Analyse

Siste fra OceanEXL (uke 36)

Obs! Denne saken er over 12 måneder gammel.

General

Our thoughts about the tanker market recently can be summarized as a healthy market that still has plenty to give.

Product tankers continue to perform well, and charterers have now finally started to properly utilize the economies of scale that LR tankers provide, and it has sent LR rates on the joy ride they have been waiting for. Things are happing on the crude side as well, and while rates have a hard time deciding their direction on the spot market, the recent improvements have made many believe that we are not far from lift-off!

The US SPR releases are coming to an end and most of the last October cargoes have already been fixed, we don’t expect the USG market to drastically drop, but some less activity should be expected. A potential market maker which has aimed to increase its exports is Nigeria. The country that used to be the number one exported in WAF has been traumatized by constant theft and crimes against oil companies, some companies claiming they have lost 80% of their oil to theft. At the greatest of times Nigeria was producing between 2.2 – 2.4 mb/d, but these days they barely have an output of 1.2 mb/d, however, if the government does as promised and proper exports get up and running in time, the WAF market could still bring a lot of upside for the crude tanker Owners.

Bli medlem for å lese alt innhold på Investornytt! Klikk her for å se våre kampanjerChartering and Spot market

VLCC: The party for the VLCCs in the USG continues as TD22 (USG/China) ended the week at around $9.1mill and Owners are pushing for more. As the last fixtures for the SPR releases start to fall in place, we could expect some less activity in the weeks to come, however, with the current sentiment it’s hard to imagine much negative impact. The AG and WAF were mostly stable this week without much noticeable change in rates, however, sentiment in WAF seems to be picking up as exports are set to increase.

SUEZMAX: Not much change on the Suezmax front, but it’s nothing concerning as rates hold firm. WAF/UKC is up a little w-o-w, with a bit of increased activity.

AFRAMAX: The Aframax Owners are starting to see earnings fall off the books as both North Europe and MED are trading downwards this past week. However, not yet to panic as the fundamentals remain positive, with potential export increases in both MED and WAF.

LR’s: Both LR1’s and LR2’s had yet another strong week with rates that continue upwards, but at a slower rate at this time. Cargoes coming from the AG are proving to be highly profitable for LR2 Owners fixing at over $5.4mill for UKC.

MR’s: The best markets for the MRs are found in the US and the Far East these days as UKC is falling a bit behind. In the East, the MR market saw a boost of activity this week and it seems like it going to last, this affects the Singapore market as well, which is starting to look a lot brighter.

Period market

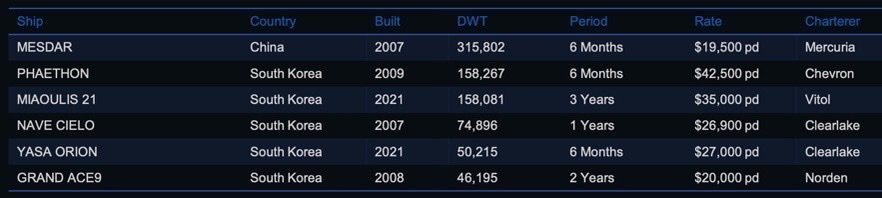

The period market is not giving us a lack of confidence for the long-term market. We are no longer seeing the big jumps in product tanker rates as we were used to, and as tables are slowly turning and we are seeing some quick developments on the crude tanker side.

List of highlighted fixtures this week:

Second-hand market

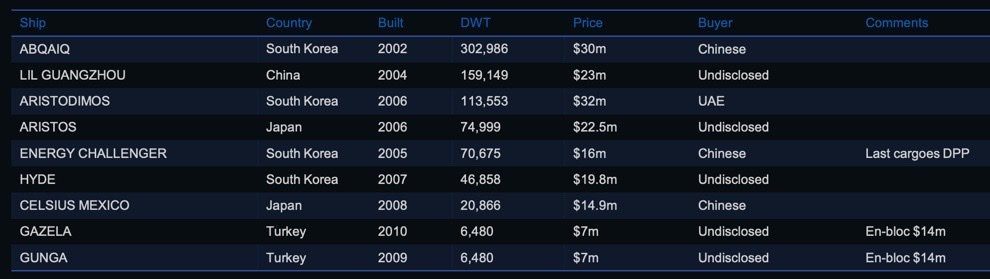

It is getting hard to draw a fine line on what pricing to give a second-hand vessel in the current market, especially on the product tanker side.

We see that there are huge gaps sometimes in the sales price achieved on two similar candidates, however, as the way the market functions right now, it is all about the delivery place and the promptness of delivery which some buyers are willing to pay millions extra to achieve.

