OPEC sees global oil demand growth of 1.3 million barrels per day for 2025 in the Monthly Oil Market Report for May. The demand growth forecasts are unchanged from OPECs previous MOMR, and total global demand is estimated to average 105 million barrels per day in 2025, supported by air and road travels and industrial, construction and agricultural activities in non- OECD countries.

Demand growth in OECD is expected to grow by 100 000 barrels per day in 2025, compared to 1,2 million barrels in non-OECD countries.

2026 forecasts are also unchanged from previous MOMR report with expected growth projected at 1,3 million barrels per day. OECD is expected to grow by 100 000 barrels per day, same as 2025, with non-OECD countries expecting to grow by 1,2 million barrels per day.

The IEA will release its monthly market report on Thursday with its latest estimates of supply and demand. Investornytt will keep a close watch on the new estimates and compare it to previous estimates from the agency.

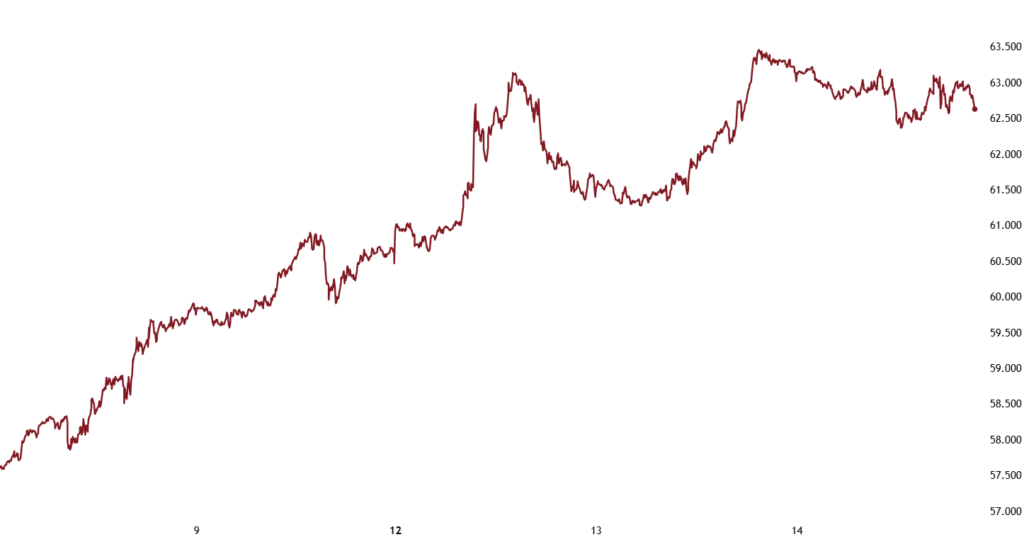

Figure 1. West Texas Intermediate the Last Five Days.

US Crude inventories and production.

