General:

Coming back from easter break are hopeful Owners and operators after weeks of upward trending rates and profit-making days, but what goes up must also go down. We are starting to feel a bit of pullback in the market as activity levels have eased down and charterers have gotten more comfortable in the volatile market. Whether it is only a bit of resistance on the way up or whether the winds are changing, only time can tell, however, it would do good for the market if we saw an uptick in the coming week.

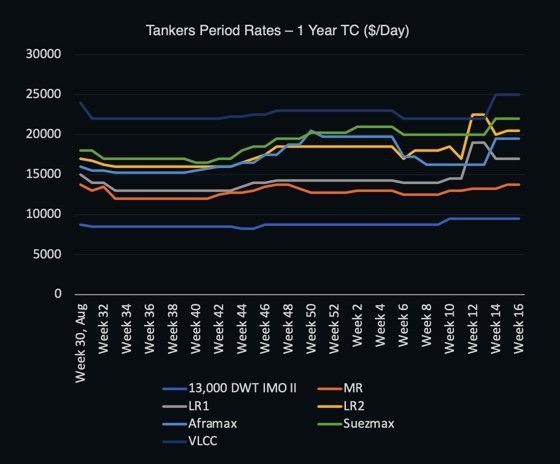

The second-hand market and period fixtures suggest that the fundamental trust in the foreseeable future remains, as buyers are still willing to close at higher prices, and the period fixtures remain relatively short.

Chartering and Spot market

The spot market remains a volatile and unpredictable territory to navigate. The crude/dirty market fell in favor of charterers this week as we saw some noticeable setbacks both in the VLCC, SUEZ, and AFRAMAX segments. As previously implied, it will be interesting to follow the fallout of the coming week, as the strength of the market will show whether the market continues to fall downwards or if it survives the resistance.

Our outlook for Q3/Q4 remains optimistic and supportive of both the product and crude market, as we believe that with the current situation and uncertainty unfolding, there will be several potential contributors to a strong tanker market.

Second-hand market

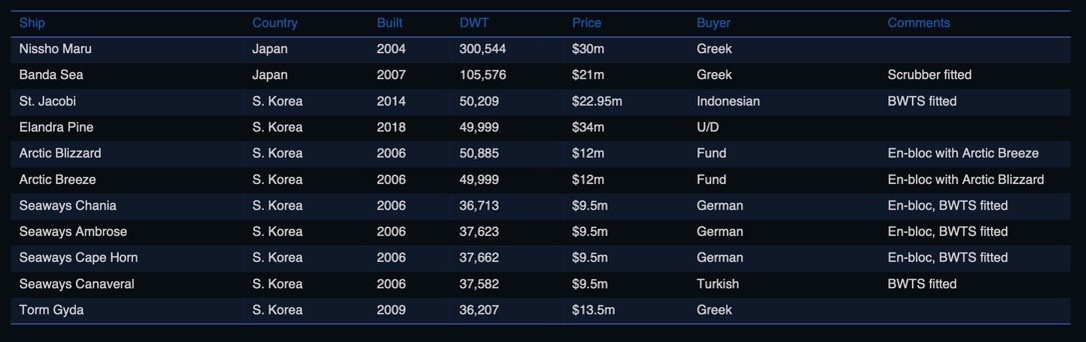

The second-hand market remains strong, and as noted in last week’s report, it seems that market participants have found common ground as recent transactions start to align with last-done levels after a few weeks of rapid increases.

List of highlighted transactions this week:

Newbuilding market

No newbuilding orders were recorded this week.

Recycling market

We were pleased to see another two units go for recycling this week, as with the recent developments, we were fearing that Owners would refrain from recycling their older units, in light of new hope.

All together we remain optimistic about the fact that the previous weeks were more active than usual. As the recycling market is a big contributor to the long-term health of the market, we are still hoping to see a few more units go for recycling while the market pays well. Recycling levels in the sub-continent are nearing $30mill for a VLCC, and only a few months ago, Sellers were concluding less than these levels on second-hand units.

Oil and futures market

WTI Crude (May contract): Settled at $102.07 and saw a decrease of 5.49% w-o-w. Brent Crude (June contract): Settled at $106.65 and decreased 5.56% w-o-w.

While energy security continues to be on top of the agenda for energy companies and states, Saudi Arabia increased their exports to average at 7.307 million barrels per day in February. Despite the recent events of sabotage in Saudi Arabia by Yemeni Houthis and the on-going geo-political issues between The Kingdom and the U.S., latest reports suggests that Saudi Arabia continues to increase output and export, raising its crude oil production by over 100,000 bpd every month under the OPEC+ deal for a total of 400,000 bpd increase from the members.

Middle Eastern producers are eying price hike opportunities as the ongoing Russo-Ukrainian war and the ban on Russian oil seems to last and fewer Buyers are being found for the Russian urals, which is now being felt in the production level of Russia. Russia’s oil production has since the beginning of the invasion of Ukraine dropped by 10% and expected to fall by 1.5 million bpd in April recent data from OilX suggests.

OX-Global Shipping Indices

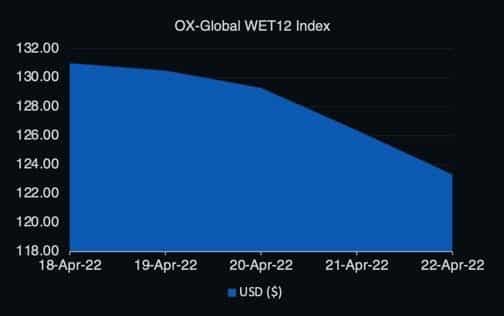

The OX-Global WET12 index saw a decrease of 7.68 points or 5.86% w-o-w.

OceanEXL

Disclaimer: The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only.

No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.