List of highlighted transactions this week:

Newbuilding market

No newbuilding orders were announced this week but as the crude and product markets continue to stay elevated and optimism persists, we are confident that we will see more newbuilding orders in the coming months as asset prices continue to gain making it more difficult for owners to renew their fleet forcing them to consider newbuildings as an alternative. Yards continue to be busy with the inflow of LNG and LPG orders and a historic container order book pushing deliveries to 2025/2026 making it even more difficult for owners to decide whether to go for expensive second-hand tonnage or to bet for a super-cycle. As of now, owners have not yet shown their optimism for a super-cycle via newbuilding orders but instead looked towards the second-hand market for vessel renewals or acquisitions to benefit from the current market situation which is pushing asset prices even higher leaving many Buyers in the dust. The low order book together with limited deliveries supports the elevated markets in both product and crude which some may say is well needed but could become an issue if more owners do not start contracting newbuildings as we could otherwise experience scarcity in terms of vessels which would artificially push rates even higher resulting in a crash once we see more deliveries.

Recycling market

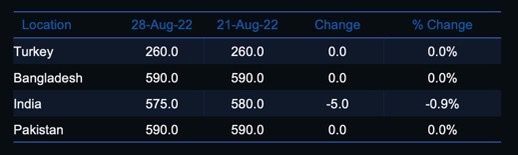

While the dry bulk market is being hammered and sentiment dropping, more dry bulk vessels are being circulated in the market leaving very little attention to the tanker segment. Cash Buyers have this week proved themselves to be ship owners rather than purely cash buyers as reports state that younger units are being sold with the intention to continue trading and leverage from their position as cash buyers/recyclers.

The tanker segment continues to be inactive in terms of recycling and remains stable with no wild changes in prices although we may see some changes in Bangladesh and Pakistan to come.

There was 1 reported LR1 tanker sold for recycling:

‘POLAN’ (Korea, South, 1999 Built, 12,423 LDT) was sold to cash buyers on ‘as is’ basis in Singapore at $589 per LDT ($7.3m)

Crude oil market

The crude market continues to remain highly volatile with both bullish and bearish sentiments affecting oil prices. EIA reported this week that inventories saw an increase of 8.8 million barrels sending oil prices back after some gain at the beginning of the week.

As Europe continues to be exposed to a winter with energy rationing and increasing energy prices the new Prime Minister in the UK, Liz Truss, announced that the fracking ban will be removed and more oil and gas licenses in the UK part of the North Sea will be issued to keep prices down as much as possible.

Russian exports to Europe have almost leveled with exports to China and India taking advantage of the ‘cheap’ Russian crude compared to others. Even with discounts of about $20-30 per barrel Russia continues to profit highly from the elevated oil prices due to the Russian war in Ukraine.

OX-Global Shipping Indices

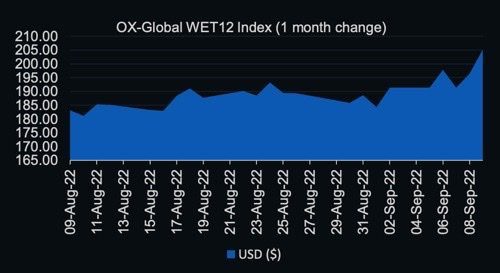

The OX-Global WET12 index increased 7.25% this week or 13.89 points settling at $205.26 which is a new all-time high. Various analysts increased targets this week ahead of the Q2 earnings which have had a positive sentiment on the market with most tankers (both product and crude) pushing the index upwards. Excitement for crude owners’ earnings isn’t too high but expectations for Q3 and Q4 earnings is a different case as we are entering peak season for crude and together with exhilarated rates for VLCC’s we imagine the index will continue to increase during September and Q4.

Disclaimer:

The data and information provided by OCEAN EXL FZCO through the Intelligence platform are solely provided in good faith to clients and other relevant parties who may benefit from it. All data marketed through the intelligence platform is owned and maintained by OCEAN EXL FZCO with exception of data directly sourced from Freightos Baltic Index (https://fbx.freightos.com/) U.S. Energy Information Administration (EIA) (https://www.eia.gov). The data and information provided by OCEAN EXL FZCO are collected via industry experts such as shipbrokers, authorities, agents and other organizations who are involved in shipping, energy, and finance. The intelligence platform is largely dependent on these industry experts’ observations and opinions and therefore the data and information are believed to be correct but are not guaranteed to be exact. All data displayed through the intelligence platform is directly owned by OCEAN EXL FZCO* with exceptions to Freight Rates for the container segment which is owned by Baltic Freight Index and oil and energy data including production, consumption and inventories. All use of data within the intelligence platform without any valid license or agreement with OCEAN EXL FZCO is considered to breach our Data Policy and will not be tolerated. To license our data or to use our data for research and analysis purposes, please get in touch to hear more. This website is provided for information purposes only. Any analysis of or reference to various data, information, and analysis are opinions only. No information in this report constitutes financial advice or other advice or any recommendation to take actions hereupon. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this website by OCEAN EXL FZCO or any of its members or employees, and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The OceanEXL Intelligence platform including services and data products is owned and distributed by OCEAN EXL FZCO. OceanEXL Intelligence displays data and insight which have been acquired by third-party providers and market participants and to the best of our knowledge we believe the information and data are correct but not guaranteed to be accurate and herein came from reliable sources. No information or opinion herein constitutes a solicitation of purchase, sale, or chartering of any assets including vessels, commodities, and or financial securities.