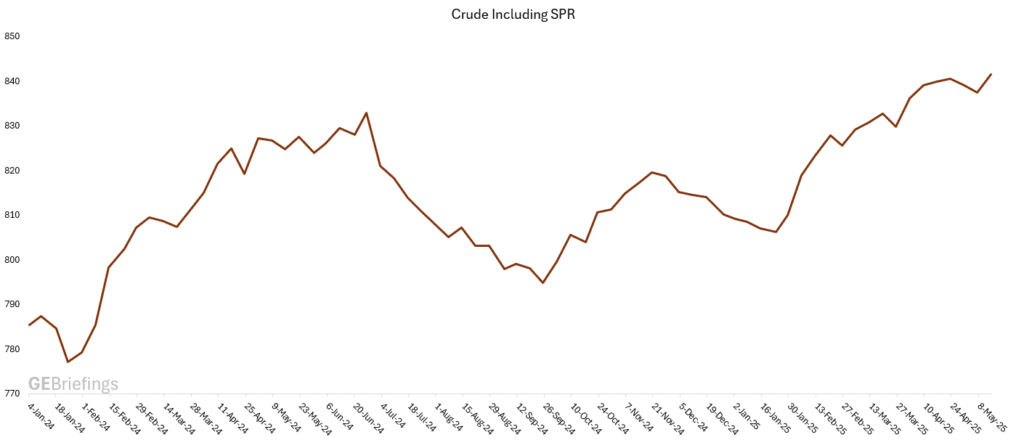

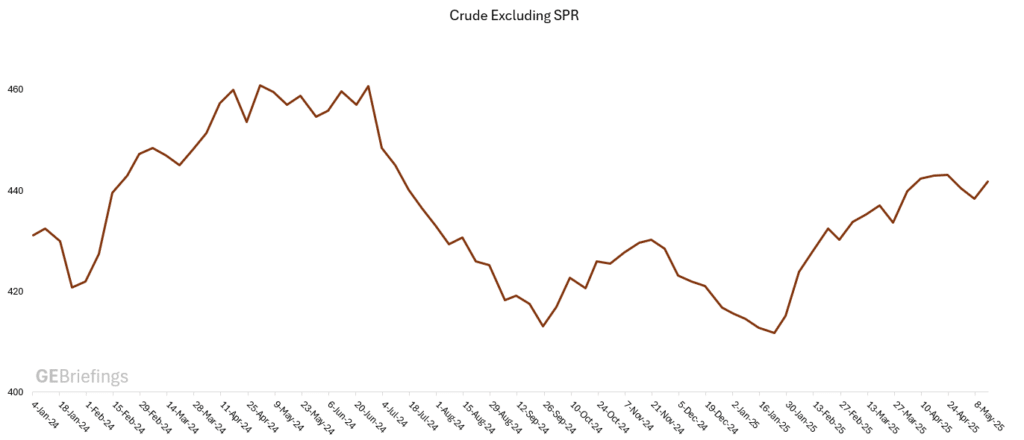

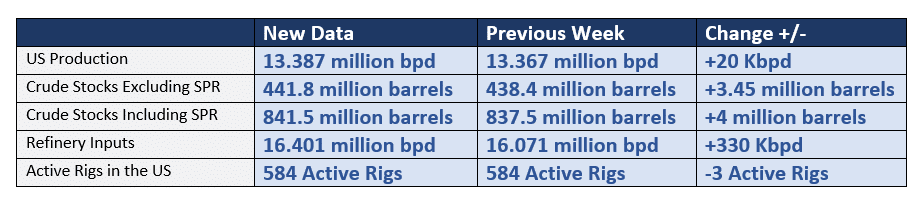

US commercial crude oil inventories increased by 3,45 million barrels in the week ending May 9, with market forecasters predicting between 2 and 2.5 million barrel-decrease in crude stocks. U.S. commercial crude oil inventories are about 6 percent below the five-year average for this time of year and 15.2 million barrels lower than a year ago. U.S. crude oil refinery inputs averaged 16.401 million barrels per day during the week ending May 9, 2025, 330 bpd higher compared to the previous week`s average. Refineries operated at 90.2 percent of their operable capacity last week.

Figure 2. US Crude Stocks including SPR at 841.5 million Barrels.

Figure 3. US Crude Stocks Excluding SPR at 441.8 million Barrels.

US Rig Activity.

