General:

The tanker market is still very much split in two. The product tanker Owners are having a party that the crude Owners have been trying to join for some time now, but haven’t been able to.

After some resistance in the spot market the previous week, the crude market gave in further to the pressure this week, as rates continued to decline across the board. However, even though the market is slow and it takes quite a bit of activity to initiate a turnaround, we continue to be careful with our predictions, as the market has recently shown its ability to change drastically during the week.

On the product side, Owners continue to enjoy the current market, and rates are climbing higher than in the previous weeks.

Chartering and Spot market

VLCC: The VLCC market seemed quite dull to the naked eye this week, with further decline and a low number of fresh cargoes to bid on. However, it seems that much is fixed in the shadows, which charterers have successfully managed to keep quiet, giving a false impression on the number of fixtures done and where the actual rates should be at.

SUEZMAX: As mentioned the week before, we started to see some resistance as rates were pushed downwards again, after a few weeks of improvement. Unfortunately, the market was not strong enough to fight through this resistance and rates have continued to drop throughout this week. Nevertheless, with the current uncertainty controlling the market, it remains impossible to even predict a week ahead.

AFRAMAX: The same story goes for the Aframax Owners, where rates saw further declines this week. Especially in the Baltic and Med, we saw some significant decline in activity, forcing rates to follow the same trajectory.

LR1/2: On the product side it is a different story, as we continue to see a steep increase across the board. The LR segment has had a few slow weeks, but this week has proven as a great win for the segment. Both the East and west market/routes have firmed significantly throughout the week.

MR: The MR Owners are not complaining these days, with even more cargoes flooding an already firm market. No matter where you are located it seems that you can catch a good ride, as long as you own an MR tanker. Even though the market is as volatile as ever, it would need to be quite a significant impact to turn around this market, hence we are just as optimistic for the next week to come.

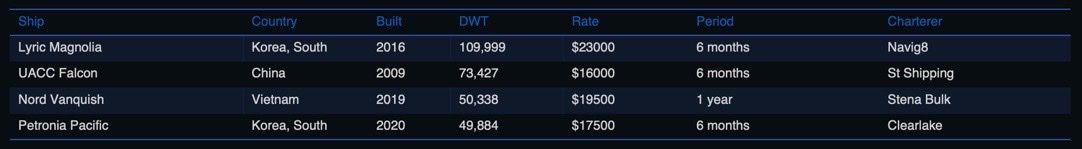

The time charter/period market rates remain relatively firm, however, the story is of course very different from Crude to product. We are seeing a crude market that remains relatively stable even though the spot market were struggling for the last two weeks. Product tanker Owners are asking for above last done for obvious reasons.

The market volatility is keeping both Owners and charterers from fixing long periods, as the longest recorded this week, was for 1 year period.

List of highlighted fixtures this week:

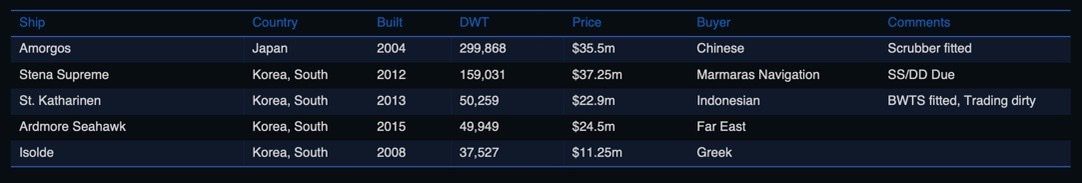

Second-hand market

The sale and purchase market is more or less stable, both in terms of transaction volume and pricing. We saw some very quick price increases on both the product and crude side as the markets improved, which seems to be the levels sellers are holding on to for now.

List of highlighted transactions this week:

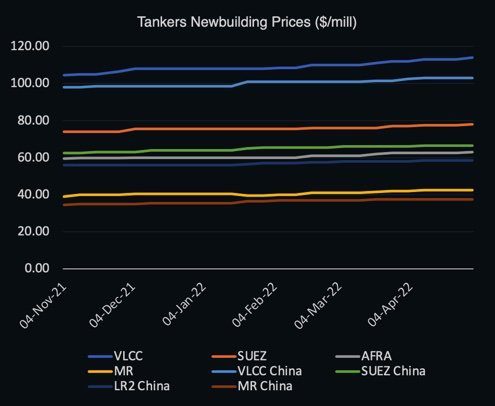

Newbuilding market

We recorded six small chemical tankers being contracted for newbuilding this week ordered at Zhejiang Friendship by Shanghai Hangzhou Shipping. The order was for 3 x 4,000 DWT, 2 x 3,5k DWT, and 1 x 3,000 DWT, IMO II chemical tankers with the delivery of all six vessels expected in 2024.

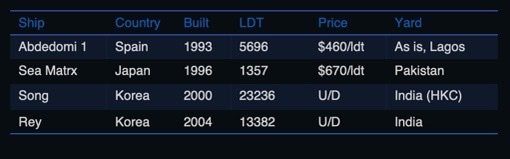

Recycling market

The recycling market is getting a bit slow as Owners keep their tonnage trading. However, we did record four tankers being sold for recycling this week, which was quite impressive, considering the last few weeks, leading to a total of 44 tankers being sold for recycling so far this year.

As written in our recycling market note (29 April), we continue to see more owners trying to convince themselves that the market is turning more profitable in the short-term outlook, which discourages many owners of vintage tonnage to sell for recycling even though the massive scrap prices. The question is whether owners of vintage vessels can stay cool and wait for more profitable market conditions or they give in and sell for recycling while the prices are elevated.

Oil and futures market

WTI Crude (June contract): Settled at $104.69 and saw an increase of 4.28% w-o-w. Brent Crude (June contract): Settled at $107.14 and increased 2.06% w-o-w.

EU increases U.S. oil import

As Europe is closing in on a full oil embargo and looks more likely, the import and purchase of U.S. oil are increasing. The U.S. being a rare Seller of large quantities of crude oil has this year so far exported at least 8 million barrels of crude oil to Europe via 4 VLCCs. In comparison, only 1 VLCC took the trip from the U.S. to Europe last year.

If the EU agrees on a full oil embargo, Russia could lose half of its revenue

As it seems right now, the European Union is discussing and planning to impose an embargo on all Russian oil, which could potentially be devastating for Russia. Russia has until now proven itself capable of redirecting exports to Asia at discounted prices of around $30 per barrel, but could soon see itself in a more difficult position, where more oil has to be redirected and even higher discounts could be a necessity ultimately resulting in a steep decline of revenue.

Small inventory build maintain prices – for now

EIA reported earlier this week a small crude oil inventory build of 700,000 barrels for the week leading up to April 22 which maintained crude prices. In comparison, there was a decline of about 8 million barrels the previous week, which pushed prices higher at the time of reporting.

OX-Global Shipping Indices

The OX-Global WET12 index saw an increase of 8.4 points or 7.08% w-o-w.

OceanEXL

Disclaimer: The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only.

No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.