $590/ldt respectively.

No recycling transactions were reported this week.

Crude oil market:

WTI Crude (July contract): Settled at $118.87 and saw an increase of 3.13% w-o-w. Brent Crude (July contract): Settled at $119.72 and increased 0.15% w-o-w. Oil prices continued to increase this week and topped Tuesday when Brent Crude almost hit $124 bbl after the news of the European Union banning all seaborne Russian oil which then took a deep decline afterward and hit this week’s bottom at $113.03 bbl Wednesday and corrects itself Thursday and Friday settling at almost same levels as of Monday’s opening.

The European Union leaders agreed this week, banning all seaborne oil trade which accounts for nearly 60% of all European imports while the rest comes from the Druzhba pipeline. Poland and Germany who are the two largest importers of oil via the Druzhba pipeline have also agreed to stop importing via the pipeline end of 2022, bringing the total percentage of banned Russian oil up to 90%. While a majority of European countries have agreed to stop the import, Hungary, the Czech Republic, and Slovakia have been exempted from the ban as they are heavily dependent on Russian oil.

While the ban is intended to impact Russian oil exports and cut revenues to halt financing Russia’s invasion, it seems Russia continues to export and increase earnings as oil prices continue to climb and therefore result in higher earnings. Russia’s exports are believed to be down about 4 mbd after the invasion of Ukraine, but Russia continues to be confident that they will find Buyers for their oil and shift their exports from Europe to Asia, but this might be difficult for India and China who are the top importers from the Asian market to absorb all 4 mbpd.

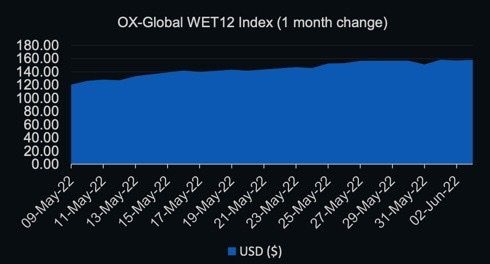

OX-Global Shipping Indices:

The OX-Global WET12 index remained fairly unchanged this week and only saw an increase of 1.23 points or 0.78% w-o-w, which is one of the lowest positive increases since Russia invaded Ukraine and can be because all Russian seaborne trade (2/3 of all Russian oil exports) have been banned by the European Union, resulting in a fleet of vessels which were involved in Russian trade now has to seek elsewhere.

The question remains as to whether the merchant tanker fleet can be deployed in an alternative trade such as Venezuelan or Iranian trade and replace the Russian trade to keep vessels employed, which seems to be one of the largest uncertainties as of now together with rising inflation and fuel prices, resulting in less demand which investors are reacting to.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.