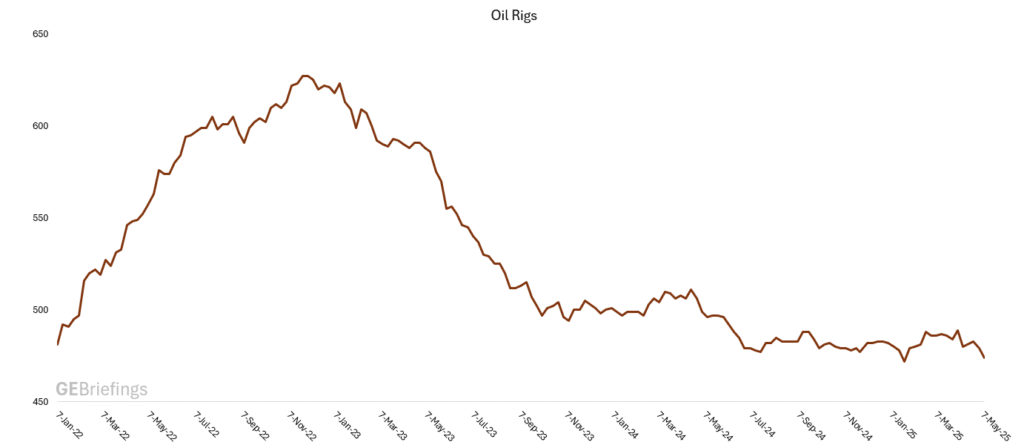

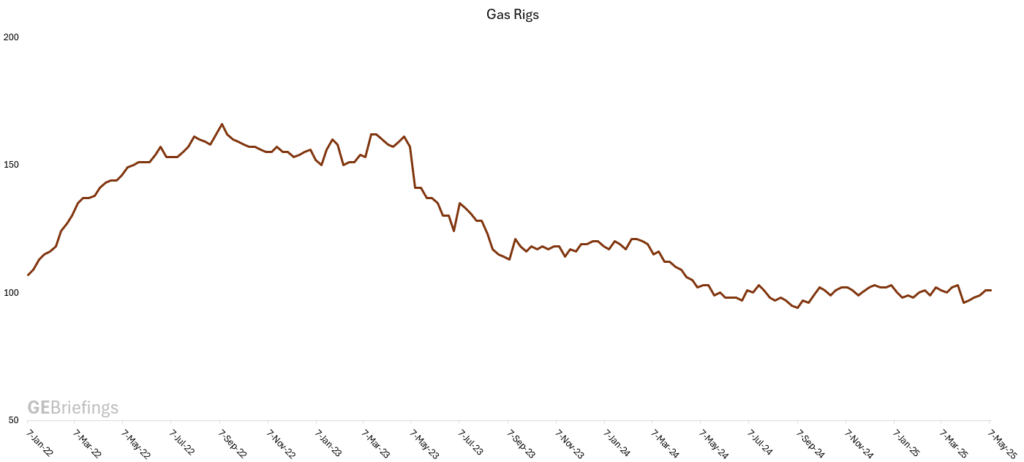

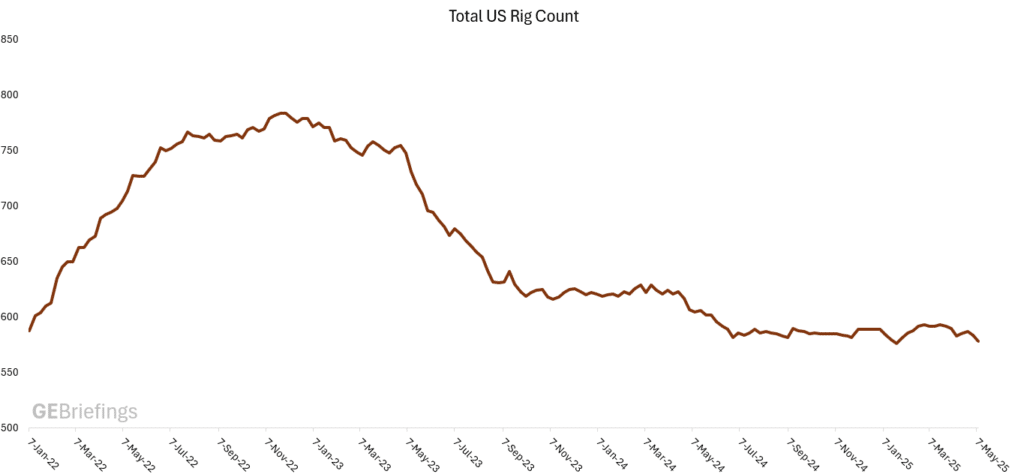

The total number of active rigs operating in the US according to Baker Hughes rig count decreased by six last week, currently at 578. Oil focused rigs decreased by five last week, at 474 active rigs. Gas focused rigs were flat at 101 active rigs. Miscellaneous decreased by one last week now at three active rigs.

Figure 4. Active Oil Focused Rigs Decreased by Five Last Week now at 474

Figure 5. Gas Focused Rigs were Flat at 101 Active Rigs.

Figure 6. Total Active Rigs in the U.S. Decreased by Six Last Week, now at 578.

Figure 7. Rig Count in Major Basins.

Baker Hughes has issued the rotary rig counts as a service to the petroleum industry since 1944, when Baker Hughes Tool Company began weekly counts of U.S. and Canadian drilling activity. Baker Hughes initiated the monthly international rig count in 1975. The North American rig count is released weekly at noon Central Time on the last day of the work week.

By the Numbers May 14, 2025.

Disclaimer

This report is under no circumstances intended to be used for or considered as investment advice. This report is to be used as information and general market guidance. The author, GE Briefings and Investornytt cannot guarantee that the information from sources is without incentives, but the author has taken considerable care to ensure that, and to the best of his knowledge, material information contained in the report is in accordance with the facts and contains no omission likely to affect its understanding. Please note that this report is the author’s own research, opinions and conclusions, and the readers are recommended to draw their own conclusions based on other sources than this report, the facts and market picture can change in an instant and therefore the reader must do their own due diligence. The author, GE Briefings and Investornytt cannot be held responsible for the readers investments based on this report.