General:

A rather stable week in the tanker market, something we haven’t seen for the past few weeks. A lot of market participants were off on holiday break for most of the week, resulting in a natural slow down. In the spot market, we did not see any major changes either.

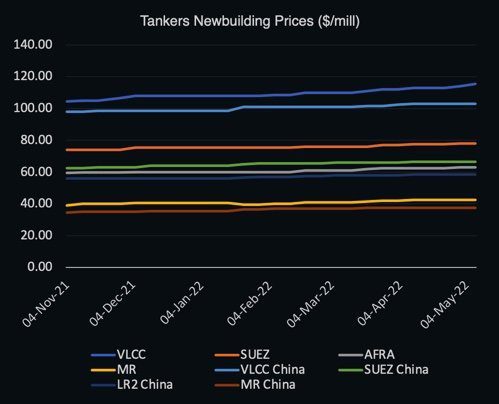

Interestingly we recorded a newbuilding order for the second week in a row, which is rare nowadays since the other segments’ buying spree, increased steel prices, equipment costs and reduced slot availability, have made it quite expensive to construct new ships, which results in strategic issues for tonnage owners.

Chartering and Spot market

VLCC: It was a rather dull week for the VLCC owners as rates continued to slide globally. The appetite for importing refined products over crude is much greater at the moment, but considering the two releases we have seen of the strategic reserves, we can imagine that this picture might change in the coming quarters, if not months.

SUEZMAX: The market is still strong enough to keep the Suezmax’s afloat, as rates were kept at relatively stable levels and demand is fairly healthy. In the AG activity was a little higher, while on the other hand, it was a slow week in the MED.

AFRAMAX: It was a bit of a slow week for Aframax Owners but rates fought to keep stable. In the MED, the week started firm but lost a little momentum throughout the week. In the North sea, we saw rates slide a bit. Given that many Owners are still willing to call Russian ports, we also see levels for Russian cargoes at the lowest since the beginning of the invasion.

LRs: The LRs are still going strong, and rates kept climbing yet another week. Globally the market is very firm and currently, LR1s are a bit more sought after.

MR: The MR market remains just as firm as the week before. At this stage, it is more a matter of keeping rates at these levels for as long as possible, and right now, there are not many signs that things will change.

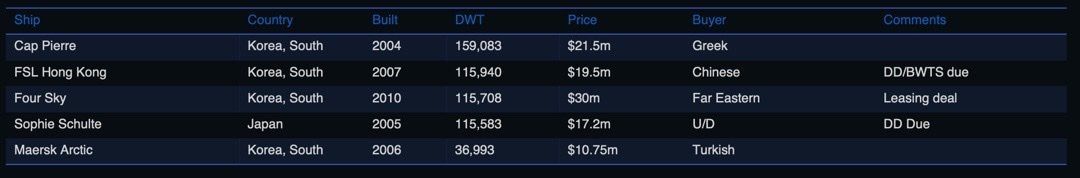

Second-hand market

The second-hand market has managed to stay impressively stable or navigable the last couple of weeks, even though the underlying spot and period markets are struggling to find solid ground.

We saw some rapid increases in product tanker prices a few weeks back when rates took off, and since the spot market has not caught a break yet, second-hand prices have started to increase a little further.

List of highlighted transactions this week:

Newbuilding market

We recorded a newbuilding order for 4 x LR2’s from Navios Maritime Partners LP at K Shipbuilding, South Korea for $62.7mill per vessel with deliveries in 2024/25. Two of the vessels with TC attached to Chevron.

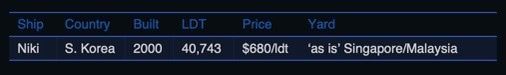

Recycling market

Not the busiest week on the recycling side, but the sales recorded did take a healthy amount of available tonnage out of the market. With declining scrap rates, more owners might just be tempted to cash in now and not wait (hope) for further improvements in the markets. The next couple of weeks could lead to a series of recycling transactions if rates continue to drop and market sentiments not improve, leaving tonnage owners in a pickle as to whether cash in while the rates continue to be elevated or risk it all for the potential upswing in the market.

List of highlighted transactions this week:

Oil and futures market

WTI Crude (June contract): Settled at $109.77 and saw an increase of 5.07% w-o-w. Brent Crude (July contract): Settled at $112.39 and increased 5.16% w-o-w.

• Declining U.S. oil inventories could halt plans to support Europe’s dependency on Russian oil

While Europe trying to free itself from Russian energy dependency and seeking alternative sources, the U.S. might just have been halted in supporting Europe further, as U.S. oil inventories have declined by around 421 million barrels which creates a problem for the Biden administration. If exporters of U.S. oil are tapping into the reserves, the increased export to Europe may be farfetched as the strategic oil reserves are low with fuel inventories being below usual levels for this time of the year.

• Oil prices continue to increase amidst Europe’s intentions of a full ban on Russian oil within 2022.

Oil prices went up another 5% this week on top of last week’s increase which can be found in the fact that Europe proposed a ban on Russian oil imports within 2022. While all EU countries have to agree on a full ban, it might not be as easy as the majority of European countries hope as more dependent countries who are more exposed are seeing difficulties in replacing the Russian oil – Hungary being one of those countries. Ursula von der Leyen admitted during a speech to the European Parliament that it won’t be easy, but they will work on it and hope to materialize an agreement within the EU to stop all imports of Russian oil within 2022.

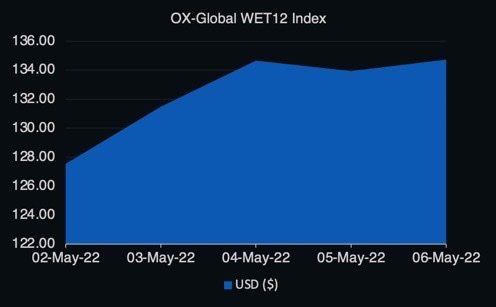

OX-Global Shipping Indices

The OX-Global WET12 index saw an increase of 7.2 points or 5.65% w-o-w.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.